Related info:

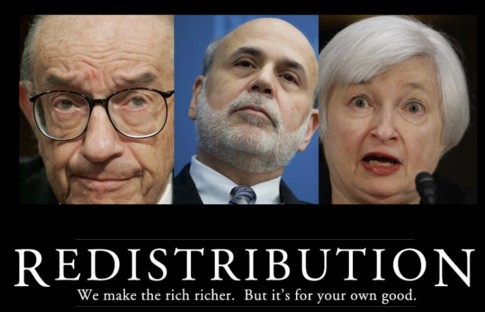

– Oops! The Federal Reserve Admits QE Widens Inequality

“When a country embarks on deficit financing (Bush-Obamanomics) and inflationism (Quantitative easing) you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.

– Ron Paul

Quantitative easing = printing money = creating money out of thin air = increasing the money supply = inflation = hidden tax on monetary assets = theft!!!

“Deficits mean future tax increases, pure and simple. Deficit spending should be viewed as a tax on future generations, and politicians who create deficits should be exposed as tax hikers.”

– Ron Paul

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

– John Maynard Keynes“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan Greenspan

– Pew Research Study – The American Middle Class Declined in 90% of Metro Areas From 2000-2014:

When you bail out financial criminals and predators, you get a criminal and predatory economy. If there’s one clear lesson from the 2008 crisis and its aftermath, that should be it.

– From last year’s post: Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

The Pew Research Center recently released a fascinating study which showed what many of us already suspected, that the U.S. middle class has declined in 90% of metropolitan areas from 2000-2014, or in 203 of 229 areas studied.

The details are just as interesting as the headline, some of which will provide ammunition for those looking to spin the historic 21st century status quo plunder into something an resembling economic recovery. Specifically, Pew notes that:

Nationwide share of adults in lower-income households increased from 28% to 29% and the share in upper-income households rose from 17% to 20% during the period.

Some people will read this and say, “so what’s the big deal, we’re making some people richer, and others poorer, as the middle class shrinks?” I think it is a big deal, for two primary reasons.

First, the study only goes up until 2014, and when you look at details it becomes obvious that a lot of the increase into the “upper-income” demographic related to the oil boom, which has since gone completely bust. So how many of those people have been since booted into a lower income segment? We simply don’t know for sure, but we know it’s likely material.

Nevertheless, that’s not the biggest issue I have with the trend. Even if the higher paying oil and gas jobs could be considered permanent, the shift to a binary economy in which you either become wealthy or poor results in greater income inequality, which ultimately leads to social unrest and the emergence of authoritarian demagogic political figures, i.e. Trump.

It’s what I like to call the Hunger Games economy. You’re thrown into the woods with a diminishing capacity to work hard and earn a middle income, and if you fail to enter the upper echelons you’ll be reduced to poverty. The result is insecurity, stress and ultimately resentment, which before too long bubbles to the surface in all sorts of unwelcome ways. A strong and vibrant middle class has always provided a buffer to truly nasty civil unrest and revolution in these United States. As it goes extinct, the probability of those things rises exponentially.

With that out of the way, here are a few excerpts from the Pew study:

The American middle class is losing ground in metropolitan areas across the country, affecting communities from Boston to Seattle and from Dallas to Milwaukee. From 2000 to 2014 the share of adults living in middle-income households fell in 203 of the 229 U.S. metropolitan areas examined in a new Pew Research Center analysis of government data. The decrease in the middle-class share was often substantial, measuring 6 percentage points or more in 53 metropolitan areas, compared with a 4-point drop nationally.

The shrinking of the middle class at the national level, to the point where it may no longer be the economic majority in the U.S., was documented in an earlier analysis by the Pew Research Center. The changes at the metropolitan level, the subject of this in-depth look at the American middle class, demonstrate that the national trend is the result of widespread declines in localities all around the country.

This report encompasses 229 of the 381 “metropolitan statistical areas” as defined by the federal government. Together, these areas accounted for 76% of the nation’s population in 2014.

With relatively fewer Americans in the middle-income tier, the economic tiers above and below have grown in significance over time. The share of adults in upper-income households increased in 172 of the 229 metropolitan areas, even as the share of adults in lower-income households rose in 160 metropolitan areas from 2000 to 2014.

