– China Scrambles to Put Plunge Protection Team Together: Banks Pledge Support For Crashing Market (ZeroHedge, July 4, 2015):

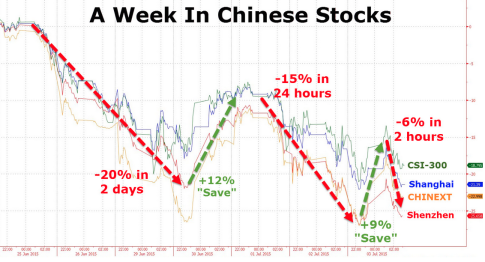

China has moved in the direction of direct intervention in its flagging equity markets, although it appears Beijing will try to orchestrate a “private” sector (whatever that means in China) solution first before going the nuclear route with the central bank’s balance sheet. As Bloomberg reports, the country’s largest brokerages are teaming up to invest nearly $20 billion in “blue chip” Chinese equities.

…

The sweater unravels, in China and around the world. The excessive web of debt built by greedy guts around the world has finally cracked, and pieces are falling out.

China has shown severe cracks in its false economy for the past few years with Ghost cities, ETC. Their stock market has been sinking for the last several months, their margin defaults also at record highs as people require their money for more urgent needs than holding margin laden stocks.

Margin defaults are at record highs here in the US, people choose to pay their mortgages and let their stocks go……Rapidly rising interest rates and the falling value of the dollar the cause.

The entire world economy is also sinking. Greece defaulted, its underwriters, the IMF, Germany, France, Italy & Spain now give their investors grave losses none can afford. All bonds & securities now worthless; losses in the Billions.

Debt relief, never on the table during Greek negotiations are now being urged by the same underwriters….. wanting to regain something from their huge losses to show investors. Its a moot point, Greece has defaulted; the money is gone. This will breed and spread panic as all debt being sold receives sharper scrutiny.

The economic pain, skyrocketing unemployment & zero growth has continued in the Euro and US for years. Falling wages, lower qualities of jobs (when they can be found)….all indicate the western economy cannot grow. For years we looked to China to rescue the world economy, but it has become clear China can do nothing.

Our plunging dollar is another indicator. Prices of food and goods are rising quickly and dramatically.

Moneychangers talk about the strong dollar……total fantasy. Fixed rate 30 year mortgage rates now exceed 5% with a perfect credit score. 5 year jumbo ARM close to 7%. This is destroying thousands of mortgage holders trying to hold their homes since 2007-08……..Mortgage holders with ARMs find conversion to fixed rate impossible.

Euro & the US are both economies in rapid implosion with exploding inflation as the value of our currencies plunge.

The debt level for the US and Euro now in quadrillions. There was not enough wealth created from the days of Ancient Rome until today to match the level of debt created & printed, thanks to the greedy guts.

No responsible accountants to monitor the debt level of either currency……the only accounting has been Enron Accounting, and that only creates more debt…….

There is more debt than global ability to pay it. Greedy guts have to take severe haircuts…….and they will do all they can to put the losses on the backs of the people of the world………