– Bizarre, Racist Math Test Resurfaces in Alabama

H/t reader kevin a.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

– 24,000 pounds of dead mullet fish make for ‘truly unbelievable’ sight:

Rarely do waters get so cold in this region of the country that a massive amount of fish dies all at one time, but that’s just what happened last week in Gulf Shores, Alabama.

Water was barely visible when Jeffrey Trout, a salesman at Harbor View Marine in Pensacola, snapped photos of a canal near his home on Jan. 11. Trout estimated he saw at least 4,000 to 5,000 mullet belly up, but that there were “probably more out there.” He believes those fish died from a lack of oxygen and said they ranged from 6 to 12 inches in length.

“It was truly unbelievable,” said Trout, who said he fishes frequently. “I’ve seen (the canal) freeze over twice in 12 years, and this occurred both times. Mullet need air, that’s why they jump out of water.”

…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– Flesh-Eating Bacteria Found In Fish At Seattle Store:

SEATTLE, WA – A local man has been sickened by a rare form of flesh-eating bacteria linked to fish from grocery store tanks. This is the second such case in the area recently – a woman was sickened by Vibrio vulnificus in November after cutting her hand while preparing tilapia purchased at a Bellevue seafood store.

…

– Alabama health officials issue warning about flesh-eating bacteria:

MOBILE, Ala. — Health officials in Alabama are warning residents of a flesh-eating bacteria found in bodies of water throughout the state.

The Alabama Department of Public Health (ADPH) on Friday warned residents that Vibrio cases have been reported along Alabama’s Gulf Coast.

– Chemical Contamination Leaves 100,000 Alabama Residents Without Drinking Water:

As the Flint water crisis has shown us, sometimes the quality of America’s water infrastructure is not what you’d expect in a developed nation. However, the problems with our tap water are not just found in a few impoverished municipalities. In fact, dangerous chemicals and pathogens can be found in faucets all over America.

Case in point, the West Morgan-East Lawrence Water Authority in Alabama just advised 100,000 of their customers to stop using their tap water for drinking or cooking. According to the general manager of the Water Authority, who spoke at a press conference on Friday, “I recommend that all our customers do not drink our water, until we are able to bring the temporary system our engineer is designing online.” That includes water that has been boiled or cleaned with Brita style filters, neither of which can remove the contaminants.

Read moreChemical Contamination Leaves 100,000 Alabama Residents Without Drinking Water

– Off-duty cops collect DNA samples at Alabama roadblocks (The Daily Caller, June 10, 2013):

Off-duty cops in two counties in Alabama spent the weekend collecting saliva and blood samples from drivers at roadblocks.

According to Lt. Freddie Turrentine with the St. Clair County Sheriff’s Department, drivers were asked to voluntarily offer samples of their saliva and blood for a study being conducted by the Pacific Institute for Research and Evaluation.

The drivers were compensated for their samples.

“They’ve got big signs up that says ‘paid volunteer survey’ and if they want to participate they pull over there and they ask them questions and if they are willing to give them a mouth swab they give them $10 and if they are willing to give them a blood sample they give them $50. And if they don’t do anything they drive off,” Turrentine explained to The Daily Caller.

Read moreAND NOW: Off-Duty Cops Collect DNA Samples At Roadblocks

– 20 US states file petitions to secede (The News, Nov 12, 2012):

WASHINGTON: At least 20 US states have filed petitions to secede following the re-election of Barack Obama.

Following the re-election, several petitions surfaced requesting the Obama administration to peacefully grant the applied state to withdraw from the United States of America in order to create their own government.

Louisiana was the first state to file a petition followed by Texas.

States with secession-related petitions on the White House website now include Alabama, Arkansas, Colorado, Florida, Georgia, Indiana, Kentucky, Michigan, Mississippi, Missouri, Montana, New Jersey, New York, North Carolina, North Dakota, Oregon, South Carolina and Tennessee.

– Dead Candidates Win Elections In Florida, Alabama (Huffington Post, Nov 7, 2012):

Florida Democrat Earl K. Wood and Alabama Republican Charles Beasley won their respective elections but they will not take office.

Both men died weeks before the November 6 election yet managed to beat their very much alive opponents by comfortable margins.

– Jefferson County Alabama Files Biggest Municipal Bankruptcy (Bloomberg, Nov. 10, 2011):

Jefferson County, Alabama, filed the biggest U.S. municipal bankruptcy after an agreement among elected officials and investors to refinance $3.1 billion in sewer bonds fell apart.

The county, home to Birmingham, the state’s most-populous city, listed assets and debt of more than $1 billion in Chapter 9 papers filed today in U.S. Bankruptcy Court in Birmingham.

The county’s bankruptcy attorney, Kenneth Klee, said the filing was necessary because talks with creditors and the receiver in charge of the sewer system built by the bonds broke down.

“There was an impasse reached,” Klee said in an interview today. “None of the creditors — zero — signed up to the deal that we have been negotiating for six weeks.”

The county’s major creditors, including JPMorgan Chase & Co. (JPM), signed tentative agreements in September to reorganize the sewer debt to avoid bankruptcy. County officials said at the time that JPMorgan would provide $750 million of about $1.1 billion in concessions.

Read moreJefferson County Alabama Files Biggest Municipal Bankruptcy

Don’t miss:

– HAARP Rings And Scalar Squares Cause – As Predicted – MASSIVE Tornado Outbreak (04/28/2011)

– TVA loses all power transmission lines in Alabama and Mississippi, Browns Ferry Nuclear plant forced into emergency shutdown (timesfreepress):

Wednesday’s storms took out all of TVA’s electric power transmission lines in Mississippi and North Alabama, and forced Browns Ferry Nuclear Plant unto diesel backup power and into emergency and automatic cold shutdown.

Bill McCollum, the chief operating officer of Tennessee Valley Authority, said it may be weeks before power can be restored to all of the 300,000 customers whose power is supplied by the federal utility.

“With the level of damage we have, it will be — we hope it will be days until we get most of the customers back on, but it will be weeks before we’ve fully repaired all of the damage,” he said.

McCollum said the reactors, now being cooled by backup diesel power, are safe.

– Browns Ferry Nuclear Plant recovering after losing power (CNN):

(CNN) – Crews are working to restore power to a nuclear plant in northern Alabama.

The severe storms that cut across the Southeast Wednesday night also managed to knock out external power to three nuclear reactors at the Browns Ferry plant.

Back-up generators kicked in, so nuclear regulators said the plant is safely in shutdown mode.

– Tornadoes damage reactors in U.S.; Backups work (CBS NEWS):

Alabama and other southern states are reeling from a series of tornadoes that killed more than 200 people. But there’s no nuclear disaster to go with the natural disaster — a promising sign amid concerns that the U.S. could someday face a nuclear crisis like the one that has followed the earthquake and tsunami in Japan.

The savage storms in that passed through parts of Alabama, Mississippi, Tennessee and Virginia on Wednesday knocked out power to the Browns Ferry nuclear power plant, about 30 miles west of Huntsville, Ala.

…..

“The Browns Ferry units are among 23 U.S. reactors that are similar in design to the crippled Fukushima Daiichi nuclear plant in Japan where backup generators were swept away in the tsunami that followed the massive earthquake on March 11,” Reuters reported.

– Browns Ferry hit by major storms (World Nuclear News):

The three boiling water reactors at TVA’s Browns Ferry nuclear power plant in Alabama shut down automatically with cooling systems powered by “a combination of offsite transmission and on-site diesel generators.” However, the shutdown was notified as an ‘unusual event’ to the Nuclear Regulatory Commission “when the normal and alternate power supplies for essential equipment were unavailable for more than 15 minutes.” TVA stressed that “safety systems performed well.”

The plant shut down on 27 April at 4.36 pm and units 2 and 3 achieved cold shutdown at 2.43 am and 5.45 am on 28 April respectively. TVA said that unit 1 was was being cooled and the priority now was to get that reactor into cold shutdown as well.

If you want to know what life in the Third World is like, just ask Lisa Pack, an administrative assistant who works in the roads and transportation department in Jefferson County, Alabama. Pack got rudely introduced to life in post-crisis America last August, when word came down that she and 1,000 of her fellow public employees would have to take a little unpaid vacation for a while. The county, it turned out, was more than $5 billion in debt — meaning that courthouses, jails and sheriff’s precincts had to be closed so that Wall Street banks could be paid.

As public services in and around Birmingham were stripped to the bone, Pack struggled to support her family on a weekly unemployment check of $260. Nearly a fourth of that went to pay for her health insurance, which the county no longer covered. She also fielded calls from laid-off co-workers who had it even tougher. “I’d be on the phone sometimes until two in the morning,” she says. “I had to talk more than one person out of suicide. For some of the men supporting families, it was so hard — foreclosure, bankruptcy. I’d go to bed at night, and I’d be in tears.”

Homes stood empty, businesses were boarded up, and parts of already-blighted Birmingham began to take on the feel of a ghost town. There were also a few bills that were unique to the area — like the $64 sewer bill that Pack and her family paid each month. “Yeah, it went up about 400 percent just over the past few years,” she says.

The sewer bill, in fact, is what cost Pack and her co-workers their jobs. In 1996, the average monthly sewer bill for a family of four in Birmingham was only $14.71 — but that was before the county decided to build an elaborate new sewer system with the help of out-of-state financial wizards with names like Bear Stearns, Lehman Brothers, Goldman Sachs and JP Morgan Chase. The result was a monstrous pile of borrowed money that the county used to build, in essence, the world’s grandest toilet — “the Taj Mahal of sewer-treatment plants” is how one county worker put it. What happened here in Jefferson County would turn out to be the perfect metaphor for the peculiar alchemy of modern oligarchical capitalism: A mob of corrupt local officials and morally absent financiers got together to build a giant device that converted human shit into billions of dollars of profit for Wall Street — and misery for people like Lisa Pack.

