– Market Wrap: Chinese Stocks Crash As Financials Suffer Record Drop; Commodities Resume Decline; US Closed (ZeroHedge, Jan 19, 2015):

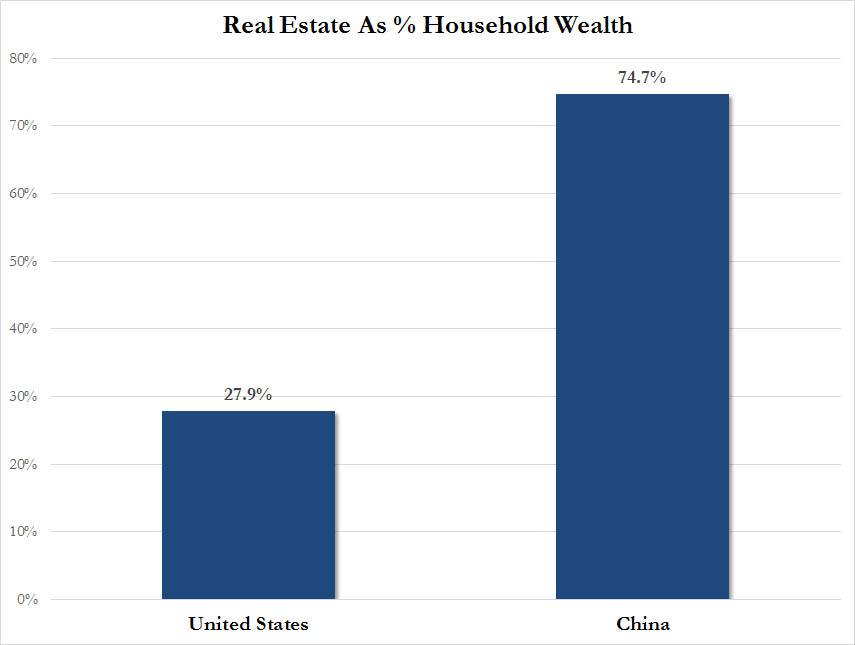

For all those who alleged the Chinese stock move in recent months, was nothing but another investing mania, i.e., bubble, benefiting a select few, because as we showed in July, unlike the US where 70% of household wealth is in financial assets, in China it is the other way around, with three quarters of “net worth” parked in real estate which is merely the latest bubble to pop…

… congratulations, you were right.

This was once again confirmed last night when the Chinese stock market waterfalled into the biggest market crash in over 6 years, with the SHCOMP closing down nearly 8% and in the process triggering various circuit breakers, most notably the CSI 300 index which fell by the 10% daily limit and the Chinese financial index (-9.9%) posting its biggest 1-day drop on record after China cracked down on continuing margin-finance and securities lending violations. In other words, the entire run up was thanks to speculation-enabling margin trading, and massive investor leverage; leverage which may or may not disappear. If the SHCOMP crash accelerates in coming days, wtch as Citic, Haitong et al once again flout regulations with the secret blessing of the PBOC, because an uncontrollable market crash is no longer acceptable to anyone.

Details on the Chinese crash from Bloomberg:

- Shanghai Composite Index falls 7.7%, most since June 2008, after three of biggest China brokerages were suspended from adding margin-finance and securities lending accounts for 3 mos. following rule violations.

- Index erases gain of past 3 weeks; volume roughly matches 3-mo. daily avg

- Property stock index leads rout with 9.1% decline, paring 12-mo. gain to 76%

- CSI 300 falls 7.7% led by financials, energy; 48 stocks drop 9% or more incl. airlines, banks, securities cos.

- “Regulators are concerned that shares have run too hard, too fast:” Bocom strategist Hao Hong

Citic Securities, Haitong Securities — two of the 3 facing suspension — plunge by 10% limit in Shanghai- HSCEI falls 5%, most since 2011, led by Haitong Securities (-17%), Citic Securities (-16%)

- China’s regulators don’t “want to crush the rally as such, but they just want to make sure the financial system is sound and not too much leverage has been abused:” Khiem Do, head of Asian multi-asset strategy at Baring Asset Management

- Shenzhen Composite Index closes down 3.4%

- Singapore-traded China stock futures fall as much as 14%

- Stock connect investors turn sellers in China shares

A bigger picture view: Asian equity markets traded mixed with Chinese bourses underperforming amid a crackdown on margin trading, which has prompted a sharp sell-off across brokerages and financials. Consequently, the Hang Seng trades down 1% while the Shanghai Composite (-7.7%) marked its biggest drop since July 2009, with the Chinese financial index (-9.9%) posting its biggest 1-day drop on record. Nikkei 225 (+0.8%) was unable to hold above 17,000 as a strong JPY prompted the index to come off best levels.

And while the move in China may be seen as a BTFD opportunity by some, the reality is that a weak China is here to stay for a long, long time, and in fact, the ongoing housing bubble pop is likely to get far worse before it gets better. To wit:

- IT’S EXAGGERATING TO SAY CHINA PROPERTY MARKET COLLAPSES: JIANG

Curious where crude is going next? Hint: not up:

- CHINA ECONOMY FACES RELATIVELY BIG DOWNWARD PRESSURE, LI SAYS.

Sure enough, that latest surge higher in crude on Friday is once again starting to get undone.

As for the next shocking currency devaluation: could it be the Yuan?

- EUROPE FURTHER EASING MAY BRING PROBLEMS TO CHINA EXPORT: JIANG

That said, following last week’s Swiss stock market massacre as a result of a central bank shocker, and last night’s crack down by Chinese authorities, it almost appears as if the global powers are doing what they can to orchestrated a smooth, painless (as much as possible) bubble deflation. If so, what Draghi reveals in a few days may truly come as a surprise to all those- pretty much everyone – who anticipate a €500 billion QE announcement on Thursday.

Elsewhere, European equities (Eurostoxx50 +0.2%) trade higher with thin volumes and a light data slate ahead as US markets are closed for the Martin Luther King holiday. The premise of ECB has also supported equities after weekend reports that ECB’s Draghi met with German Finance Minister Schaeuble and German Chancellor Merkel to discuss the extent to which national banks will be liable for the sovereign bond purchase programme, meaning German’s liability will be smaller than any other countries losses. In other news, the SMI (+3.4%) outperforms European indices after recovering from last week’s sharp selloff following the SNB decision. Meanwhile, the energy sector continues to underperform with oil prices slightly lower in the session after comments from the Iraqi Oil Minster overnight.

In FX markets, EUR/USD briefly broke back above 1.1600 triggering stops at the handle with EUR strength observed across the board following subdued market conditions. Elsewhere, in Asia the JPY gained against all of its peers as the Shanghai Comp (-7.7%) marked its largest decline since July 2009 after it was reported that Chinese regulators would crackdown on margin trading which prompted sharp selloff among Chinese bourses.

Iraq’s Oil Minister said Iraq is to boost its crude exports to 3.3mln bpd in 2015 sending WTI and Brent Crude to break the USD 49 and USD 50 handle respectively. In precious metals, Gold (-0.37%) saw a mild loss overnight following last week’s near 5% rise, where the safe-haven soared amid the SNB-triggered FX volatility, with prices of the precious gold metal remaining near 4-month highs after the SPDR Gold Trust also increased holdings by the most since May 2010.

Copper prices have seen a slight pull-back from Friday’s highs amid profit taking ahead of this week’s key-risk events with Chinese GDP scheduled for tomorrow and the ECB meeting on Thursday, while iron futures were also weaker overnight with investor sentiment dampened after data over the weekend showed China’s property prices declined at a faster pace in

December.In summary: European stocks rise for a third day, extending their highest level since 2008. Swiss shares rebound after posting their worst week since 2008. Chinese stocks fall most since 2008 after margin-trading suspensions. U.S. futures fall, Martin Luther King holiday today. Oil declines, paring Friday’s advance. The dollar weakens against the euro and Japanese yen.

- S&P 500 futures down 0.3% to 2007.4

- Stoxx 600 up 0.1% to 353

- US 10Yr yield down 0bps to 1.84%

- German 10Yr yield down 2bps to 0.44%

- MSCI Asia Pacific up 0.2% to 137.7

- Gold spot down 0.2% to $1277.4/oz

- Dollar Index down 0.09% to 92.44

- Italian 10Yr yield down 0bps to 1.66%

- Spanish 10Yr yield down 1bps to 1.5%

- French 10Yr yield down 1bps to 0.63%

- Brent Futures down 0.7% to $49.8/bbl, WTI Futures down 1% to $48.2/bbl

- LME 3m Copper down 0% to $5715/MT

- LME 3m Nickel down 1.6% to $14550/MT

Bulletin Headline Summary from RanSquawk and Bloomberg:

- NYSE & CBOT closed, CME Equity, Interest Rate & FX, Energy & Metals are halted for trade at 1800GMT/1300CST* & resume trading at (2300GMT/0500CST)

- European equities trade in modest positive territory with the prospect of ECB QE imminent ahead of Thursday’s meeting.

- The Shanghai Comp closes down 7.7% overnight as a result of a crackdown on margin trading which weighed on financials.

- Markets remain very thin owning to the US holiday and as such there is an absence of tier 1 data releases with ECB’s Coeure (Dove) participating in a panel in Dublin at (1600GMT/1000CST).

* * *

DB’s Jim Reid concludes the weekend recap

For this week the market will be waltzing to the beat of the ECB. Indeed a lot will have happened by time we write the daily next Monday morning. We’ll be just waking up to the results of the Greek election after having had a few days to reflect on what could be a monumental ECB meeting on Thursday. The big debate in the market as the decision nears will probably be based around whether it would be more positive to see a bigger size of QE announced but with each member central bank technically responsible for the losses or a smaller size where any future losses were fully mutualised. The press reports we got on Friday and Saturday from the likes of Der Spiegel and the FT suggested that the ECB is possibly going to bow to German pressure to have member state’s central banks responsible. There is much debate about whether this matters. Some say that the target 2 system will ensure the risk gets spread so the move is mostly cosmetic. Others might argue its exposing the cracks in the theory that we have a full monetary union. As with everything EU related nothing is clean, there’s compromise in every policy. However it is so complicated that we won’t really know whether it’s a problem until an event tests it. On balance while sentiment towards the weaker members (ex Greece) is positive as it is today, the non-mutualisation probably isn’t as big a deal as it would be if sentiment was a lot weaker.

In terms of the press reports, according to the Der Spiegel the ECB’s Draghi was reported to have presented a scheme to both German Chancellor Merkel and Finance Minister Schaeuble on Wednesday. The report suggests that a ceiling of 20-25% will be set on how much a Central Bank can buy of its own government debt with Greece excluded from the equation. In support of the idea was the ECB’s Knot who was quoted as saying (Reuters) that ‘if each central bank was only buying debt of its own country, the danger of an unwanted redistribution of financial risk would be lower’, before going on to say that ‘we have to avoid decisions that are taken though the back door of the ECB balance sheet that have to continue to be reserved for elected politicians in euro-area countries’. Also in support is the Italian Economy Minister Padoan who was quoted in the Italian press (Il Sole) on the weekend calling for a QE programme ‘without constraints’. The comments go against the Bundesbank President Weidmann, who, in the past has rejected the proposal of ECB QE and following the ECJ decision last week, somewhat reiterated that his views haven’t changed as well as noting that the ‘Central Bank mustn’t engage in economic policy, even though the line between monetary policy and economic policy can be drawn differently’.

Interestingly, a report in the UK Sunday Times this weekend took a slightly different view. Specifically, the article noted that ‘a bitter row has erupted between the ECB and Germany over a giant stimulus programme to save the eurozone from a deflationary crisis’. The report suggested that a programme worth up to €600bn was in play, however German and ECB officials ‘remain at loggerheads over the basic points of the plan’. Finally a Bloomberg survey this morning showed 93% of respondents expecting a QE program to be announced this week with a median size package of €550bn. A lot to consider and expect to see further press speculation this week in the run up to Thursday.

Away from the ECB, markets on Friday finished the week on a positive note as the S&P 500 (+1.34%) and Dow (+1.10%) rebounded from five previous days of declines whilst the Stoxx 600 (+1.13%) and Dax (+1.35%) extended their recent gains. A better than expected Michigan confidence print (more later) helped support the better tone whilst a rally in oil markets helped energy stocks lead the gains. Indeed both WTI (+5.28%) and Brent (+3.94%) bounced back to $48.69/bbl and $50.17/bbl respectively to close the week some $3 off their recent lows. The rebound appears to be as a result of the latest supply report out of the IEA forecasting lower supplies from non-OPEC members – the first cut since the 2015 forecast was first reported in July last year. The rally helped support a strong performance in energy stocks with the component returning +3.19% whilst US HY energy names pared back some of the recent declines to tighten 5bps.

With the broadly better tone in the market, Treasuries finished weaker across the curve. 10y yields closed 12.2bps higher on Friday to wipe out most of Thursday’s gains to yield 1.837%. Meanwhile 30y yields closed up 8.5bps, bouncing off their record lows to finish at 2.453%. Coming back to the data, markets were supported by a strong Michigan consumer sentiment print (98.2 vs. 94.1 expected), up 4.6pts from the December reading. The print was the highest since January 2004 and second highest since 2000, fuelled by lower energy prices and an improving job market. Elsewhere data was largely in line with market consensus. CPI offered little surprises with the headline December number (-0.4% mom) as expected whilst the core print (0.0% vs. +0.1% expected) ticked down a notch. Industrial production (-0.1% mom vs. -0.1% expected) and capacity utilization (79.7% vs. 79.9% expected) rounded off the releases.

There was plenty of Fedspeak on Friday to keep the market guessing. The Fed’s Williams in particular was noted on Reuters reiterating his mid-year hike expectations, specifically saying that ‘I think sometime around the middle of the year we are going to be closer to a decision, at least I would think we would be closer to it being an appropriate timing to raise rates’. Williams did however mention that ‘weakness abroad is trimming some from my forecast in growth in the US’. Adding to the somewhat more hawkish comments was the St Louis Fed’s Bullard who noted on Bloomberg saying that zero interest-rate policy is ‘too low’ for a ‘near normal’ economy before going on to say that raising rates in the middle of the year would be a ‘little behind schedule’. Taking a somewhat different view was the Fed’s Kocherlakota, who although agreeing with Bullard that the Fed could be losing its credibility with regards to its inflation goal, he maintains his 2016 ‘lift-off’ timeline.

Closer to home and away from the ECB news, energy stocks (+3.23%) also led the gains on Friday in Europe whilst core government bonds continued to strengthen with 10y yields in both Germany (-2bps) and France (-3.9bps) closing lower at 0.454% and 0.633% respectively. Swiss equities (-5.96%) however took another sharp leg lower and 10y Swiss government bonds moved into negative territory for the first time ever, closing at -0.034% (-10.9bps). The SNB’s Jordan was board but that the Central Bank was aware that it could have a major market impact and that signaling the move ahead of time ‘would’ve opened the door to speculators’. The Franc closed 1.9% weaker versus the Euro on Friday at CHF0.994. Data in Europe took something of a backseat, although in reality offered few surprises with the final CPI prints in Germany (0.0% mom) and Euro-area (-0.2% yoy) as expected.

The Swiss move is causing a fair bit of pain out there amongst various market participants. US-based retail currency broker FXCM continues to be one catching the headlines. FXCM is at the receiving end of a $300m cash bailout from Leucadia as client losses of more than $200m have left the broker facing potential regulatory capital issues. At its Q4 results last Friday Goldman Sachs said that the CHF moves on Thursday will have an ‚immaterial? impact but speculation mounts in the press of losses across a wide range of players.

Moving onto US corporate results it is early days but the signals are so far mixed. Clearly the US bank results were weighed down by a poor quarter for FICC but broadly speaking most firms are still able to beat earnings consensus. Revenue beats, as it has been the case for few years now, are more mixed. Of the 24 S&P 500 firms that have reported so far only 11 of them have beaten revenue estimates but an overwhelmingly 20 of them have come ahead of EPS consensus.

Wrapping up the weekend news, ahead of this Sunday’s election the latest opinion poll is out in the Greek press To Vima on the weekend showed Syriza maintaining its lead over the New Democracy party, with the gap widening marginally to 3.1% from 2.5% earlier in the month. The data also comes after news on Friday that two Greek lenders – Eurobank and Alpha Bank – have formally requested access to the ELA facility, although executives for both banks stated that the requests were precautionary and partly related to their exposure to Swiss Franc mortgages.

Before we look at this week’s calendar, Asian equity markets are generally taking cues from the positive US close on Friday. The exception though being Chinese equities where news of margin-trading curbs have sent the Shanghai Composite and CSI 300 down by nearly 7% as we type. Citic Securities and Haitong Securities both were limit down (10%) after news that they were suspended from lending money to new equity clients (Bloomberg). The new policy is probably a response to the sharp retail-driven rally in the domestic stock market last year. Away from China the Nikkei, KOPSI and the Sensex are up +0.89%, +0.77% and +0.70%, respectively. Asian credit spreads have also started the week on a firmer footing partly helped by the rebound in Oil.

Looking ahead to this week, it’s a quiet start this morning with the US markets shut for Martin L. King Day. In Europe the November trade data and construction output will be the only notable releases today. The calendar picks up tomorrow however, starting in Asia with Q4 GDP due out of China (market looking for +7.2% yoy print from +7.3% previously) as well as industrial production, retail sales and fixed assets. German PPI, the ever-important ZEW survey, Italian trade data and Euro-area government deficits are also due. We will also get January’s NAHB housing market print out of the US and comments from the Fed’s Powell. In terms of Wednesday’s highlights, we start in Japan with machine tool orders for December before moving onto the UK where we get the usual employment readings as well as the release of the BOE minutes. Housing starts and building permits are the key releases in the US on Wednesday with the market looking for an improvement in both. Kicking off Thursday we should get the BOJ monetary policy statement early in the morning. Closer to home and away from the aforementioned ECB meeting, unemployment data out of Spain, industrial orders and retail sales in Italy and public finance data out of the UK are the notable highlights. Thursday’squoted in the French press (Le Temps) as saying that the decision to remove the cap was backed by the majority of the afternoon highlights also include the Euro-area consumer confidence whilst in the US we are expecting jobless claims (where our US colleagues are noting could be subject to seasonal volatility) as well as the Kansas City Fed manufacturing activity print and FHFA house price data. It’ll be a busy end to the week on Friday with various PMI prints due. Starting in Asia, preliminary manufacturing PMI data out of both Japan and China will be worth keeping an eye out for whilst in Europe we are expecting the January services and manufacturing readings for the Euro-area as well as regionally in France and Germany. Retail sales in the UK will also be released. In the afternoon on Friday in the US, existing home sales, manufacturing PMI and the Chicago Fed Activity Index will all be due. Then on Sunday we have the Greece elections and all the uncertainty that results based on current polling could bring.

So a busy 7 days ahead.

A short preview of the torture being endured at Gitmo……this is a small part of a diary that became a book. No wonder the US is crashing and burning, this is stuff the Nazis would have loved…..evil only breeds more.

This is appalling.

http://www.theguardian.com/world/2015/jan/18/-sp-guantanamo-diary-the-torture-squad-was-so-well-trained-that-they-were-performing-almost-perfect-crimes-peter-serafinowicz

On this subject, Chinese real estate values have been declining steadily for a long time because of ghost cities and buildings being erected regardless the Chinese worker does not have wages high enough to buy into these cities. This isn’t new, it is just reaching the crisis point.

It is only for so long a rabbit can be pulled out of a hat………and these financial greedy guts have played every cheap trick at their disposal to show growth where there is none, wealth where none exists, and so on. The Chinese Government claims a debt level to GDP of less than 7%, and nobody with any sense believes that, either.

Lies are still fake information, no matter how often sold as truth.