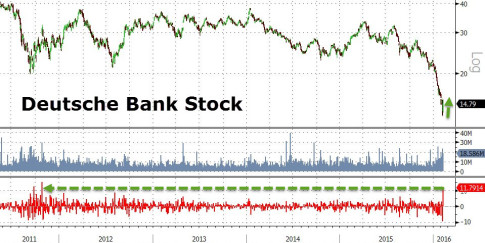

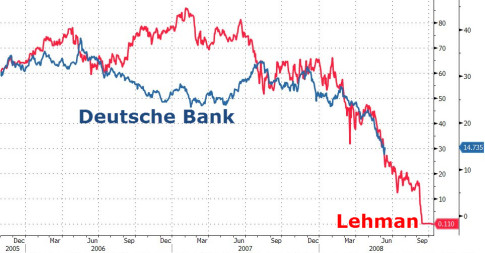

– Deutsche Bank Spikes Most In 5 Years (Just Like Lehman Did):

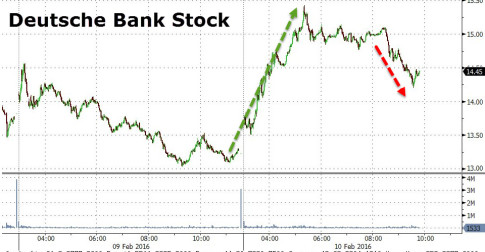

Rumors of ECB monetization (which would be highly problematic in the new “bail-in” world) and old news of the emergency debt-buyback plan have sparked an epic ramp in Deutsche Bank’s stock this morning (+11% – the most since Oct 2011). This extreme volatility is, however, eerily reminiscent of 2007/8 when headline hockey sparked pumps and dumps on a daily basis in Lehman stock… until it was all over.

“Deutsche Bank is fixed”?

Or is it?

Things are already fading…

We suspect every bounce will be met by opportunistic selling as an inverted CDS curve has seldom if ever reverted back to life.

I recall a year ago Deutsche Bank was exposed to derivative toxicity to the tune of $70Trillion. Now it’s $75T, so they haven’t done much to protect either the stakeholders or depositors.

The debt is now bigger than Lehman’s exposure in 2008.

As Max Keiser says, it’s a Ponzi House of Cards and must collapse due to its unsustainability.

https://www.superstation95.com/index.php/world/893