The banksters looting the American taxpayer again.

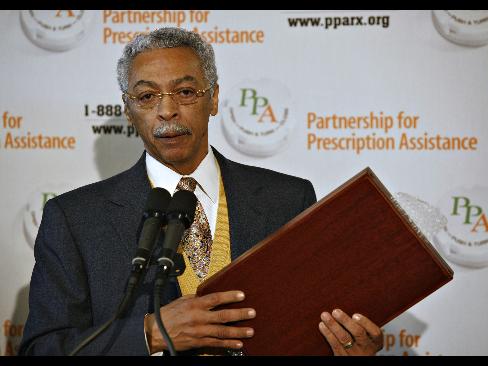

Larry Langford, then Jefferson County commissioner, speaks at a Partnership for Prescription Assistance event in Birmingham, Alabama, in this file photo taken Feb. 2, 2007. Photographer: Gary Tramontina/Bloomberg

Oct. 19 (Bloomberg) — In its 190-year history, Jefferson County, Alabama, has endured a cholera epidemic, a pounding in the Civil War, gunslingers, labor riots and terrorism by the Ku Klux Klan. Now this namesake of Thomas Jefferson, anchored by Birmingham, is staring at what one local politician calls financial “Armageddon.”

The spectacle — a tax struck down, about 1,000 county employees furloughed, a politician indicted over $3 billion in sewer debt that may lead to the largest municipal bankruptcy in history — has elbowed its way up the ladder of county lore.

“People want to kill somebody, but they don’t know who to shoot at,” says Russell Cunningham, past president of the Birmingham Regional Chamber of Commerce.

One target of their anger is Larry P. Langford, who was the county commission’s president in 2003 and 2004 and is now mayor of Birmingham. The 61-year-old Democrat goes on trial today, charged in a November 2008 federal indictment with taking cash, Rolex watches and designer clothes in exchange for helping to steer $7.1 million in fees to an Alabama investment banker as the county refinanced its sewer debt.

Jefferson County’s debacle is a parable for billions of dollars lost by state and local governments from Florida to California in transactions done behind closed doors. Selling debt without requiring competition made public officials vulnerable to bankers’ sales pitches, leaving taxpayers to foot the bill for borrowing gone awry.

Swaps Blew Up

Under Langford’s stewardship, the county bet on interest- rate swaps, agreements that a representative of New York-based JPMorgan Chase & Co. told commissioners could reduce their interest costs. Instead, the swaps — covering more than $5 billion in all — blew up during the credit crisis after ratings for the county’s bond insurers fell.

JPMorgan, through spokeswoman Christine Holevas, declined to comment for this story.

Thousands of public borrowers across the U.S. chose a similar strategy, and many are now paying billions of dollars to escape the contracts, said Peter Shapiro, managing director at Swap Financial Group in South Orange, New Jersey. Even Harvard University, the world’s richest academic institution with an endowment of $26 billion, fell for Wall Street’s financing in the dark: It paid $497.6 million to investment banks during the fiscal year ended June 30 because it chose to cancel $1.1 billion of interest-rate swaps.

Read moreFinancial ‘Armageddon’ in Alabama Proves Parable for Local US Governments

|

With $3.2 billion in debt, the county that is home to Alabama’s largest city is about to go bust. How the credit crisis went South.

(Fortune Magazine) — Bob Riley wanted to help. It was Sunday, Oct. 5, and the Alabama governor was on the phone with Neel Kashkari, a Treasury Department official who the next day would be named by Treasury Secretary Hank Paulson as interim leader of the government’s just-approved $700 billion Troubled Asset Relief Program. But Riley couldn’t wait for Kashkari’s role to become official. He needed to impress upon the new bailout boss the seriousness of the exploding financial crisis in Jefferson County, home to Birmingham. Riley argued that it was urgent that the federal government come to the aid of his state – now.

As he would describe it in a follow-up letter to Kashkari, the situation in Jefferson County was “the single biggest threat to the municipal bond market today and a poster child for how the subprime mortgage crisis is hurting Main Street America.”

For months now, Riley and other civic leaders in Alabama have been battling to avert what appears almost certain – that Jefferson County will file for Chapter 9 protection, in what would be the largest municipal bankruptcy in our nation’s history. The county has fallen hopelessly behind on payments to service the $3.2 billion it borrowed – on reckless terms – from Wall Street over the past decade to build a new sewer system. As Fortune went to press, the Jefferson County Commission was days away from a vote that could make the bankruptcy official.

At least 29 states plus the District of Columbia, including several of the nation’s largest states, faced an estimated $48 billion in combined shortfalls in their budgets for fiscal year 2009 (which began July 1, 2008 in most states.) At least three other states expect budget problems in fiscal year 2010.