– How Greece Folded To Germany: The Complete Breakdown (ZeroHedge, Feb 20, 2015):

Having, as we previously explained, been given ‘just enough rope’ by the Germans, we thought it worth looking at just what Greece capitulated on (or perhaps a shorter version – what they did not capitulate on) and how Tsipras and Varoufakis will sell this to their fellow politicians… and most of all people.

What points has Greece capitulated on?

1. Completion of the current review – Greece has basically agreed to conclude the current bailout. Any funding is conditional on such a process:

Only approval of the conclusion of the review of the extended arrangement by the institutions in turn will allow for any disbursement of the outstanding tranche of the current EFSF programme and the transfer of the 2014 SMP profits. Both are again subject to approval by the Eurogroup.

This is a clear capitulation for Greek Prime Minister Alexis Tsipras, who said the previous bailout was “dead” and the EU/IMF/ECB Troika is “over”.

2. Remaining bank recapitalisation funds – Greece wanted this money to be held by the Hellenic Financial Stabilisation Fund (HFSF) over the extension period, and possibly be open for use outside the banking sector. However, this has been denied and the bonds will return to the EFSF, although they will remain available for any bank recapitalisation needs.

3. Role of the IMF – The Eurogroup statement says, “We also agreed that the IMF would continue to play its role”. Again, Greece has given in on this point and the Troika continues to exist and be strongly involved in all but name.

4. No unilateral action – According to the statement,

The Greek authorities commit to refrain from any rollback of measures and unilateral changes to the policies and structural reforms that would negatively impact fiscal targets, economic recovery or financial stability, as assessed by the institutions.

In light of this, a large number of promises that SYRIZA made in its election campaign will now be hard to fulfil. In the press conference given by Eurogroup Chairman Jeroen Dijsselbloem and EU Economics Commissioner Pierre Moscovici, it was suggested that this pledge also applied to the measures which were announced by Tsipras in his speech to the Greek parliament earlier this week – when he announced plans to roll back some labour market reforms passed by the previous Greek government.

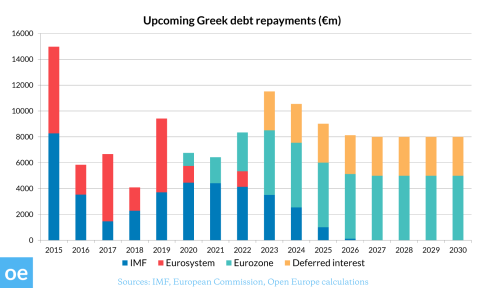

5. Four months rather than six months – Greece requested a six-month extension, but the Eurogroup only agreed to four months. This is a crucial point: it means the extension expires at the end of June. As the graph below shows, Greece faces two crucial bond repayments to the ECB in July and August which total €6.7bn. This is a very tough hard deadline. There is limited time for the longer term negotiations which will take place – provided that a final agreement on the extension is reached. It is very likely we will be back in a similar situation at the end of June.

* * *

Has Greece secured any wins?

Greece has received a couple of small fillips in the wording:

The institutions will, for the 2015 primary surplus target, take the economic circumstances in 2015 into account.

This suggests that Greece may, during this year and the extension in particular, get more fiscal leeway. As we predicted many times, this would manifest itself as a lower primary surplus target. A small victory which may provide a bit of temporary breathing space for the government. In practice, though, it was already looking difficult for Greece to meet its target this year given significant shortfalls in tax revenue.

Greece also managed to get the word “bridge” into the statement, and a specific promise to discuss a fresh programme and approach:

This extension would also bridge the time for discussions on a possible follow-up arrangement between the Eurogroup, the institutions and Greece.

* * *

What happens now?

As was stressed in the press conference, Greece will on Monday “present a first list of reform measures, based on the current arrangement”. Moving forward from this agreement, which is still largely in principle, will be conditional on these measures being judged as sufficient by the EU/IMF/ECB as a step towards completing the current bailout.

Once that is confirmed work will begin on getting the “national procedures” in place, so that all the necessary parliaments (such as Germany and Finland) have approved the extension by the end of next week.

In the not too distant future, discussions will begin on the “possible follow-up arrangement”. As we outlined in extensive detail here, there are a huge amount of differences which need to be resolved. The crucial ones being labour market and pension reforms, as well as debt relief. Chances of an agreement remain unclear, but we would expect Greece to struggle once again to get what it wants.

Finally, the Greek government has to return to Greece and sell what is almost an entire capitulation to its own MPs (some of whom would have rather left the Eurozone than abandon their aims), its coalition partner, and the public (which has strongly supported the hard-line stance). We got a taste of this in the presser, when Finance Minister Yanis Varoufakis said:

From the very first day, we refused to see these negotiations as a zero sum game.

We’re beginning to be co-authors of our destiny.

The Eurogroup statement is a good example of ‘constructive ambiguity’ on primary surplus targets.

I’m pleased to report that our commitments are commitments we wanted to make anyway.

Focusing on the longer term and selling the openness of the negotiation as an escape from the current programme. This may or may not be true, it is in the end a negotiation.

* * *

Greece has folded this hand but the game of poker continues. Greece is now short stack and living hand to hand (day to day). It continues to be in a very tough position and how the evaporation of the vision which SYRIZA sold at the election is a crucial and potentially explosive unknown.

* * *

Accepting more debt, without funds for growth goes nowhere.

It is internecine, and foolish.

The Greek people will not sit still for it, they are going hungry as food prices skyrocket all over the world. Food shortages are on the horizon as drought conditions in much of the food growing parts of the world worsen.

The old system, the old money laundering and processing game is about over, there is nothing left to steal. People are starting to ask for their money. When enough do, the short fall will become obvious, and the entire western economy will collapse taking the Euro and the dollar down.

They produce nothing, they build nothing………it is all paper shuffling and more debts for the banks to put in their vaults and endeavor to sell as assets on Wall Street. Debt without means to repay is worthless, and that is what the west has been building for years, with nothing else.