– “Another Crisis Is Certain”, Warns Former BOE Chief:

“The global economy risks becoming trapped in a low growth, low inflation, low interest rate equilibrium,” BOE governor Mark Carney warned, in a speech at the G20 summit in Shanghai. “For the past seven years, growth has serially disappointed—sometimes spectacularly,” he added.

That’s a bit of unwelcome “truthiness” from one of the world’s most powerful central bankers and it comes as his predecessor, the incomparable Mervyn King, warns that a new financial crisis is “certain.”

Below, find an excerpt from King’s new book as originally published by The Telegraph.

* * *

From “Why Throwing Money At Financial Panic Will Lead As Into A New Crisis,” by Mervyn King

The past 20 years in the modern world were the best of times and the worst of times.

It was a tale of two epochs – in the first growth and stability, followed in the second by the worst banking crisis the industrialised world has ever witnessed. The largest banks in the biggest financial centres in the advanced world failed, triggering a worldwide collapse of confidence and bringing about the deepest recession since the 1930s. How did this happen? Was it a failure of individuals, institutions or ideas?

Unless we go back to the underlying causes we will never understand what happened and will be unable to prevent a repetition and help our economies truly recover.

In the spring of 2011, I was in Beijing to meet a senior Chinese central banker. Over dinner in the Diaoyutai State Guesthouse, where we had earlier played tennis, we talked about the lessons from history for the challenges we faced, the most important of which was how to resuscitate the world economy after the collapse of the western banking system in 2008.

Bearing in mind the apocryphal answer of Premier Chou Enlai to the question of what significance one should attach to the French Revolution (it was ‘“too soon to tell”), I asked my Chinese colleague what importance he now attached to the Industrial Revolution in Britain in the second half of the 18th century.

He thought hard. Then he replied: “We in China have learnt a great deal from the West about how competition and a market economy support industrialisation and create higher living standards. We want to emulate that.”

Then came the sting in the tail, as he continued: “But I don’t think you’ve quite got the hang of money and banking yet.”

His remark was the inspiration for this book.

Since the crisis, many have been tempted to play the game of deciding who was to blame for such a disastrous outcome.

But blaming individuals is counterproductive – it leads you to think that if just a few, or indeed many, of those people were punished then we would never experience a crisis again. If only it were that simple.

The crisis was a failure of a system, and the ideas that underpinned it, not of individual policymakers or bankers, incompetent and greedy though some of them undoubtedly were. There was a general misunderstanding of how the world economy worked.

There is more to life than finance, and more to finance than the events of 2008. The world economy today seems incapable of restoring the prosperity we took for granted before the crisis.

Many of the problems that seem to overwhelm us – poverty, rising inequality, crumbling infrastructure, ethnic tensions within and between countries – would all be eased by rates of growth that before the crisis seemed quite normal. But economic growth has fallen back across the developed world.

Some blame this on a slowing of innovation and productivity as the information revolution proves less transformative than earlier technological revolutions. I see the issue differently – the struggle to revive the world economy is the result of the disequilibrium that led to the crisis itself.

Before the crisis, spending continued at unsustainably high levels in the United States, United Kingdom and some other countries in Europe, and at unsustainably low levels in Germany and China.

That created an imbalance within those countries, with spending either too high or too low relative to current and prospective incomes. And the imbalance between countries – large trade surpluses and deficits – grew. These developments were not irrational, but were the consequence of people struggling to behave rationally in a world of radical uncertainty, part and parcel of a market economy.

All this added up to a disequilibrium within and between major economies. There was neither internal nor external balance.

From the mid-1990s, international meetings settled into a pattern in which European officials would berate the United States for saving so little, American officials would lambast Europeans for failing to understand the need for a change in trade balances, and Japanese officials would remain knowingly silent. Chinese officials would report the latest historically high growth rate. But there seemed little understanding of how all these factors fitted together.

The disequilibrium in the world economy became increasingly serious. Real interest rates were distorted well below the likely expected return on capital investment in an economy growing at its normal rate, encouraging investment in areas where demand was subsequently revealed to be unsustainably high.

Real exchange rates were distorted, so creating unsustainable trade deficits and surpluses, along with a flow of capital from countries where returns on investment were high to countries where they were low. Bad investments were made – in housing in the US and some countries in Europe, in commercial property, such as shopping centres, in the UK, in construction in China and in the export sector in Germany.

The most obvious symptom of the current disequilibrium is the extraordinarily low level of interest rates which, since the crisis, have fallen further.

The consequences have been further rises in asset prices and a desperate search for yield as investors, from individuals to insurance companies, realise that the current return on their investments is inadequate to support their spending needs. Central banks are trapped into a policy of low interest rates because of the continuing belief that the solution to weak demand is further monetary stimulus.

