– China, Russia Dump US Treasurys In October As Foreigners Sell Most US Stocks Since 2007 (ZeroHedge, Dec 15, 2014):

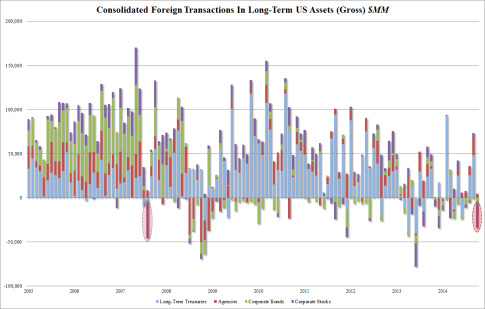

Perhaps the most notable feature of the October Treasury International Capital report is that in October foreigners sold a whopping $27.2 billion in US equities, surpassing the dump just after the first Taper Tantrum, when they sold $27.1 billion in June of 2013 when they also sold $40.8 billion in Treasurys. This was the largest selling of US corporate stocks by foreign entities since the August 2007 quant flash crash, when some $40.6 billion in US stocks were sold by offshore accounts.

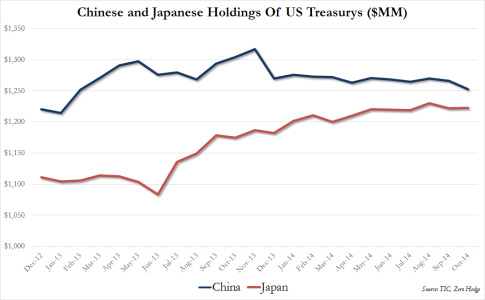

However, what this month’s TIC data will surely be best remember for, is that both China and Russia dumped US Treasurys in October, some $14 billion and $10 billion, respecitvely, in the process sending China’s total Treasury holdings to just $1,253 billion, the lowest since February 2013 and just $30 billion more than the TSYs held by America’s second largest (offshore) creditor, Japan. This happens even as Belgium which many have said is a proxy for Chinese bond purchases, also saw its total holdings decline by $5 billion to $348 billion.

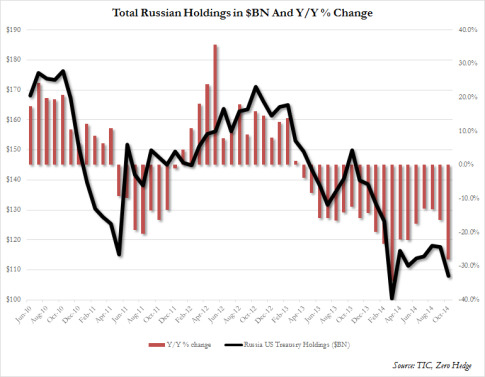

As for Russia, after selling $9.7 billion in October (a process which certainly continued in November) its latest total is just $108 billion, or just modestly higher than the $100 billion hit in March after the Ukraine conflict first broke out, and the second lowest total Russian Treasury holdings since 2008.

For a long time China and Russia have been warning about selling US paper, if only in theory. Increasingly, this appears to be also taking place in practice.

There is a huge change in global financial systems, and it is obvious to me, and to those in the know, it is certain. The dollar is close to collapse.

OPEC’s refusal to cut production was their way of kicking the petrodollar to the curb. All the stuff they are putting out is political, add the lies from US media, and you have confusion.

Follow the money. The dollar is shot. If the US attacks Russia, a nation that has done nothing to them on a military level (kicked their ass financially, but that was using one’s brains), the rest of the world will join Russia and desert the US.

Nobody needs the US any longer, Putin has cut the rope that held other nations to the US. With an open basket of currencies, using an electronic currency that translates the value of each member’s currency, the need for a world reserve currency is obsolete. The world has been liberated.

BRICS put up the equivalent of E100 billion to loan small nations who don’t want to live under US financial domination. BRICS is doing what the US used to do, now the US just makes promises it doesn’t fulfill, and makes threats. BRICS put their money where their mouth was, and many nations in the EU need loans.

How long do you think it will take for the EU members to borrow money from BRICS and dump the dollar?

We are down to weeks, maybe days.

The game is about over.