– Tax Code Complexity Now Costs U.S. Economy up to $1 Trillion Annually:

Source: Tax Revolution Institute

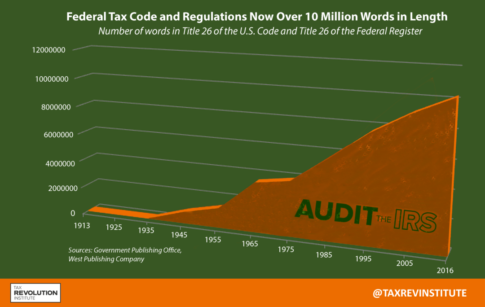

74,608 pages, 2.4 million words.

That is the present size of Title 26 of the U.S. Code, i.e. the “Internal Revenue Code.” One would think this would be nearly impossible for an enterprise wielding an army of tax experts to absorb, let alone the average taxpayer. However, it doesn’t stop there.

The IRS has added an additional 7.7 million words of tax regulations designed to clarify what the original 2.4 million words mean. You can’t make this stuff up. Add 60,000 pages of tax-related case law essential to accountants and tax lawyers, and the burden is revealed.

More than 10 million words with a hidden annual compliance cost of up to $1 trillion. This is what Title 26 of the U.S. code and the Federal Register is estimated to cost the United States economy each year.

Data aggregated by Philip D. Schlosser. Design by Philip D. Schlosser and Andrew Hawks.

To put this into perspective, the Encyclopedia Britannica — 32 volumes that contain the general knowledge of man — is 44 million words in length. This means that in order to understand the federal tax code and its supplementary regulations in their entirety, one would have to absorb highly complex tax language that is nearly one quarter the length of the entire Encyclopedia Britannica.

Indeed, Albert Einstein said it best when he noted that “the hardest thing in the world to understand is the income tax.”

As one can ascertain from the positive trend in Figure 1, the complexity of the tax code and its supplementary regulations is continuing to climb at an alarming rate. This is exacerbated by growing layers of provisional carve-outs, loopholes, and special privileges.

Estimating Accounting Costs

Using data from the Office of Information and Regulatory Affairs and U.S. Bureau of Labor Statistics, the Tax Foundation estimates that it will take Americans more than “8.9 billion hours” per year to ensure compliance with Title 26 of the U.S. tax code and Federal Register. This is equivalent to 4.3 million Americans doing nothing other than working on tax compliance for the entire year in 2016.

Taken together, data from the Office of Information and Regulatory Affairs and U.S. Bureau of Labor Statistics reveal that tax compliance will cost the U.S. economy roughly $409 billion in 2016. In 2011, the Laffer Center estimated said cost at $431.1 billion.

In other words, the annual cost of complying with the tax code is equivalent to the annual GDP of 36 states combined. Furthermore, these numbers basically capture explicit accounting costs: what happens when we thoroughly estimate our economic costs as well?

Economic costs include those accounting costs (i.e. the direct price tag of carrying out the actions) and our opportunity cost (i.e. the amount of money that could have been made via employing the same capital on other economic objectives). There is no doubt that firms would use 8.9 billion labor hours per year on far more efficient tasks than attempting to comply with over 10 million words of tax rules.

Estimating Economic Costs

A prominent study published by the Mercatus Center of George Mason University surveyed the economic literature to document the hidden costs of the U.S. tax system. The study looked beyond the explicit accounting costs of tax compliance, measuring also the hidden costs of compliance with taxation — ultimately arriving at an estimate for foregone economic growth.

Beyond the evident opportunity costs that are associated with accounting, the tax code also targets political and social ends through special tax provisions, which come at a price. Structural patterns are altered via special-interest carve-outs; market competition is grossly distorted; additional lobbyists are hired to rent-seek and protect tax advantages, and so on. This magnifies our economic costs.

Mercatus estimates that the hidden costs of tax compliance — the time and money spent on tax compliance coupled with the opportunity cost of foregone economic growth — range from $215 billion to $987 billion per year.

Since the Mercatus study was published, the Office of Information and Regulatory Affairs has updated its estimate for annual hours expended on tax compliance from 6.1 billion to 8.9 billion, which would almost certainly increase Mercatus’s estimates. For example, a static adjustment to accounting costs alone would already raise our top estimate from $987 billion to north of $1 trillion per year.

We Can Do Better

A recent Wallet Hub poll has revealed that 75 percent of Americans believe the federal tax code is too complex. A similar Pew poll registered Americans’ dissatisfaction with the federal tax code at 72 percent, while the last Tax Foundation poll found a staggering 82 percent of the public in favor of a “complete overhaul” of the entire federal tax system. Even the U.S. Treasury Department has admitted that “the complexity of the U.S. tax code makes the tax law too difficult for taxpayers to understand and for the IRS to administer.”

Enough is enough; it’s time for a change.

H/t reader kevin a.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP