– Caught On Tape: Chinese Investors Find Out They Got Fleeced By A $7 Billion Ponzi Scheme:

When it comes to all things China, the old adage “go big or go home” certainly applies.

The country’s monumental expansion in the wake of the financial crisis was financed by borrowing on a massive scale, as the country’s debt burden rose from “just” $7 trillion in 2007 to more than $28 trillion today. That’s big.

Last year, at the peak of the country’s equity bubble, margin financing outstanding amounted to 18% of the SHCOMP’s free float market cap. Also big.

When the PBoC moved to devalue the yuan last August, Beijing ended up triggering an enormous amount of volatility that reverberated through global markets and culminated with an 8% one-day decline for the SHCOMP on August 24 and a 1,000 point drop in the Dow the same day. Again, big.

On Monday we got the latest “big” news out of China when Beijing announced it had arrested 21 people over a $7.6 billion P2P fraud Ezubao. 900,000 people were defrauded, making the fiasco the biggest ponzi scheme in history by number of victims.

Ezubao’s model was simple: they pitched the “business” as a P2P lending company through which investors could fund a variety of projects. The problem: 95% of the projects didn’t exist. Ezubao just made them up and used the new money to repay existing investors who were promised annual returns of between 9% and 15%.

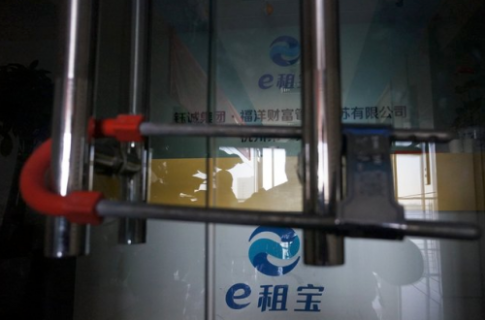

(the locked door at Ezubao’s office in Hangzhou)

Zhang Min, the former president of Yucheng Group, Ezubao’s parent, calls the company “a complete Ponzi scheme.”

Yes, a “complete ponzi scheme”, and one that was quite lucrative for Yucheng chairman Ding Ning who allegedly bought extravagant gifts for friends including a CNY12 million pink diamond ring and a CNY50 million green emerald.

The company’s assets have been frozen since December. Investments were pitched to unsuspecting Chinese as “high yield, low risk.”

“According to more than one suspect confessed, Ding Ning and several closely related group of female executives, their private life extremely extravagant, spendthrift to suck money,” a highly amusing Google translation of the original Xinhua story reads.

Ding Ning paid his brother CNY100 million per month, Xinhua says.

“Police used two excavators and dug for 20 hours to unearth 80 bags of evidence that Ezubo executives had buried six meters underground on the outskirts of Hefei, a city in the eastern province of Anhui,” Bloomberg adds.

On thing we’ve discussed at length over the past year is the extent to which China is teetering on the verge of social unrest. Between the stock market meltdown, the cratering economy (which will invariably lead to massive job losses) Chinese policymakers are going to have their hands full explaining what went wrong to the country’s 1.4 billion people (see here for more).

Needless to say, the revelation that 900,000 people were defrauded in a ponzi scheme run through China’s largely unregulated P2P space won’t help matters. “Cases of illegal fund-raising related to peer-to-peer lending have grown quickly in the past two years, according to the local authorities, and officials pledged in December to tighten regulation of the industry,” The New York Times writes. “Because of the enormous sums involved and the large investor base, the collapse of a major online-financing platform could raise concerns over confidence in the security of such investments.”

Here’s a clip of Ezubao’s defrauded “clients” protesting late last month. Expect more of this to come. And not just as it relates to ponzi schemes.