– “Nobody Has Any Idea How Disastrous It’s Going To Be” Warns California Water Expert (ZeroHedge, Oct 5, 2014):

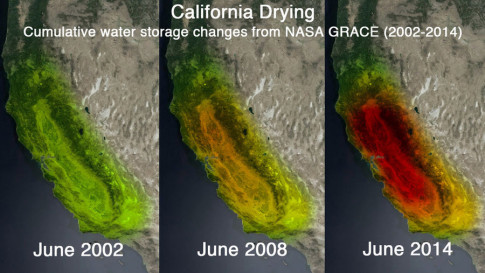

Newly released images created from NASA satellite data illustrate the staggering effect the California drought has had on groundwater supply in the state. As Mashable’s Patrick Kulp explains, the images show the amount of water lost over the past 12 years, with different colors indicating severity over time. “Nobody has any idea how disastrous it’s going to be,” Mike Wade of California Farm Water Coalition told the Associated Press, as RT reports a growing number of communities in central and northern California could end up without water in 60 days due to the Golden state’s prolonged drought. While California is bearing the brunt, experts note “We’re seeing it happening all over the world, in most of the major aquifers in the arid and semi-arid parts of the world.”

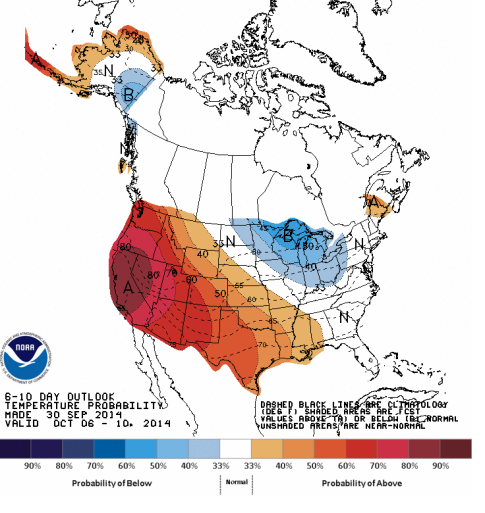

California is currently experiencing the third year of one of the most severe short-term droughts ever recorded. Data from U.S. Drought Monitor shows that as of Sept. 30, 82% of the state is facing extreme or exceptional drought conditions.

Read more“Nobody Has Any Idea How Disastrous It’s Going To Be” Warns California Water Expert