European banks are suffering the exact ‘contagion’ that we were told numerous times would be contained ... led by limit down moves in Italy.

– “Uncontained” – Greek Stocks Crash 17% As European Banks Plunge Most In 3 Years (ZeroHedge, June 29, 2015):

Despite the Greek stock market being closed there is an option for hedging the exposure that all the smart money has been building to Greece in the past few days – GREK – the US-trade Greek ETF. In the pre-open, GREK is trading down 17% but the problems lie ahead as more and more realize how illiquid it is and redemptions are forced to be made from ‘cash’ – since there is no way to offload the underlying Greek stocks, unless OTC trades can be arranged with other entities – which could thus expose the entire false-liquidity-facade of the ETF industry.

GREK – the Greek Stock ETF – is getting hammered on negligible volume already…

While the best efforts of the SNB are underway to protect the markets from unease, European banks are suffering the exact ‘contagion’ that we were told numerous times would be contained.

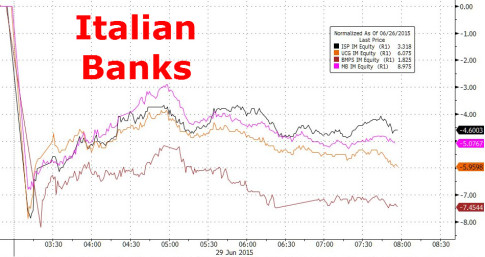

And European Banks are getting crushed

led by Italian banks…

Charts: Bloomberg

The BANKSTERS’ BANKSTERS admit they’ve *uc#ed up” and used all their ammunition to cover up decades of incompetence and this next crash will be a Tsunami.

http://www.shtfplan.com/headline-news/central-bank-of-central-banks-says-the-world-is-unable-to-fight-next-global-crash_06292015

This one has been quietly bubbling in the background since we were told a year ago that world demand was falling off a cliff……now the results are coming in……

http://www.shtfplan.com/headline-news/the-market-detonation-youre-ignoring-the-chinese-market-is-in-an-all-on-crash_06272015

This could trigger the US collapse in sync with Greece triggering other EU defaults and the euro collapse.

Can only be good news seeing as the alternative is financial oppression and austerity to support the banksters. Hey…a return to the Wild West!