Among American adults overall, including those from outside the 229 areas examined in depth, the share living in middle-income households fell from 55% in 2000 to 51% in 2014. Reflecting the accumulation of changes at the metropolitan level, the nationwide share of adults in lower-income households increased from 28% to 29% and the share in upper-income households rose from 17% to 20% during the period.

The widespread erosion of the middle class took place against the backdrop of a decrease in household incomes in most U.S. metropolitan areas. Nationwide, the median income of U.S. households in 2014 stood at 8% less than in 1999, a reminder that the economy has yet to fully recover from the effects of the Great Recession of 2007-09.

A previous report from the Pew Research Center, released on Dec. 9, 2015, focused on national trends in the size and economic well-being of the American middle class from 1971 to 2015. That report demonstrated that the share of American adults in middle-income households shrank from 61% in 1971 to 50% in 2015. The national level estimates presented in the earlier report were derived from Current Population Survey (CPS) data. Thus, they differ slightly from the estimates in this report.

A distinct geographical pattern emerges with respect to which metropolitan areas had the highest shares of adults who were lower income, middle income or upper income in 2014. The 10 metropolitan areas with the greatest shares of middle-income adults are located mostly in the Midwest. Wausau, WI, where 67% of adults lived in middle-income households in 2014, had the distinction of leading the country on this basis, followed closely by Janesville-Beloit, WI (65%). Sheboygan, WI, and four other Midwest areas also placed among the top 10 middle-income areas.

Beyond a shared geography, the top 10 middle-income metropolitan areas are more rooted in manufacturing than the nation overall.

In about a quarter of the metropolitan areas in 2014, middle-class adults do not constitute a clear majority of the adult population. Notably, many of the nation’s largest metropolitan areas fall into this group, including Los Angeles-Long Beach-Anaheim, CA, where 47% of adults were middle income; San Francisco-Oakland-Hayward, CA (48%); New York-Newark-Jersey City, NY-NJ-PA (48%); Boston-Cambridge-Newton, MA-NH (49%); and Houston-The Woodlands-Sugar Land, TX (49%).

The extent of income inequality in a metropolitan area also matters. Middle-income adults account for a larger share of the adult population in metropolitan areas where there is less of a difference between the incomes of the highest-earning and lowest-earning households. Wausau, WI, Janesville-Beloit, WI, and Sheboygan, WI, the three areas with the largest middle classes, are also among the metropolitan areas that had the lowest levels of income inequality in 2014.

This correlation between a thriving middle class and lower levels of income inequality is the most significant takeaway from the study.

Although other factors may also be at work, the 10 metropolitan areas with the greatest losses in economic status from 2000 to 2014 have one thing in common—a greater than average reliance on manufacturing. 15 Most of these areas, such as Springfield, OH, and Detroit-Warren-Dearborn, MI, are in the so-called Rust Belt. The areas not in the Rust Belt, such as Rocky Mount, NC, and Hickory-Lenoir-Morganton, NC, are also industrial communities.

American households in all income tiers experienced a decline in their incomes from 1999 to 2014. Nationally, the median income of middle-income households decreased from $77,898 in 1999 to $72,919 in 2014, a loss of 6%. The median incomes of lower-income and upper-income households fell by 10% and 7%, respectively, over this period.

The decline in household incomes at the national level reflected nearly universal losses across U.S. metropolitan areas. Middle-income households lost ground financially in 222 of 229 metropolitan areas from 1999 to 2014. Meanwhile, the median income of lower-income households slipped in 221 metropolitan areas and the median for upper-income households fell in 215 areas.

For related articles, see:

The Oligarch Recovery – U.S. Military Veterans are Selling Their Pensions in Order to Pay the Bills

The Oligarch Recovery – 30 Million Americans Have Tapped Retirement Savings Early in Last 12 Months

The Oligarch Recovery – Low Income Americans Can’t Afford to Live in Any Metro Area

Another Tale from the Oligarch Recovery – How a $1,500 Sofa Costs $4,150 When You’re Poor

In Liberty,

Michael Krieger

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP