– UK’s Cameron Sets June 23 Date For EU Membership Referendum:

On Friday, David Cameron trumpeted a “deal” the British PM says he secured with the EU that will reduce the UK’s financial burden as it relates to refugees and other EU nations.

To be sure, the “agreement” seems more symbolic than anything. Indeed, it’s not even clear exactly what it is Cameron accomplished with negotiations in Brussels. Apparently, the UK won concessions on welfare curbs and financial regulation, and the ambiguity surrounding the agreement didn’t stop the PM from proclaiming he had secured “special status” for Britain in the EU.

I have negotiated a deal to give the UK special status in the EU. I will be recommending it to Cabinet tomorrow. Press conference shortly.

— David Cameron (@David_Cameron) February 19, 2016

Other EU officials voiced their support for Cameron’s efforts.

Deal. Unanimous support for new settlement for #UKinEU

— Donald Tusk (@eucopresident) February 19, 2016

@David_Cameron fought hard for Britain. Good deal for UK and for EU. Congrats! #EUCO#UKinEU

— Lars Løkke Rasmussen (@larsloekke) February 19, 2016

Agreement #UKinEU done. Drama over.

— Dalia Grybauskait? (@Grybauskaite_LT) February 19, 2016

Yes, “drama over.” Only not really, because now the British people will decide whether they agree with Cameron’s contention that “leaving Europe would threaten [the country’s] economic and national security” and that Britian “will be safer, stronger, and better off in a reformed European Union.”

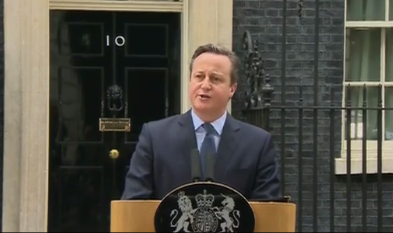

Today, Cameron held the first Saturday cabinet meeting since the Falklands War in 1982 before announcing that a referendum on EU membership will take place on June 23. “The choice is in your hands, but my recommendation is clear,” he told his fellow Brits.

BREAKING: Britain will hold EU referendum on June 23, David Cameron confirms https://t.co/d5gC6kRpzvhttps://t.co/HDwCKGhg4n

— Bloomberg Business (@business) February 20, 2016

As Bloomberg notes, “Cameron was given a fillip on Saturday when Business Secretary Sajid Javid and Home Secretary Theresa May, both seen as wavering over which way to vote, threw their support behind the campaign to remain.”

“For reasons of security, protection against crime and terrorism, trade with Europe, and access to markets around the world, it is in the national interest to remain a member of the European Union,” May said. As a reminder, here’s what’s at stake for the UK financial sector:

- What is at stake? Financial services account for 180 billion pounds ($258 billion) a year — about 12 percent — of U.K. economic output and contribute 66 billion pounds in taxes. In some areas, like foreign exchange trading (41 percent of the world total) and over-the counter derivatives (49 percent), London is the undisputed global leader. Opponents of a Brexit fear a departure would precipitate years of uncertainty and steady waning of influence and market share.

- What is passporting and why does it matter? Under the current regime, any firm authorized in the U.K. firm is free to do business in any other European Economic Area state by applying for a “passport” from British regulators. For non-EU banks like JPMorgan Chase & Co., Credit Suisse Group AG or Nomura Holdings Inc., the ability to access the region’s 500 million customers from a base in London has been an important draw. Without it, many firms may seriously consider upping sticks.

- What would Brexit mean for the banks? Every day more than a trillion dollars worth of euros change hands in London, close to half the global total, according to the Bank for International Settlements. The City’s global dominance of the foreign-exchange market is likely to be tested by any Brexit package that fails to guarantee a continuation of access to the single market. Over-the-counter derivatives are another area for concern. About three-quarters of all trading in such instruments in Europe currently takes place in the British capital. Without access to the single market, much of that is likely to migrate, according to lawyers and bankers who say that U.S. banks are already mulling moving operations.

It is now the task of the British electorate to decide whether it’s in their best interest to tie their fate to an increasingly unstable union. Cameron has given ministers free rein to campaign as they please for or against continued EU membership and as Bloomberg goes on to write, “divisions in the Conservative Party are evident.”

“Euroskeptics, including many in Mr. Cameron’s party, have said EU membership is undemocratic, costly and ties British businesses up with red tape,” WSJ reminds us. “They have argued that the U.K. must leave the bloc to regain sovereign control over a range of policies, from immigration to trade.”

At least one analyst says the timing of the referendum bodes well for UK risk assets and for sterling (the cable rallied on Friday after the “deal” was struck). Calling the referendum early gives limited time for the “leave” campaign to come up with a coherent rebuttal, Lombard Odier’s global strategist Salman Ahmed argues.

Maybe. But really, the “leave” campaign’s message is fairly straightforward and on that note, we close with the following tweet from firebrand Nigel Farage:

June 23rd: our golden opportunity. Let battle be joined. We want our country back.

— Nigel Farage (@Nigel_Farage) February 20, 2016

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP