– Turmoil Spreads: Ruble Replunges, Crude Craters, Yen Surges, Emerging Markets Tumbling (ZeroHedge, Dec 16, 2014):

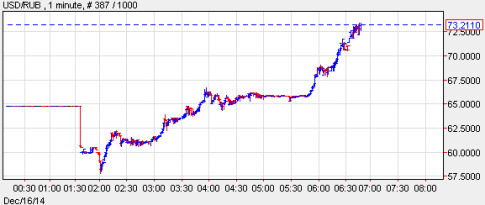

For those wondering if the CBR’s intervention in the Russian FX market with its shocking emergency rate hike to 17% overnight calmed things, the answer is yes… for about two minutes. The USDRUB indeed tumbled nearly 10% to 59 and then promptly blew right back out, the Ruble crashing in panic selling and seemingly without any CBR market interventions, and at last check was freefalling through 72 74 76, and sending the Russian stock market plummeting by over 15%.

It is so bad, US equity futures which had jumped earlier on hopes of more Chinese intervention following the latest disastrous Chinese PMI print, as well as a French manufacturing PMI beat (don’t laugh), are back to unchanged.

The latest rout continues to be driven by the relentless plunge in Brent which also continued crashing overnight to fresh 5 year lows, sliding decidedly under $60 as WTI dropped well under $55 as well. And as we previewed over a month ago, it is not just Russia, but every single petroleum exporting country that is suddenly seeing a currency crisis, and spreading to all EMs with the Indian Rupee weakening the most since 2013, Indonesia lowering the Rupiah’s reference rate by the most on record, and so on. Ironically, this happens as the USDJPY is also crashing and dropping moments ago to 116.25, the lowest level since mid-November. At this rate the Fed will have no choice but to intervene, however in the opposite direction, and admit that despite all its best intentions, the US can not decouple from the rest of the world and a rate hike – so very priced in by everyone – is just no going to happen in the coming years (which sadly means that the latest subprime debt driven “recovery” is about to be called off).

A quick look at the oil market where Brent drops for 5th day, falls below $60 for 1st time since July 7, 2009 as the market continues to look for signs that falling prices is crimping production. WTI breaks below $55, drops to lowest since May 6, 2009. “The race to the bottom continues, we are still not seeing any signs of supply disruption,” says Saxo Bank head of commodity strategy Ole Hansen. “There is very big negative momentum in the mkt and the fact people are starting to talk about breakeven levels of $35-$40 has put up a new red flag for mkts to aim at.… Jan. WTI options expire today and there is quite a lot of open interest ~$55 put strikes, that is probably the key level of potential support today.”

Not helping things was Russia’s announcement that it too like the Saudis will not cut production: Russia agrees with OPEC that market will determine crude price, Energy Minister Alexander Novak tells reporters at meeting of Gas Exporting Countries Forum in Doha, Qatar. Novak says that he met with OPEC energy ministers in Vienna; “The participants of that meeting concurred that the situation will be fixed by the market itself in terms of supple and demand balance. Russia is not a country that changes its supply. We will maintain our production unchanged.”

Looking at the Markets, first in Asia, the Nikkei 225 tumbled -2% fell for a 2nd day to breach the key psychological 17,000 level for the first time since the 17th Nov. as the JPY continued to strengthen. In China bad news was good, and the Shanghai Comp surged higher som +2.3% on renewed easing calls following disappointing Chinese data. December HSBC flash Manufacturing PMI printed a contractionary reading for the first time in 7 months (49.5 vs. Exp. 49.8 (Prev. 50.0), with both output and new orders components slipping, the latter contracting for the first time since April. Hang Seng traded down 1.55% weighed on by weakness across energy stocks.

Despite opening higher, European stocks took a turn lower in early trade, with the move to the downside led by energy names after Brent crude futures broke below USD 60/bbl pre-market and WTI broke below USD 54/bbl. Furthermore, the softness in stocks lifted European fixed income products with the Bund tripping stops through 154.73, leading the German 10yr yield to once again print record lows and slip below 0.6%. Overall global sentiment remains relatively negative with Saudi Arabian (-5.5%) and Dubai (-8%) stock indexes also placed under further pressure as the fall in oil prices continue to dent domestic profits. Furthermore, concerns were also placed on Russia as despite the Russian central bank hiking their rate by 650bps, the RUB hit record lows vs the USD and the MICEX was down as much as 7%. This then triggered fears over the ramifications for the Eurozone economy, given the close trade ties to Russia, particularly for Germany.

Nonetheless, European equities then reversed earlier losses, with the move higher led by utility and consumer discretionary names, while Russian asset classes began to stabilise. Additionally, from a data perspective, Eurozone PMIs also painted a less dreary than expected picture with the headline manufacturing and services Eurozone PMIs exceeding expectations. This was then later exacerbated by a particularly strong German ZEW survey (Expectations 34.9 vs. Exp. 20.0), which also subsequently saw Bunds pull away from their best levels.

Looking ahead, attention turns towards US housing starts, building permits, manufacturing PMI and API crude oil inventories. Most importantly, the two-day FOMC meeting begins.

Market Wrap

In Summary, European stocks rise led by carmakers after German investor expectations increased more than estimated. Shares with exposure to Russia dropped as the ruble continues its decline. Asian stocks fall as Hong Kong shares enter a correction, U.S. stock index futures gain. Brent crude oil price falls through $60 a barrel for the first time in 5 years. Euro rises against the dollar.

- S&P 500 futures unchanged, after being up 0.5%

- Stoxx Europe 600 up 0.7% to 325.44

- US 10Y yield down 2bps to 2.1%

- German 10Y yield down 1bps to 0.61%

- MSCI Asia Pacific down 0.7% to 134.73

- Gold spot up 0.4% to $1198.55/oz

M&A

- Repsol Agrees to Buy Canada’s Talisman for $8.3b

- RBS Sells Irish Property-Loans Portfolio to Cerberus

- InterContinental to Purchase Kimpton Hotels for $430m

- Wanda Said to Be Poised to Raise $3.7b in Hong Kong IPO

- Woodside to Pay $2.75b for Apache LNG Project Stakes

- Olam to Buy Archer-Daniels-Midland Cocoa Unit for $1.3b

FX/BONDS

- USDJPY down to 116.290

- Euro up 0.5% to $1.25065

- Dollar Index down 0.4% to 88.064

- Italian 10Y yield up 2bps to 2.02%

- Spanish 10Y yield up 1bps to 1.8%

- 3m Euribor/OIS down 1bps to 9.38bps

COMMODITIES

- S&P GSCI index down 1.7% to 434.07

- Brent futures down 2.8% to $59.33/bbl, WTI futures down 2.6% to $54.46/bbl

- LME 3m copper down 0.7% to $6357.25/MT

- LME 3m nickel down 1.6% to $16192/MT

- Wheat futures down 0.1% to $618.25/bu

Bulleting Headline Summary

- European stocks rebound from earlier energy/Russia-inspired losses as Eurozone data helps to lift investor sentiment.

- The USD-index trades in negative territory, with the move lower in US yields hitting the greenback and seeing EUR/USD break above 1.2500.

- Looking ahead, attention turns towards US housing starts, building permits, manufacturing PMI and API crude oil inventories.

- Treasuries gain as Brent crude plunges though $60/bbl for first time in five years, ruble slides to record low as investors shrug off surprise Bank of Russia decision to hike its key rate to 17% from 10.5%.

- HSBC/Markit’s China PMI fell to 49.5 in Dec., lowest in seven months, from 50 in Nov., even after PBOC efforts to ease monetary conditions

- Manufacturing and services in the 18-nation euro area barely expanded in December as sluggish growth in Germany and France kept business activity subdued

- Bundesbank’s Jens Weidmann said there’s no need for the ECB to expand monetary stimulus, and argued that sovereign-debt purchases aren’t a solution even if slumping oil prices cause deflation

- German investor confidence rose for a second month, with ZEW Center’s index rising to 34.9 in Dec. from 11.5 in Nov.

- U.K. inflation fell to 1% in Nov., lowest in more than a decade, as tumbling oil prices pushed down transport costs and food prices dropped; U.K. 30Y yields fell below 2.5% for the first time on record

- Sweden’s central bank kept its main interest rate at zero and said it’s preparing more measures to jolt the largest Nordic economy out of a deflationary spiral

- Norway’s krone dropped to parity with Sweden for the first time since 2000

- Bank of England Governor Mark Carney said the selloff in emerging markets may worsen, posing the risk of higher borrowing costs and weaker growth in core markets

- China’s U.S. Treasury holdings fell to a 20-month low in October, as yuan appreciation indicated less of an impetus to buy the government securities

- Pakistan militants killed 84 children after storming an army-run school in the northwestern city of Peshawar, one of the country’s worst terrorist attacks in years

- Sovereign yields mostly lower. Nikkei falls 2% as most Asian equity indexes fall; Shanghai +2.3%. European stocks mostly higher, U.S. equity-index futures gain. Brent crude falls 3%, trades below $60/bbl level; copper falls, gold gains

US Event Calendar

- 8:30am: Housing Starts, Nov., est. 1.040m (prior 1.009m)

- Housing Starts m/m, Nov., est. 3.1% (prior -2.8%)

- Building Permits, Nov., est. 1.065m (prior 1.080m, revised 1.092m)

- Building Permits m/m, Nov., est. -2.5% (prior 4.8%, prior 5.9%)

- 9:45am: Markit US Manufacturing PMI, Dec. preliminary, est. 55.2 (prior 54.8)

Central Banks

- FOMC two-day meeting begins in Washington Supply

FX

The main focus has been on the RUB as despite the Russian central bank hiking their key rate by 650bps, USD/RUB has erased its opening losses, with RUB printing a record lows vs. USD and breaking above the 66.00 handle. Allied to this, the USD-index has weakened throughout the morning and made a technical break below 88.00 alongside the move lower in US yields as USTs benefited from a flight to quality. This has also benefited JPY and CHF in a safe-haven Bid, while EUR/USD broke above 1.2500 for the 1st time since 1st Dec. UK inflation data came in at 1.0% vs. Exp. 1.2% and printed its lowest reading since 2002. This subsequently saw a fast-money move lower in GBP/USD of around 46 pips. However, this move to the downside was later reversed, as market participants focused on the fact these numbers do not change the course of BoE action. Finally, the SEK has also weakened throughout the session after the Riksbank this morning kept their key rate on hold at 0.0% as expected but warned the repo rate needs to remain at zero for longer than initially forecast and are preparing further measures that can be used to make monetary policy more expansionary. This has also weighed on neighbouring currency NOK, which also falling victim to the slide in oil prices.

COMMODITIES

In the commodity complex, energy prices have once again been a key focus after Brent crude futures broke below USD 60/bbl pre-market and WTI broke below USD 54/bbl. This has been a continuation of the bearish rhetoric we’ve seen for the sector following comments yesterday from the UAE oil minister who said OPEC stands by their decision not to cut output even if oil prices fall as low as USD 40/bbl and will wait at least three months before considering an emergency meeting, while Saudi reiterated they have no plans to cut output. In metals markets, precious metals have been granted some reprieve with spot gold breaking above USD 1,200 following the cautious sentiment throughout the session while copper has remained under pressure following lacklustre Chinese HSBC manufacturing data and comments from Deutsche Bank who said the copper market is moving into surplus and the lagged effects of the weaker Chinese property market will hit copper demand.

* * *

DB’s Jim Reid concludes the overnight recap

We were expecting difficult times before tighter spreads in 2015 but this is already proving to be such a tough December that 2015’s returns across many asset classes are going to be influenced by where we end the year.

For example, as recently as December 5th many equity markets were trading at YTD or multi month highs. 6 business days later and the turmoil is being seen in Greece, Russia, Oil, many areas of EM and in DM equity and credit markets. In Europe virtually all equity markets are comfortably down for the year now. Some markets have lost a few years of normal sized returns in the last few days alone so this has to impact 2015.

Given the mini turmoil, we will truly learn a lot about the Fed tomorrow night as if they become more hawkish we can see that they’re comfortable that financial markets are not the primary concern. If they end up being dovish then it’s probably a sign that they will struggle to have the confidence to upset markets in 2015 and will only raise rates if both the economy merits it and markets are calm. As we state in the outlook we think they will struggle to raise rates but this might not stop them from signalling an intention to do so in advance. So definitely more volatility than the QE3 period we’ve now left far behind.

Oil continues to dominate headlines with further sharp declines yesterday, extending the 5-year lows and pairing an earlier rally. Indeed both WTI (-3.29%) and Brent (-1.28%) declined to $55.91/bbl and $61.06/bbl and have continued to trade some 0.5-0.6% lower overnight. The oil-sensitive Russian Rouble continues to suffer and yesterday it closed 10.22% lower versus the Dollar at 64.24. The move marked the biggest one-day decline since 1998 taking the year to date decline to nearly 96%. The move appears to have sparked the nation’s Central Bank into action who, post the U.S. close, raised benchmark interest rates by 650bps to 17%. The rate rise marks the sixth hike this year and comes just five days since the last rate move with the Central Bank stating that ‘the decision was driven by the need to limit the risks of devaluation and inflation, which have recently significantly increased’. The move also corresponds with an expansion in foreign currency repo auctions of $3.5bn to $5bn as well as further statements from the Central Bank that GDP may shrink 4.5% to 4.7% next year should oil prices average $60/bbl. The MICEX closed 2.38% lower yesterday and 10y benchmark local government bond yields finished 20bps wider at 13.02%. Expect big moves again this morning. The Russian central bank will no doubt be hoping they can repeat the success of the Turkish central bank earlier this year where they raised rates from 7.75% to 12%. If the new rate is sustained for any length of time it will surely have huge implications for the economy though so it’s certainly high risk. Ironically when Russia collapsed in 1998, the Fed slashed rates and arguably started the era of ‘moral hazard’. So it’ll be interesting if the Fed choose to ignore international events this time round. I suspect they’ll find it tough.

