– Warren Buffett the Slumlord – Predatory Loans, Kickbacks and Preying on the Poor at Clayton Homes (Liberty Blitzkrieg, April %, 2015):

The disastrous deal ruined their finances and nearly their marriage. But until informed recently by a reporter, they didn’t realize that the homebuilder (Golden West), the dealer (Oakwood Homes) and the lender (21st Mortgage) were all part of a single company: Clayton Homes, the nation’s biggest homebuilder, which is controlled by its second-richest man — Warren Buffett.

Buffett’s mobile-home empire promises low-income Americans the dream of homeownership. But Clayton relies on predatory sales practices, exorbitant fees, and interest rates that can exceed 15 percent, trapping many buyers in loans they can’t afford and in homes that are almost impossible to sell or refinance, an investigation by The Seattle Times and Center for Public Integrity has found.

Berkshire Hathaway, the investment conglomerate Buffett leads, bought Clayton in 2003 and spent billions building it into the mobile-home industry’s biggest manufacturer and lender. Today, Clayton is a many-headed hydra with companies operating under at least 18 names, constructing nearly half of the industry’s new homes and selling them through its own retailers. It finances more mobile-home purchases than any other lender by a factor of six. It also sells property insurance on them and repossesses them when borrowers fail to pay.

Former dealers said the company encouraged them to steer buyers to finance with Clayton’s own high-interest lenders.

Buyers told of Clayton collection agents urging them to cut back on food and medical care or seek handouts in order to make house payments.

To maintain its down-to-earth image, Clayton has hired the stars of the reality-TV show “Duck Dynasty” to appear in ads…

– From the excellent Seattle Times article: The Mobile-Home Trap: How a Warren Buffett Empire Preys on the Poor

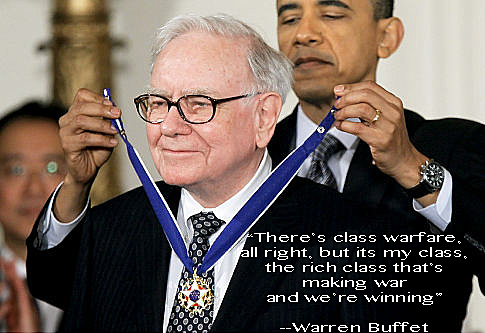

In so many ways, Warren Buffett and modern America are the same thing. An idea packaged and marketed so brilliantly, most of humanity unquestionably believes the myth. Warren Buffett and the U.S. both sell themselves as encompassing the very best of human qualities; highly successful, extraordinarily intelligent, yet at the same time, extremely ethical. It’s that last part that’s actually most important to the continued power and prestige of both the man and the nation-state. However, when you look beneath the surface, it becomes increasingly clear that neither of them actually come close to what’s printed on the package.

Incredibly, Mr. Buffett has proven far more successful in maintaining and nurturing his own personal myth, than America itself has during these post crisis years. While more and more people domestically, and especially internationally, have come to acknowledge the hypocrisy of U.S. foreign and economic policy, it continues to be something marginally short of cultural blasphemy to harshly criticize Warren Buffett. This provides a fertile environment for him to continue to doggedly and ruthlessly expand his ubiquitous economic and political empire.

This is not an empire built simply on cheeseburgers, cherry coke and ice cream cones. As you will see in the following article, his empire is also dependent on predatory lending to the poor, kickbacks, market domination, lobbying and opacity, via Berkshire Hathaway’s mobile home company, Clayton Homes.

Clayton Homes was previously mentioned here at Liberty Blitzkrieg a year ago in the post, With 1 in 3 Homes Unaffordable, Freddie Mac Prepares to Enter the Trailer Home Loan Market, but an excellent deep-dive article recently published by the Seattle Times provides a great deal of additional and extremely disturbing information.

Here are some excerpts, but I strongly suggest reading the entire article:

Billionaire philanthropist Warren Buffett controls a mobile-home empire that promises low-income borrowers affordable houses. But all too often, it traps those owners in high-interest loans and rapidly depreciating homes.

EPHRATA, Grant County — After years of living in a 1963 travel trailer, Kirk and Patricia Ackley found a permanent house with enough space to host grandkids and care for her aging father suffering from dementia.

So, as the pilot cars prepared to guide the factory-built home up from Oregon in May 2006, the Ackleys were elated to finalize paperwork waiting for them at their loan broker’s kitchen table.

But the closing documents he set before them held a surprise: The promised 7 percent interest rate was now 12.5 percent, with monthly payments of $1,100, up from $700.

The terms were too extreme for the Ackleys. But they’d already spent $11,000, at the dealer’s urging, for a concrete foundation to accommodate this specific home.

Kirk’s construction job and Patricia’s Wal-Mart job together weren’t enough to afford the new monthly payment. But, they said, the broker was willing to inflate their income in order to qualify them for the loan.

The disastrous deal ruined their finances and nearly their marriage. But until informed recently by a reporter, they didn’t realize that the homebuilder (Golden West), the dealer (Oakwood Homes) and the lender (21st Mortgage) were all part of a single company: Clayton Homes, the nation’s biggest homebuilder, which is controlled by its second-richest man — Warren Buffett.

Buffett’s mobile-home empire promises low-income Americans the dream of homeownership. But Clayton relies on predatory sales practices, exorbitant fees, and interest rates that can exceed 15 percent, trapping many buyers in loans they can’t afford and in homes that are almost impossible to sell or refinance, an investigation by The Seattle Times and Center for Public Integrity has found.

Berkshire Hathaway, the investment conglomerate Buffett leads, bought Clayton in 2003 and spent billions building it into the mobile-home industry’s biggest manufacturer and lender. Today, Clayton is a many-headed hydra with companies operating under at least 18 names, constructing nearly half of the industry’s new homes and selling them through its own retailers. It finances more mobile-home purchases than any other lender by a factor of six. It also sells property insurance on them and repossesses them when borrowers fail to pay.

Berkshire extracts value at every stage of the process. Clayton even builds the homes with materials — such as paint and carpeting — supplied by other Berkshire subsidiaries.

Former dealers said the company encouraged them to steer buyers to finance with Clayton’s own high-interest lenders.

Buyers told of Clayton collection agents urging them to cut back on food and medical care or seek handouts in order to make house payments. And when homes got hauled off to be resold, some consumers already had paid so much in fees and interest that the company still came out ahead. Even through the Great Recession and housing crisis, Clayton was profitable every year, generating $558 million in pre-tax earnings in 2014.

The company’s tactics contrast with Buffett’s public profile as a financial sage who values responsible lending and helping poor Americans keep their homes.

This is the key to Buffett’s continued success. A public profile that is basically a myth compared with reality.

Berkshire Hathaway spokeswoman Carrie Sova and Clayton spokeswoman Audrey Saunders ignored more than a dozen requests by phone, email and in person to discuss Clayton’s policies and treatment of consumers. In an emailed statement, Saunders said Clayton helps customers find homes within their budgets and has a “purpose of opening doors to a better life, one home at a time.”

In 2013, Clayton provided 39 percent of new mobile-home loans, according to a Times/CPI analysis of federal data that 7,000 home lenders are required to submit. The next biggest lender was Wells Fargo, with just 6 percent of the loans.

Of course, Warren Buffett’s Berkshire Hathaway is the largest shareholder in Wells Fargo.

Clayton provided more than half of new mobile-home loans in eight states. In Texas, the number exceeds 70 percent. Clayton has more than 90 percent of the market in Odessa, one of the most expensive places in the country to finance a mobile home.

To maintain its down-to-earth image, Clayton has hired the stars of the reality-TV show “Duck Dynasty” to appear in ads.

It’s all just a show, yet Americans remain completely awestruck by this clever oligarch.

“Home purchases should involve an honest-to-God down payment of at least 10% and monthly payments that can be comfortably handled by the borrower’s income,” Buffett later wrote. “That income should be carefully verified.”

But in examining more than 100 Clayton home sales through interviews and reviews of loan documents from 41 states, reporters found that the company’s loans routinely violated the lending standards laid out by Buffett.

Clayton dealers often sold homes with no cash down payment. Numerous borrowers said they were persuaded to take on outsized payments by dealers promising that they could later refinance. And the average loan term actually increased from 21 years in 2007 to more than 23 years in 2009, the last time Berkshire disclosed that detail.

Many borrowers interviewed for this investigation described being steered by Clayton dealers into Clayton financing without realizing the companies were one and the same. Sometimes, buyers said, the dealer described the financing as the best deal available. Other times, the Clayton dealer said it was the only financing option.

Kevin Carroll, former owner of a Clayton-affiliated dealership in Indiana, said in an interview that he used business loans from a Clayton lender to finance inventory for his lot. If he also guided homebuyers to work with the same lender, 21st Mortgage, the company would give him a discount on his business loans — a “kickback,” in his words.

During the most recent four-year period, 93 percent of Clayton’s mobile-home loans had such costly terms that they required extra disclosure under federal rules. Among all other mobile-home lenders, fewer than half of their loans met that threshold.

A couple of years after moving into their new mobile home, Kirk Ackley was injured in a backhoe rollover. Unable to work, he and his wife urgently needed to refinance the costly 21st Mortgage loan they regretted signing.

They pleaded with the lender several times for the better terms that they originally were promised, but were denied, they said. The Ackleys tried to explain the options to a 21st supervisor: If they refinanced to lower payments, they could stay in the home and 21st would get years of steady returns. Otherwise, the company would have to come out to their rural property, pull the house from its foundation and haul it away, possibly damaging it during the repossession.

They both recall being baffled by his reply: “We don’t care. We’ll come take a chainsaw to it — cut it up and haul it out in boxes.”

Nine Clayton consumers interviewed for this story said they were promised a chance to refinance. In reality, Clayton almost never refinances loans and accounts for well under 1 percent of mobile-home refinancings reported in government data from 2010 to 2013. It made more than one-third of the purchase loans during that period.

Carroll has since sold belongings, borrowed money from relatives and cut back on groceries to make payments. When she was late, she spoke frequently to Clayton’s phone agents, whom she described as “the rudest, most condescending people I have ever dealt with.” It’s a characterization echoed by almost every borrower interviewed for this story.

Consumers say the company’s response to pleas for help is an invasive interrogation about their family budgets, including how much they spend on food, toiletries and utilities.

Denise Pitts, of Knoxville, Tenn., said Vanderbilt collectors have called her multiple times a day, with one suggesting that she cancel her Internet service, even though she home-schools her son. They have called her relatives and neighbors, a tactic other borrowers reported.

After Pitts’ husband, Kirk, was diagnosed with aggressive cancer, she said, a Vanderbilt agent told her she should make the house payment her “first priority” and let medical bills go unpaid. She said the company has threatened to seize her property immediately, even though the legal process to do so would take at least several months.

Practices like contacting neighbors, calling repeatedly and making false threats can violate consumer-protection laws in Washington, Tennessee and other states.

The government has known for years about concerns that mobile-home buyers are treated unfairly. Little has been done.

MHI spent $4.5 million since 2003 lobbying the federal government. Those efforts have helped the company escape much scrutiny, as has Buffett’s persona as a man of the people, analysts say.

“There is a Teflon aspect to Warren Buffett,” said James McRitchie, who runs a widely read blog, Corporate Governance.

Personally, I never thought twice about the Warren Buffett myth until I noticed how much he pandered to the government for Wall Street bailouts. Bailouts, which clearly in retrospect, funneled enormous wealth to the super rich, while leaving everyone else out to dry.

My most popular post on the subject of Mr. Buffett was published all the way back in 2011, and titled, A Wolf in Sheep’s Clothing. Here’s the opening paragraph:

Anyone that has read these pieces for a while knows where I stand on Warren Buffett. Namely I can’t stand him. It has nothing to do with the fact that he has so much money. I am not an envious person and moreover I think having wealth anywhere near his is more of a curse than a blessing. The reason I can’t stand him is because he is a fraud. While he may have been a great investor at one point, he is more of a great actor than anything else. Here is one of the richest people in the world. He sits there in Nebraska, chuckling, drinking his cherry coke and eating hamburgers in this pathetically obvious attempt to convince the masses he is “just like us.” The term wolf in sheep’s clothing was invented for guys like this. Like most people out there I don’t like bad guys. The trick; however, is that the most dangerous bad guys don’t come out and tell you they are bad guys and how they are going to fleece you. What they do is pretend they are the good guys. Pretend that they are on the side of the little guy or working for the “collective good,” which is a preposterous statement because there is no such thing. Human desires and notions of what is a good life are as varied as the stars in the sky. Once we start allowing officials or rich people to define “collective good” you can be sure we are finished.

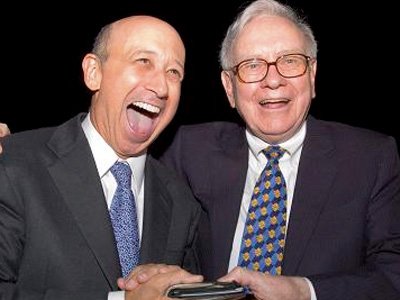

With all of that in mind, take a look at one of the pictures used in the Seattle Times article:

The man to the left is Kevin Clayton, CEO of Clayton Homes, and the man to the right is, of course, “Uncle” Warren Buffett, clutching his characteristic ice cream pop. Take a close look at the expression on the face of Kevin Clayton. This isn’t a look of admiration, respect, or even love. It’s a look of worship, of undying cultish fervor. The only thing missing is a tongue hanging out of his mouth and a blob of drool on his tie. If you ever see me looking at anyone with this sort of expression, immediately put me out of my misery.

One thing that’s crystal clear, is there’s no doubt regarding the intelligence of Warren Buffett. We don’t need to discuss it, or express admiration for that here. On the other hand, many questions need to be asked about his supposedly ethical business practices. To me, he seems to represent the consummate personification of the saying “do as I say, not as I do.” At the end of the day, I think the secret to his continuing success is more about his acting skills than his intelligence.

As I noted on Twitter recently:

The best actor I’ve ever seen in my life: pic.twitter.com/EZ263Ly1LT

— Michael Krieger (@LibertyBlitz) February 28, 2015

That, more than anything else, is the Oracle of Omaha’s secret weapon.