– Greece Becomes First Developed Country To Default To The IMF (ZeroHedge, June 30, 2015):

Faced with almost impossible choices…

And just as promised earlier in the week, Greece has now passed the midnight deadline for repayment of the €1.6 billion bundled loans due to the IMF and in thus in default.

Yes we are fully aware that using the pejorative term ‘default’ makes us members of the ignorati, but what else do you call it when you fail to pay back a contracted debt in a timely fashion? (and don’t say ‘arrears’) Anything else is semantics.

- *IMF SAYS GREECE FAILED TO MAKE PAYMENT DUE TUESDAY

- *IMF TO CONSIDER GREEK REQUEST FOR PAYMENT DELAY IN DUE COURSE

- *IMF BOARD INFORMED THAT GREECE IS NOW IN ARREARS

“I can also confirm that the IMF received a request today from the Greek authorities for an extension of Greece’s repayment obligation that fell due today, which will go to the IMF’s Executive Board in due course,” IMF spokesman Gerry Rice says in e-mailed statement.

This is the first time an advanced economy has defaulted to The IMF and is by far the largest default The IMF has ever faced.

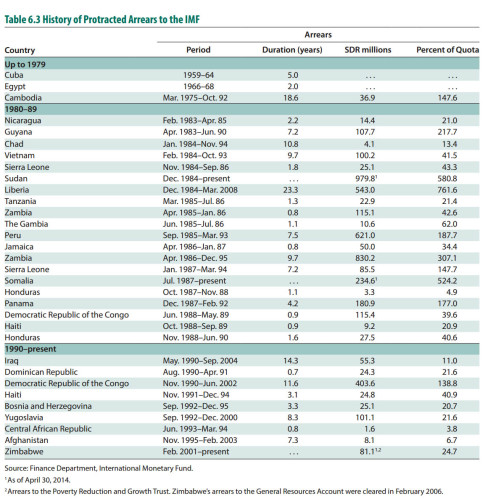

Below is the full list of countries who are (ahem Zimbabwe) or have been in “protracted arrears” to the IMF in the past. Greece is now officially on this list.

And as AP reports,

Greece’s international bailout formally expires, country loses access to existing financing.

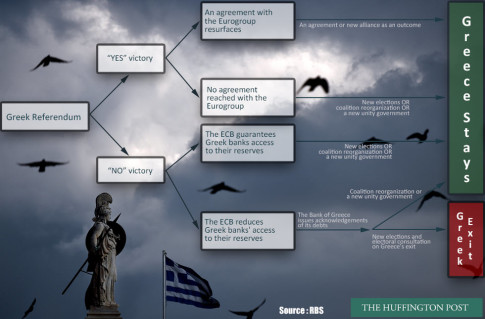

What happens next:

And therefore Greece is poised between remaining a member of the eurozone or leaving it. In fact, as WSJ’s Stephen Fidler explains, there are five possible future currency arrangements for Greece. Here they are…

1. Greece stays in the eurozone: This is the option likely to cause the smallest short-term disruption to the Greek economy. The Greek central bank would retain access to liquidity from the European Central Bank, and the Greek banks would stay on life support. This looks increasingly likely to be accompanied by some kind of further negotiated debt relief. To get it, Greece would almost certainly have to agree to more conditions of the sort successive Greek governments have found it hard to accept.

2. Greece keeps the euro, but sits outside the eurozone: Jacob Funk Kierkegaard of the Peterson Institute for International Economics in Washington calls this the “Montenegro option” and argues this is the most likely outcome should Greece exit the eurozone. This would not be “a new drachma, but Montenegro—i.e. Greece becomes just another relatively poor unilaterally euroized non-EU Balkan economy,” he writes here. In some ways, this would be the worst of all worlds because Greece would lose access to the ECB. Countries using a foreign currency as legal tender have no access to a lender-of-last-resort, which means that every bank liquidity crisis becomes a solvency crisis. They therefore tend to have stunted domestic financial sectors — which almost every academic study shows is bad for growth — or have a banking system owned by foreigners, which exports the lender-of-last resort role to other countries’ central banks. (Mexico didn’t adopt the dollar after the 1994-95 financial crisis — but in order to avoid an undue shrinkage of its banking sector, it allowed most of its banks to be bought by foreigners.)