Returning to markets, in the US the S&P 500 closed 0.63% lower at the close after a volatile day which saw a near 2% intraday range. Energy stocks continued to weigh on the overall index with the component declining 0.71% although in reality all sectors finished weaker. Credit markets softened, CDX IG closing 2bps and CDX HY around half a point lower and spreads on US HY energy names widening a further 18bps. Pressure on smaller oil and gas producers continues with US-based Apache reporting yesterday that it has agreed to sell its stake in a natural gas project whilst the Canadian oil and gas company Talisman Energy confirmed it’s in talks with various targets over a potential sale of the company.

Macro data was perhaps a bright spot in an otherwise weaker day. An initially weaker December NY Fed manufacturing reading (-3.58 vs. +12.4 expected) was followed up by a stronger November industrial production (+1.3% vs. +0.7% expected) print and capacity utilization (80.1% vs. 79.4%) reading. On the firmer industrial production print in particular, the reading was the highest since May 2010 and our US colleagues note that at its current level, production is growing at a near 8% annualized rate relative to its Q3 average, supporting the case for a strong Q4 GDP number. Just rounding off the data prints in the US yesterday, the NAHB housing market notched down slightly to 57 for December. Treasuries took something of a back seat, the yield on the 10y benchmark bouncing off Friday’s lows to close 1.8bps higher at 2.118%.

Closer to home and with a lack of data releases, risk assets took a sharp leg lower in Europe with the Stoxx 600 closing 2.08% lower – with similar weakness in energy names (-2.95%) – the index now 1.5% in negative territory YTD. There was similar weakness in credit markets with Xover finishing 19bps wider. Whilst core yields closed largely unchanged, supportive comments from ECB officials Visco and Nowotny helped support peripheral bonds with 10y benchmark yields in Spain (-9.1bps), Italy (-6.8bps) and Portugal (-5.6bps) all closing tighter at 1.789%, 1.996% and 2.916% respectively. Recapping the comments, the ECB’s Visco commented in Rome that the central bank could begin large-scale asset purchases ‘rather quickly’ if deflation risks continue citing the threat from oil price declines. This was followed up by Austria’s central bank governor Nowotny who stated that any further QE measures would be the ‘prospect of missing our target on price stability in the longer term’. One of the ECB’s preferred measure of inflation expectations – the EUR 5y5y inflation swap rate – extended declines to close at 1.67% yesterday and mark a 10-year low. With chatter around further ECB broad-based asset purchases likely to attract more headlines in the new-year, a Bloomberg survey yesterday showed that 90% of respondents expect sovereign QE in 2015 from 57% last month.

Interestingly with the large sell off in risk assets in Europe yesterday, Greek equities closed firmer ahead of tomorrow’s election with the ASE ending +1.45% stronger at the end of play. Greek government bonds also recovered somewhat with 3y and 5y yields tightening 87bps and 34bps respectively. DB’s resident expert George Saravelos noted that there is little change in terms of current government support ahead of tomorrow’s first-round presidential election (due 5.00pm GMT) with initial ‘bean-count’ estimates still below the 180 votes required for the final vote.

Turning our attention over to markets this morning, following the disturbing scenes in Sydney yesterday, the ASX 200 is -0.65% and AUD is holding in at 0.82 to the Dollar. With the exception of China, equities are weaker in Asia this morning with the Nikkei, Hang Seng and KOSPI -1.85%, -1.40% and -0.83% respectively. The CSI 300 (+1.03%) and Shanghai Comp (+0.85%) have strengthened despite a weak flash HSBC manufacturing PMI print. The 49.5 reading for December is below the 49.8 consensus and down from 50 last month with the print the first below 50 since May.

Looking ahead to today’s calendar and away from the start of the FOMC meeting, we kick this morning off in Europe with the flash manufacturing and services PMI prints for the Eurozone as well as regionally for both France and Germany. Elsewhere we’ll keep an eye on the BoE statement on the financial stability report due out this morning with Carney speaking shortly after, as well as UK inflation data. We round off the key releases this morning with the ZEW survey out of Germany. Across the Atlantic this afternoon we’ve got housing data to keep an eye on with both building and November housing starts due. This is followed up later in the US with the flash manufacturing PMI print.