– Revolt In Athens: Syriza Central Committee Member Says “Leadership Strategy Has Failed Miserably” (ZeroHedge, Feb 23, 2015):

Not everybody is ignoring that fact that just days after the new Prime Minister promised the Greek population on prime time TV that the loathed bailout program wouldn’t be extended and that Greece would have a fresh start – i.e., the mandate it was elected on – one without austerity, Greece folded on virtually every demand, to the point where the European Commission may itself have drafted the “reform agreement“ that the Greek finance minister was said to have created.

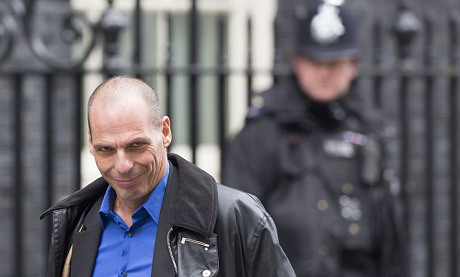

One person who may be starting a splinter revolt within Syriza itself is Stathis Kouvelakis, a member of the central committee of the leftist organization, a teacher of political theory at King’s College, and the latest to demonstrate that the Syriza facade of cohesive acceptance of the past week’s “negotiations”, is starting to crumble.

From his post “The Alternative In Greece“, translated by Wayne Hall, and appearing first in Jacobinmag.

The strategy of Syriza’s leadership has failed miserably. But it’s not too late to avert total defeat.

Let us begin with what should be indisputable: the Eurogroup agreement that the Greek government was dragged into on Friday amounts to a headlong retreat.

The memorandum regime is to be extended, the loan agreement and the totality of debt recognized, “supervision,” another word for troika rule, is to be continued under another name, and there is now little chance Syriza’s program can be implemented.

Such a thorough failure is not, and cannot be, a matter of chance, or the product of an ill-devised tactical maneuver. It represents the defeat of a specific political line that has underlain the government’s current approach.

Friday’s Agreement

In the spirit of the popular mandate for a break with the memorandum regime and liberation from debt, the Greek side entered negotiations rejecting the extension of the current “program,” agreed to by the Samaras government, along with the €7 billion tranche, with the exception of the €1.9 billion return on Greek bonds to which it was entitled.

Not consenting to any supervisory or assessment procedures, it requested a four-month transitional “bridge program,” without austerity measures, to secure liquidity and implement at least part of its program within balanced budgets. It also asked that lenders recognize the non-viability of the debt and the need for an immediate new round of across-the-board negotiations.

But the final agreement amounts to a point-by-point rejection of all these demands. Furthermore, it entails another set of measures aimed at tying the hands of the government and thwarting any measure that might signify a break with memorandum policies.

In the Eurogroup’s Friday statement, the existing program is referred to as an “arrangement,” but this changes absolutely nothing essential. The “extension” that the Greek side is now requesting (under the “Master Financial Assistance Facility Agreement”) is to be enacted “in the framework of the existing arrangement” and aims at “successful completion of the review on the basis of the conditions in the current arrangement.”

It is also clearly stated that

only approval of the conclusion of the review of the extended arrangement by the institutions … will allow for any disbursement of the outstanding tranche of the current EFSF programme and the transfer of the 2014 SMP profits [these are the 1.9 billion of profits out of Greek bonds to which Greece is entitled]. Both are again subject to approval by the Eurogroup.

So Greece will be receiving the tranche it had initially refused, but on the condition of sticking to the commitments of its predecessors.

What we have then is a reaffirmation of the typical German stance of imposing — as a precondition for any agreement and any future disbursement of funding — completion of the “assessment” procedure by the tripartite mechanism (whether this is called “troika” or “institutions”) for supervision of every past and future agreement.

Moreover, to make it abundantly clear that the use of the term “institutions” instead of the term “troika” is window-dressing, the text specifically reaffirms the tripartite composition of the supervisory mechanism, emphasizing that the “institutions” include the ECB (“against this background we recall the independence of the European Central Bank”) and the International Monetary Fund (“we also agreed that the IMF would continue to play its role”).

As regards the debt, the text mentions that “the Greek authorities reiterate their unequivocal commitment to honour their financial obligations to all their creditors fully and timely.” In other words forget any discussion of “haircuts,” “debt reduction,” let alone “writing off of the greater part of the debt,” as is Syriza’s programmatic commitment.

Any future “debt relief” is possible only on the basis of what was proposed in the November 2012 Eurogroup decision, that is to say a reduction in interest rates and a rescheduling, which as is well-known makes little difference to the burden of servicing debt, affecting only payment of interest that is already very low.

But this is not all, because for repayment of debt the Greek side is now fully accepting the same framework of Eurogroup decisions of November 2012, at the time of the three-party government of Antonis Samaras. It included the following commitments: 4.5% primary surpluses from 2016, accelerated privatizations, and the establishment of a special account for servicing the debt — to which the Greek public sector was to transfer all the income from the privatizations, the primary surpluses, and 30% of any excess surpluses.

It was for this reason too that Friday’s text mentioned not only surpluses but also “financing proceeds.” In any case, the heart of the memorandum heist, namely the accomplishment of outrageous primary surpluses and the selling-off of public property for the exclusive purpose of lining lenders’ pockets, remains intact. The sole hint of relaxation of pressure is a vague assurance that “the institutions will, for the 2015 primary surplus target, take the economic circumstances in 2015 into account.”

But it was not enough that the Europeans should reject all the Greek demands. They had, in every way, to bind the Syriza government hand and foot in order to demonstrate in practice that whatever the electoral result and the political profile of the government that might emerge, no reversal of austerity is feasible within the existing European framework. As European Commission President Jean-Claude Juncker stated, “there can be no democratic choice against the European treaties.”

And the provision for this is to take place in two ways. Firstly, as indicated in the text: “The Greek authorities commit to refrain from any rollback of measures and unilateral changes to the policies and structural reforms that would negatively impact fiscal targets, economic recovery or financial stability, as assessed by the institutions.”

So no dismantling of the memorandum regime either (“rollback of measures”), and no “unilateral changes,” and indeed not only as regards measures with a budgetary cost (such as abolition of taxes, raising of the tax-free threshold, increases in pensions, and “humanitarian” assistance) as had been stated initially, but in a much more wide-ranging sense, including anything that could have a “negative impact” on “economic recovery or financial stability,” always in accordance with the decisive judgment of the “institutions.”

Needless to say this is relevant not only to the reintroduction of a minimum wage and the reestablishment of the labor legislation that has been dismantled these last years, but also to changes in the banking system that might strengthen public control (not a word, of course, about “public property” as outlined in Syriza’s founding declaration).

Moreover, the agreement specifies that

the funds so far available in the Hellenic Financial Stability Fund (HFSF) buffer should be held by European Financial Stability Facility (EFSF), free of third party rights for the duration of the MFFA extension. The funds continue to be available for the duration of the MFFA extension and can only be used for bank recapitalisation and resolution costs. They will only be released on request by the ECB/SSM.

This clause shows how it has not escaped the attention of the Europeans that Syriza’s Thessaloniki program stated that “seed money for the public sector and an intermediary body and seed money for the establishment of special purpose banks, amounting to a total in the order of €3 billion, will be provided through the HFSF’s so-called ‘cushion’ of around €11 billion for the banks.”

In other words, goodbye to any thought of using HFSF funds for growth-oriented objectives. Whatever illusions still existed regarding the possibility of using European funds for purposes outside of the straitjacket of those for which they had been earmarked — and even more that they should be placed under the Greek government’s jurisdiction — have thus been dispelled.

Defeat of the “Good Euro” Strategy

Can the Greek side possibly believe that it has achieved something beyond the impressive verbal inventiveness of the text? Theoretically yes, insofar as there are no longer any explicit references to austerity measures, and the “structural changes” mentioned (administrative reforms and a clampdown on tax evasion) do not pertain to this category, a modification which of course needs cross-checking against the list of measures that can be expected to emerge in the coming days.

But given that the target of the outrageous budgetary surpluses has been retained, along with the totality of the troika machinery of supervision and assessment, any notion of relaxation of austerity appears out of touch with reality. New measures, and of course stabilization of the existing “memorandum acquis” are a one-way street as long as the present regime prevails, is renamed, and is perpetuated.

It is clear from the above that in the course of the “negotiations,” with the revolver of the ECB up against its head and resultant panic in the banks, the Greek positions underwent near-total collapse. This helps to explain the verbal innovations (“institutions” instead of “troika,” “current arrangements” instead of “current program,” “Master Financial Assistance Facility Agreement” instead of “Memorandum,” etc.). Symbolic consolation or further trickery, depending on how you look at it.

The question that emerges, of course, is how we landed in this quandary. How is it possible that, only a few weeks after the historic result of January 25, we have this countermanding of the popular mandate for the overthrow of the memorandum?

The answer is simple: what collapsed in the last two weeks is a specific strategic option that has underlaid the entire approach of SYRIZA, particularly after 2012: the strategy that excluded “unilateral moves” such as suspension of payments and, even more so, exit from the euro, and argued that:

- On the issue of the debt, a favorable solution for the debtor can be found with the concurrence of the lender, following the model of the London agreements of 1953 for the debts of Germany — ignoring of course the fact that the reasons the Allies behaved generously towards Germany do not in any way apply to the Europeans today vis à vis the Greek debt, and more generally the public debt of the over-indebted states of today’s EU.

- Overthrow of the memoranda, expulsion of the troika, and a different model of economic policy (in other words implementation of the Thessaloniki program) could be implemented irrespective of the outcome of debt negotiations and, above all, without triggering any real reaction from the Europeans, above and beyond the initial threats, which were dismissed as bluffing. Indeed, half of the funding for the Thessaloniki program was envisaged as coming from European resources. In other words, not only would the Europeans not have reacted, but they would have generously funded the opposite policies they had been imposing for the last five years.

- Finally, the “good euro” scenario presupposed the existence of allies of some significance at the level of governments and/or institutions (the reference here is not to the support from social movements or other leftist forces). The governments of France and Italy, the German social democrats, and finally, in a veritable frenzy of fantasy, Mario Draghi himself were from time to time invoked as such potential allies.

All of this came crashing down within the space of a few days. On February 4 the ECB announced the suspension of the main source of liquidity to Greek banks. The outflow that had already started rapidly acquired uncontrollable dimensions, while the Greek authorities, fearing that such a reaction would mark the commencement of the Grexit, didn’t take the slightest “unilateral” measure (such as imposition of capital controls).

The words “writing-off” of debt and even “haircut” were rejected in the most categorical manner possible by lenders who became enraged even hearing them (with the result that they were almost immediately withdrawn from circulation). Instead of their overthrow, it turned out that the only “non-negotiable” element was that of keeping the memoranda and supervision by the troika. Not a single country supported the Greek positions, above and beyond some diplomatic courtesies from those who wanted the Greek government to be able, marginally, to save face.

Fearing the Grexit more than it feared its interlocutors, entirely unprepared in the face of the absolutely predictable contingency of bank destabilization (the system’s classical weapon internationally for almost a century when faced by leftist governments), the Greek side was essentially left without any bargaining tools whatsoever. It found itself with its back to the wall and with only bad options at its disposal. Friday’s defeat was inevitable and marks the end of the strategy of “a positive solution inside the euro,” or to be more accurate “a positive solution at all costs inside the euro.”

How to Avert Total Defeat

Rarely has a strategy been confuted so unequivocally and so rapidly. Syriza’s Manolis Glezos was therefore right to speak of “illusion” and, rising to the occasion, apologize to the people for having contributed to cultivating it. Precisely for the same reason, but conversely, and with the assistance of some of the local media, the government has attempted to represent this devastating outcome as a “negotiating success,” confirming that “Europe is an arena for negotiation,” that it is “leaving behind the Troika and the Memoranda” and other similar assertions.

Afraid to do what Glezos has dared to do — i.e. acknowledge the failure of its entire strategy — the leadership is attempting a cover-up, “passing off meat as fish,” to cite the popular Greek saying.

But to present a defeat as a success is perhaps worse than the defeat itself. On the one hand it turns governmental discourse into cant, into a string of clichés and platitudes that is simply summoned up to legitimate any decision retrospectively, turning black into white; and on the other because it prepares the ground, ineluctably, for the next, more definitive, defeats, because it dissolves the criteria by which success can be distinguished from retreat.

To make the point through recourse to a historical precedent well-known to leftists, if the Treaty of Brest-Litovsk, under which Soviet Russia secured peace with Germany, accepting huge territorial losses, had been proclaimed a “victory,” there is no doubt that the October Revolution would have been defeated.

If, therefore, we wish to avert a second, and this time decisive, defeat — which would put an end to the Greek leftist experiment, with incalculable consequences for society and for the Left inside and outside this country — we must look reality in the face and speak the language of honesty. The debate on strategy must finally recommence, without taboos and on the basis of the congress resolutions of Syriza, which for some time now have been turned into innocuous icons.

If Syriza still has a reason for existing as a political subject, a force for the elaboration of emancipatory politics, and for contribution to the struggles of the subordinated classes, it must be a part of this effort to initiate an in-depth analysis of the present situation and the means of overcoming it.

“The truth is revolutionary,” to cite the words of a famous leader who knew what he was talking about. And only the truth is revolutionary, we may now add, with the historical experience we have since acquired.

‘Change?’…

… or ‘forced’ change?

Here’s how the the elite is getting governments under control …

– IMF whistleblower John Perkens, Confessions of an Economic Hitman – NwoMafiaCrimes (Video)

– The Extended Confessions Of Economic Hit Man John Perkins (Video)

And if you would not take the money, then what would you do if ‘somebody’ (CIA/Mossad/MI5) is putting a gun to the head of your children and/or grandchildren?

Well, that is how these people operate.

And Paul Craig Roberts knows it:

– Dr. Paul Craig Roberts: The New Greek Government May Be Assassinated