3. A currency board: In this case, Greece would create a new currency but lock it to the euro – as Estonia did with the German mark in 1992 after it gained independence from the Soviet Union. The amount of new drachmas in circulation would be limited by the size of Greece’s international reserves: about $5.8 billion at the last count. Advocates argue that this would impose discipline on the Greeks — poor economic policies lead to an outflow of reserves and therefore of the domestic monetary base, which pushes up drachma interest rates, while good policies have the reverse effect. The drawback is that again the central bank is limited in its lender-of-last resort powers because it cannot create money freely. It also imposes discipline that, for now, may make it look unappetizing to Greece’s current rulers. It’s not much talked about, has a few enthusiastic and long-standing cheerleaders, but is a theoretical possibility. Here’s Steve Hanke arguing in favor.

4. A dual system: Here the drachma and the euro would circulate side-by-side. This has many historical precedents going back centuries. In practice, a dual system is likely to emerge when the Greek government runs out of euros and has to pay its domestic bills in government IOUs. The IOUs could at some future date be redeemed in euros, or could be eventually redeemed in drachmas, but they would initially be euro-denominated obligations of the government that would have a lesser value in the public mind than euro notes or coins. This state of affairs could continue for a long time, but there is an economic tendency called Gresham’s Law: ”Bad money chases out good.” Over time, euros would disappear from circulation because people would hoard them as a store of value – and people would spend the government IOUs. De facto, the drachma, whether or not it would so be called, would become the main means of exchange.

5. The new drachma: The move to the new drachma may well not come with a bang, but gradually — as described in 4 above. But an eventual formal switch of the currency would give Greece control over its own monetary policy. However, a new currency — which would likely float against the euro and other major currencies — would likely create enormous short-term disruption, not least because a heavy devaluation would follow and the banks would in effect be insolvent. Longer-term, it could be a motor for future growth of the Greek economy — because it would stimulate demand for Greek exports by lowering in real-terms the price of goods and services produced in Greece. Longer term, the effects of a devaluation depends on the quality of economic policies that accompany it. It will create inflation, by increasing the costs of imports. One important issue is how much the government raises wages and pensions to compensate for higher inflation. The more domestic wages and pensions are allowed to rise, the less impact the devaluation will have in simulating Greek exports longer term and the lower the benefits to economic growth.

Place your bets.

It may be the first, but it won’t be the last. At http://www.usdebtclock.org, check out some other world nations, especially Ireland with a debt load over 800%……This is the beginning of something new, yet inevitable. Loaning money to people who cannot repay will always lead to default, regardless.

I would name it financial suicide……..

Right now, Puerto Rico, Argentina, Greece & the Ukraine are sliding into default as I write this response, the trend is setting up, getting stronger all the time.

Looks like can kicking time is here, Greece to accept greedy gut terms this morning (9am eastern, 6am where I live July 1). Obama came out and said Greece would hurt the world economy………..can’t allow the truth to come out.

Looks like a 2 year plan to kick the can once again according to Bloomberg Surveillance……The insanity continues.

So much for Greek standing up to the greedy guts, they have a choke hold on the Euro & US economies…….

Just an update.

The Greek Prime Minister sent a letter preparing to accept greedy gut bailout from greedy guts with modifications;

1. Maintain discount on value added tax on Greek island to keep tourism strong.

2. Expresses unwillingness to accept pension reform as outlined by greedy guts.

German response is negative to Greek offer, they say his conditions are a no start. Greeks must accept all austerity measures, which I doubt.

Since Greece has gone beyond the IMF expiration date, greedy guts want harsher measures, making news I posted here earlier less viable.

http://www.theguardian.com/world/2015/jun/30/eurozone-emergency-greece-without-financial-lifeline

Prime Minister completely controls the Sunday referendum. A no vote now feasible according to a new poll: 46% showing No to bailout terms, 37% Yes, 17% Undecided. If poll reflect badly by Saturday, he can cancel the referendum; he alone having power to decide. Greece still requires more money than greedy guts wish to advance….only wanting to pay enough to kick the debt can down the road longer.

Adding to the growing default trend: Puerto Rico bond prices have dropped 17% in two days due to missing their debt payments; their governor seeks delay in debt payment. (This can prevent hedge fund managers from selling their positions. Poor greedy guts.) Obama says Greece will be a problem for the world economy but has nothing to say or do for this US commonwealth member. Add in Argentina, the Ukraine……++++