They are in a prisoner’s dilemma: if any one of them were to raise interest rates, they would risk a slowing of growth and possibly another downturn.

If real interest rates remain close to zero, the disequilibrium in spending and saving will continue and the ultimate adjustment to a new equilibrium will be all the more painful. If real interest rates start to move back to more normal levels, markets will reassess their view of the future and asset prices could fall sharply. Neither prospect suggests a smooth and gradual return to a stable path for the economy. Further turbulence in the world economy, and quite possibly another crisis, are to be expected.

The epicentre of the next financial earthquake is as hard to predict as a geological earthquake. It is unlikely to be among banks in New York or London, where the aftershocks of 2008 have led to efforts to improve the resilience of the financial system.

But there are many places where the underlying forces of the disequilibrium in their economies could lead to cracks in the surface – emerging markets that have increased indebtedness, the euro area with its fault lines, China with a financial sector facing large losses, and the middle and near east with a rise in political tensions.

Since the end of the immediate banking crisis in 2009, recovery has been anaemic at best. By late 2015, the world recovery had been slower than predicted by policymakers, and central banks had postponed the inevitable rise in interest rates for longer than had seemed either possible or likely.

There was a continuing shortfall of demand and output from their pre-crisis trend path of close to 15pc. Stagnation – in the sense of output remaining persistently below its previously anticipated path – had once again become synonymous with the word capitalism. Lost output and employment of such magnitude has revealed the true cost of the crisis and shaken confidence in our understanding of how economies behave. How might we restore growth, and what could happen if we don’t?

Many countries can now see that they have taken monetary policy as far as it can go. The weakness of demand across the world means that many, if not most, countries can credibly say that if only the rest of the world were growing normally then they would be in reasonable shape. But since it isn’t, they aren’t.

So with interest rates close to zero, and fiscal policy constrained by high government debt, the objective of economic policy in a growing number of countries is to lower the exchange rate.

In countries as far apart as New Zealand, Australia, Japan, France and Italy, central banks and governments are becoming more and more strident in their determination to talk the exchange rate down. Competitive depreciation is a zero-sum game as countries try to “steal” demand from each other.

The experience of stubbornly weak growth around the world since the crisis has led to a new pessimism about the ability of market economies today to generate prosperity. One increasingly common view is that the long-term potential rate of economic growth has fallen. But the proposition that the era of great discoveries has come to an end because the major inventions, such as electricity and aeroplanes, have been made and humankind has plucked the low- hanging fruit is not convincing.

In areas such as information technology and biological research on genetics and stem cells we are living in a golden age of scientific discovery.

By definition, ideas that provide breakthroughs are impossible to predict, so it is too easy to fall into the trap of thinking that the future will generate fewer innovations than those we saw emerge in the past.

Over time, and with sufficient investment to support it, a move to a new equilibrium will enable economies to regain their pre-crisis path of productivity. To restore faith in capitalism will require bold action – to raise productivity, rebalance our economies, and reform our system of money and banking.

At present, the world’s finance ministers and central bank governors, well intentioned and hard working, meet regularly and issue communiqués rededicating themselves to achieving the objective of “strong, sustainable and balanced growth”.

Whatever can be said about the world recovery since the crisis, it has been neither strong, nor sustainable, nor balanced. There seems little political willingness to be bold, and so perhaps we should fear that the size of the ultimate adjustment will just go on getting bigger.

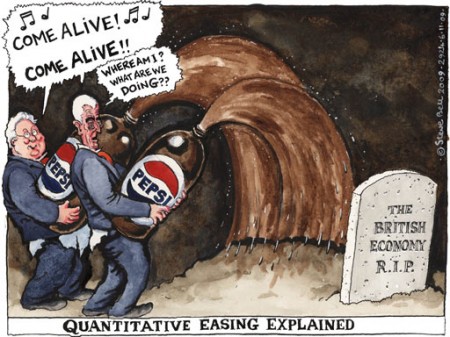

Dealing with the immediate symptoms of crises by taking short- term measures to maintain market confidence – usually by throwing large amounts of money at it – will only perpetuate the underlying disequilibrium.

Almost every financial crisis starts with the belief that the provision of more liquidity is the answer, only for time to reveal that beneath the surface are genuine problems of solvency.

* * *

King also says the following: “Without reform of the financial system, another crisis is certain, and the failure … to tackle the disequilibrium in the world economy makes it likely that it will come sooner rather than later.”

Why do central bankers always wait until after they’ve retired to tell the truth?

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP