The German reunification happened in 1990 between the poor German Democratic Republic (GDR/East Germany = Communism = all are equal [poor], while some are more equal [rich officials, etc.]) and the Federal Republic of Germany (FRG/West Germany) one of the richest countries in the world (at that time).

And in 2014 there is still inequality … imagine that!!!

What a BS report.

However, Germany is run into the ground by its own government and its central bank (Axel Weber for example dished out 138 billion in credit to other EU countries that will never be able to pay it back, leaving the German taxpayer on the hook.) …

… and not to forget the greatest enemies of all countries in the EU:

EU officials, the ECB, the IMF and the elitists who orchestrated the entire financial crisis, the biggest ‘bank robbery’ in world history, with the banks doing the robbing and the comlicit governments bailing out criminal banksters & complete and utter failure.

And thanks to all those criminals (incl. greedy corporations) more and more children in Germany do not even get one warm meal a day.

This is happening in every country around the globe that is run or targeted (like Libya & Syria) by the elitists.

The greatest financial collapse in world history is coming and it will also wipe out and destroy the rich (as intended by the power elite).

– Germany has ‘greatest inequality in eurozone’ (The Local, Feb 27, 2014):

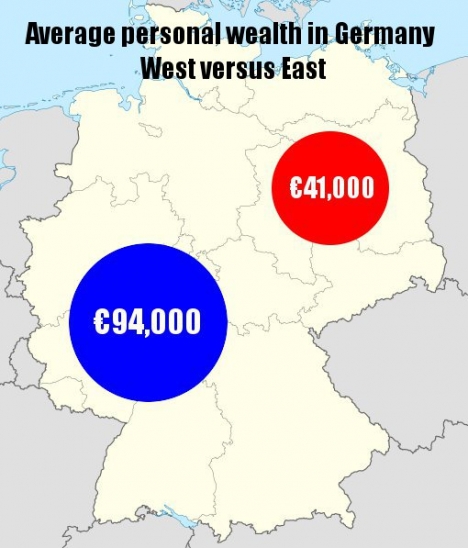

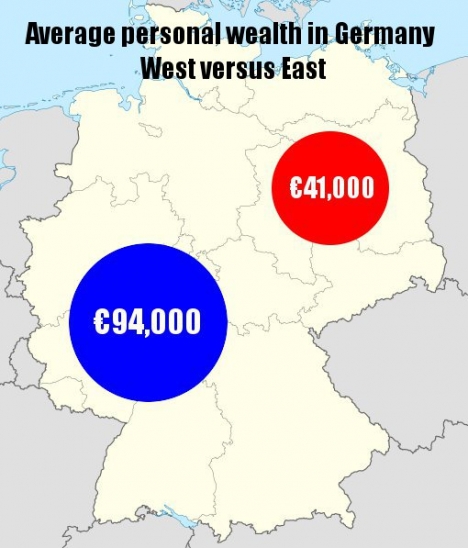

The distribution of wealth in Germany is the most unequal in the eurozone, a report released on Thursday revealed. Large differences remain between men and women and east and west.The report, from The German Institute for Economic Research and the centre-left Hans-Böckler Foundation, found that living in the former West Germany meant you were more than twice as rich than in the East, with average wealth of €94,000 compared to €41,000.

This disparity is mainly due to the difference in house prices in the two regions, the study said.

It calculated personal wealth by adding up savings, property, insurance and jewellery, but did not include the value of cars or cash.

Gender also played a significant role in wealth distribution, with the average man €27,000 wealthier than the average woman.

Researchers found that the distribution of wealth in Germany was, along with Austria, the worst among all eurozone countries.

Germany has consistently received a rating of 0.78 on the Gini co-efficient, well above the majority of European countries.

Read moreGermany Has ‘Greatest Inequality In Eurozone’