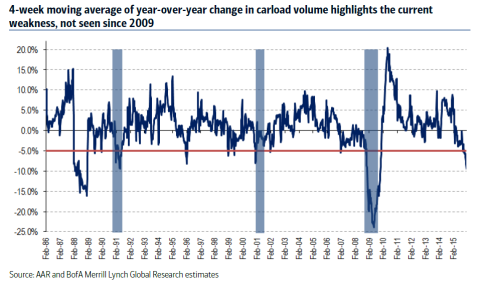

“And she added this nerve-wracking chart. Note the steep plunge to -10% at the right edge. The last three times this occurred, the economy was either entering a recession or was already deep into a recession: …”

– Rail Shipments Plummet to Recessionary Levels:

“Weaknesses in energy and manufacturing, as well as world economic softening, had a negative impact on both carload and intermodal traffic in 2015.” Those were the encouraging words of John T. Gray, Senior VP of Policy and Economics at the Association of American Railroads (AAR).

Transportation is a measure of how well the real economy is clicking. Alas rail traffic is getting clobbered.

The deterioration in the second half of 2015 dragged the whole year down from 2014: carloads fell 6.1%, according to the AAR, while intermodal containers and trailers edged up 1.6%, for a total decline of 2.5%. But the deterioration late in the year was a doozie.

In December, total volume dropped 8.9% year over year, with both components down: even intermodal containers and trailers, which had been holding up for much of the year, edged down 0.7%; and carloads (bulk commodities, autos, and the like) plunged 15.6%.

Only four of the 20 carload categories showed gains, and they’re relatively small categories: miscellaneous carloads, up 46.6%; motor vehicles and parts, up 5.2% (that relentlessly booming auto sector); chemicals, up 0.7%; and waste and scrap, up 3.3%.

But the big ones got crushed: carloads of coal, the largest category – done in by the low price of US natural gas emanating from the collapsing natural gas industry – plunged 27.9%; metallic ores, the second-largest category, plunged 39.1%; and petroleum and petroleum products, the third largest category, plunged 20.5%. The commodities rout is tearing into railroads with a vengeance!

And then there was last week’s rail traffic!

Christine Hughes, Chief Investment Strategist at OtterWood Capital, put it this way: “Rail volumes at recessionary levels.”

Last week rail carload data showed volumes fell 10.1% on a year-over-year basis resulting in the longest period of sustained weakness since 2009. Rail carloads have now fallen 5% on a year-over-year basis for the past 11 consecutive weeks. Over the last 30 years this has only happened five times and each occurrence either overlapped or preceded a recession by a few quarters.

And she added this nerve-wracking chart. Note the steep plunge to -10% at the right edge. The last three times this occurred, the economy was either entering a recession or was already deep into a recession:

Miracles do happen, and rail traffic could turn around on a dime and recover somehow, but it would take a major miracle to get that done, and not an ordinary run-of-the-mill miracle. And those have become exceedingly rare.

For our over-indebted, junk-rated retailers, our favorite LBO queens, it’s going to get very tough. Read… Defaults and Restructuring Next for Retailers