From the article:

“In other words, if US inventories, already at record high levels, and with the inventory to sales rising to great financial crisis levels, had not grown by $121.9 billion and merely remained flat, US Q1 GDP would not be 0.2%, but would be -2.6%.

Oh heck, just round it down to -3.0%“

– Biggest Inventory Build In History Prevents Total Collapse Of The US Economy (ZeroHedge, April 29, 2015):

While we already observed that in Q1, US GDP rose by an appalling 0.2%, far, far below the consensus Wall Street estimate (in case you missed it, here again is the one thing every Wall Street economist desperately needs) and precisely in line with the Atlanta Fed forecast which we brought attention to in early March, confirming yet again that US stocks no longer reflect any fundamentals but merely Fed and global liquidity injections, there is something far more disturbing under the surface of today’s GDP report.

Inventories.

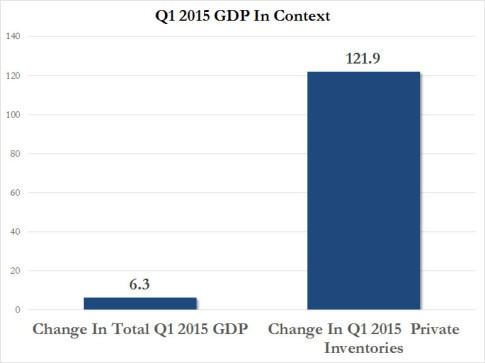

Specifically, the $121.9 billion increase in private, mostly nonfarm, inventories in the first quarter.

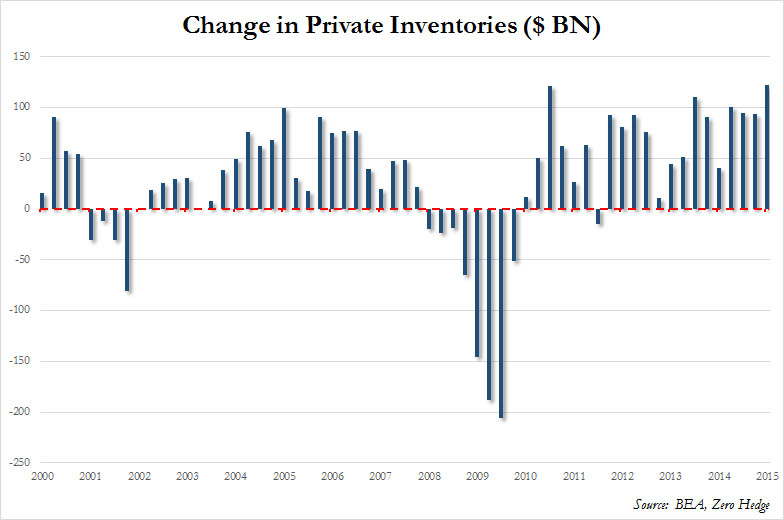

Cutting to the punchline, this was the biggest inventory build in history.

Another punchline: in Q1 2015, the US economy rose by a paltry $6.3 billion in nominal terms to $17.710 trillion.

Here is how the total GDP growth compares to just the increase in inventories, which as we wrote earlier this week, is the primary reason why the world is now gripped in a global deflationary wave.

In other words, if US inventories, already at record high levels, and with the inventory to sales rising to great financial crisis levels, had not grown by $121.9 billion and merely remained flat, US Q1 GDP would not be 0.2%, but would be -2.6%.

Oh heck, just round it down to -3.0%

Which means that as this massive inventory overhang is eventually cleared out (once the US runs out of space to store all these widgets, gadgets and raw materials, here’s looking at you Cushing) and there has been $1.1 trillion in consistent inventory build in the past 3 years, US GDP will be pressured even more with every passing quarter, or else the moment of deflationary rapture when everyone is forced to liquidate and/or dump this inventory at the same time, will result in a monetary supernova which will leave the Fed with no choice but to literally paradrop money on the continental US.