Coming to a country near you … soon … very soon.

– This Is What Hyperinflationary Collapse Looks Like:

There was some good news for citizens of Venezuela yesterday, when the government – having mostly given up on trying to provide its citizens’ with even the most basic food needs – announced it has opened its border with Colombia for the second time this month to allow people to buy food and medicine unavailable at home in their country’s collapsing economy. Colombia’s government said 44,000 people crossed on Saturday to buy food, medicine and cleaning products and said it expected that number to almost double on Sunday.

Bus terminals were packed and hotels filled to capacity in the border town of San Antonio, with many traveling hundreds of miles to shop.

The result of the scramble to obtain much needed staples is shown in the photos below.

More than 100,000 Venezuelans crossed into Colombia over the weekend in

search for food and medicine.

Tebie Gonzalez holds a wad of Bolivar bills as she exchanges what remains of

her and her husband’s savings.

Crowds of people flooded the bridge that links to the Colombian city of Cucuta

to cross the border on foot

Activists handed out anti-government pamphlets, looking to galvanize the

frustration that has characterized food riots

The border was heavily packed by Venezuelan troops, the crowds were mostly

orderly amin and atmosphere of tense excitement

According to Reuters, last week, over 35,000 people crossed over for the first time since the governor of Venezuela’s state of Tachira, opened the border. Socialist President Nicolas Maduro shut the border last year in an effort to crack down on smuggling of subsidised products.

Venezuela’s product shortages have since worsened, creating further incentives to buy goods in Colombia and bring them back. Venezuelans routinely spend hours in lines at home seeking items ranging from corn flour to cancer medication to car parts. Shoppers complain of violence in lines, and looting is on the rise.

* * *

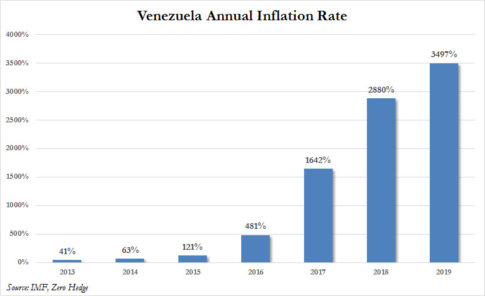

That was the good news. The bad news for ordinary Venezuelans is that unless they can permanently move to Colombia or any other country, their plight is only going to get worse. The reason is that according to the IMF, Venezuela’s consumer-price inflation is forecast to hit 480% this year and top 1,642% in 2017, according to the International Monetary Fund. At that point it will proceed into suborbital hyperinflationary territory, hitting 2,880% in 2018 before “plateauing” at 3,500% in 2019.

While it has been speculated that the insolvent nation will soon have to ask the IMF for a bailout, Venezuela, whose government severed ties with the IMF nearly a decade ago under its former socialist autocratic leader, Hugo Chávez, hasn’t tried to restore relations with the world’s emergency lender. Cited by the WSJ, IMF spokesman Gerry Rice said that “there has been no change in Venezuela’s relationship with the fund. The Venezuelan authorities have not contacted us.”

China, seeking to take advantage of poor political relations that many African and Latin American nations have with the U.S. and Western-based institutions like the IMF, has been giving Venezuela and other commodity exporters cheap loans to help tide them through the commodity slump. Last year, the country supposedly secured $10 billion in cheap credit to help keep it afloat. The problem is that that loan was pledged by oil at much higher prices, which means that now Venezuela has to pump overtime just to meet its obligations to Beijing, as we explained previously.

While those loans may keep the state budget limping along, including massive costly subsidy programs, and strengthen political ties to Beijing, they don’t require the deep policy overhauls many economists say are vital to repairing the broken economy.

Meanwhile, Venezuela’s problem is simple: a lack of credible currency as the value of the Bolivar has imploded as a result of the policies of Maduro, leading to a collapse in the economy.

“A lack of hard currency has led to scarcity of intermediate goods and to widespread shortages of essential goods—including food—exacting a tragic toll.” –IMF Western Hemisphere chief, Alejandro Werner, “Latin America and the Caribbean in 2016: Adjusting to a Harsher Reality”

The bottom line is that even the IMF appears to have given up: “we have dire forecasts…predicated on very limited information that we have.” Gian Maria Milesi-Ferretti, Deputy Director, Research Department, IMF, at the October 2015 World Economic Outlook press conference.

So for those who are curious what modern-day, runaway hyperinflation looks like, here is the IMF’s forecast of Venezuela’s inflation over the next three years. We can’t help but chuckle that even in this dire case the IMF chooses to put a positive spin on events, and predicts that instead of exponential inflationary growth, somehow the country’s CPI will “taper” by 2019. Good luck.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP