One can’t make this up:

“The scenario of deflation is not there because indeed we don’t consider that deflation is going to happen.”

– Vítor Constâncio, Vice-President of the ECB

– The Chart That Crushes All Credibility Of The ECB’s Latest Stress Test (ZeroHedge, Oct 26, 2014):

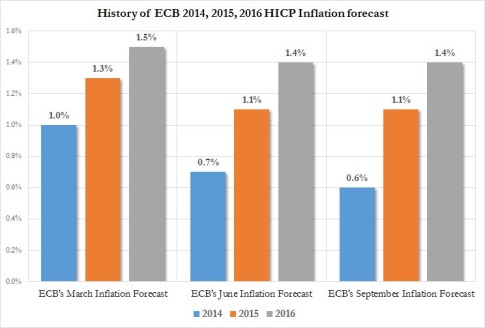

While we would be the last to comment on the ECB’s laughable forecasting capabilities, we do have to note that there is a bit of a disconnect between the ECB’s projections of Eurozone inflation for 2014, 2015 and 2016 as presented in its March, June and September meetings…

… and what the market is currently anticipating based on 5Y5Y forwards which as we noted two weeks ago, recently hit an all time low.

The reason we bring this up, is because just after the latest “most serious, most confidence inspiring” stress test was revealed, that perpetual troublemaker, the head of Germany’s IFO Institute, Hans-Werner Sinn, who relentlessly refuses to drink the European Kool Aid, pointed out something rather stunning. According to Bloomberg, in an emailed statement, Sinn said that “ECB avoided modelling a deflation scenario for southern Europe which explains why the capital shortfall was so small for many banks.”

Additionally Sinn said that the change in relative prices that includes inflation in north and deflation in south is “unavoidable” if southern European countries are to regain competitiveness without euro-zone inflation. He added that regaining that competitiveness solely via inflation in north – something Germany clearly is not too crazy about – would violate ECB mandate. HIs conclusion: the AQR/stress test implied inflation for all of euro zone to prevent too many banks from failing test.

We will leave what the ECB implied aside for the time being, and instead merely focus on his claim: if indeed the ECB completely ignored to model deflation as a possible outcome, then it makes an even greater mockery of the ECB’s pet “confidence building exercise” within the financial community.

And sure enough, within the massive 178-page Stress Test document, there is a “whopping” 4 mentions of the word inflation (deflation appears just once).

Here is what the “Stress Test” does say about inflation:

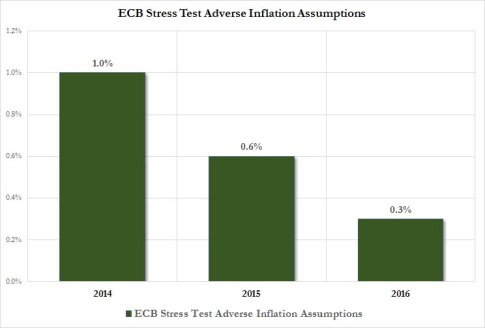

… while the adverse scenario does not strictly embody a prolonged deflationary environment [ZH: because it clearly does not embody any deflationary environment], it does entail material downward pressures on inflation. Thus, the scenario leads to annual inflation rates for the euro area below the baseline rates by 0.1 percentage points in 2014, by 0.6 percentage points in 2015, and by 1.3 percentage points in 2016. The implied adverse inflation rates amount to 1.0% in 2014, 0.6% in 2015 and 0.3% in 2016.

Which brings us to the chart that renders the ECB’s entire exercise in goalseeked stress meaningless and with zero credibility: presenting the ECB’s “worst-case” inflation assumptions.

What is the common with the forecast inflation bars shown above? They are all positive, meaning even in the worst case scenario, the ECB does not think deflation is even a possibility! (and whatever you do, don’t look at the 2014 “worst-case” inflation forecast and compare it to the ECB’s revised September forecast).

So just as the Troika “never modeled” a Grexit from the Eurozone, and just as the ECB “never modeled” for the Euro to be replaced by its predecessor sovereign currencies – who can forget Mario Draghi’s famous “There is No Plan B” speech… which turned out to be glaring lie – simply because the mere assumption of such an outcome would lead to its reality in a self-fulfilling prophercy, so the ECB, in its allegedly most stringent stress test yet… “never modeled” the one most likely outcome for the Eurozone: deflation!

Ironically, for once journalists did not give the ECB a hall pass, and at the press conference for the Stress Test results, there was this exchange with the ECB’s Constancio:

My question would be on how credible these tests are. Looking at the adverse scenario, you haven’t even included deflation. You have not included an interruption in gas imports to Europe. You have not included full-on sanctions on Russia. So please elaborate and convince us.

Constâncio: The scenario for the stress test was published earlier in the year, so some of the things you mentioned would not have been considered. But indeed, what was considered is a severe shock being the growth of other countries. If you look to the scenario, you see that for the US, there is also a big deceleration of growth which is part of the scenario and also for other countries that are the markets of the euro area. So that is embedded in those assumptions of indeed a big drop in external demand directed to the euro area. That’s the first point.

The scenario of deflation is not there because indeed we don’t consider that deflation is going to happen.

So…. wait a minute.

Just because the ECB, in all of its brilliance – brilliance which apparently was not brilliant enough to realize that there is, first, not nearly enough ABS in the private market for the ECB to monetize, to bring its balance sheet up by €1 trillion and, second, as its Reuters trial balloon revealed, an ECB monetization of corporate bonds would amount to… a negligible €10 billion per month – does not think a scenario is possible is precisely the necessary and sufficient reason to not include it in the stress test.

Uhmm, guys in Frankfurt: here’s a tip – the quote-unquote Stress Test, and especially its adverse scenario, is precisely there to “assume” everything that you don’t consider is going to happen! Because otherwise, there is no need for a stress test: one can just wait every quarter and watch as the ECB’s forecast grinds lower and lower until deflation becomes the norm. A norm which the ECB “didn’t consider is going to happen.”

Because how do you rebuild confidence in a system in which the market is telling you deflation is the most likely outcome, and yet you fail to even model for it because, drumroll, you want to rebuild credibility, however by only modeling what you, and not the market, “consider will happen”!?

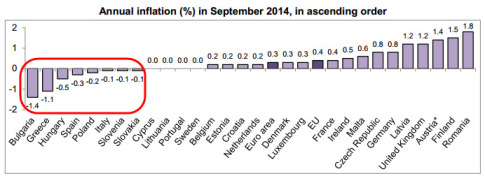

Oh, and the final reason why one can stick a fork in the ECB’s latest attempt to “rebuild confidence”, is that when preparing to report its stress test results, the ECB would at least look at what Eurostat revealed on October 16 regarding European inflation. Or rather deflation. For those who missed it, such as the entire ECB governing council apparently, 8 countries in Europe are already in outright deflation, including, but not limited to the bulk of the PIIGS, namely Spain, Italy, and Greece.

That said, despite the complete humiliation that was the ECB’s latest stress test, we commend the ECB for working on a Sunday in releasing the stress test and actually holding a press conference on a day when the entire deflationary continent is relaxing in the park, drinking an espresso and smoking a cigarette.

They are just as corrupt as the leaders of the nations they control. This projection isn’t an analysis, it is a joke……on all the countries who suffer with it.

The evil bastard who founded Blackwater walks free while his employees get convicted of murder. What it is to be a friend of GW Bush……no consequences…….this should show anyone there is zero difference between the two parties……

Bet this won’t be covered by corporate meda.

https://firstlook.org/theintercept/2014/10/22/blackwater-guilty-verdicts/

Why do I get this ridiculous feeling that we are all part of a herded pack of lemmings, obediently obeying the chiefs as they guide us to the inevitable?

The Infinite Unknown……..

Friend Stanley:

My late lifetime soul mate had a small picture next to the clock on his desk. It was a picture of lots of white sheep running towards a very deep cliff at top speed. In the middle was one black sheep trying to go in the opposite direction, away from the cliff.

He had a whimsical sense of humor, and that picture has a lot of relevance to me today………The mindless have inherited the earth, and the rest of us haven’t a chance against the horde of idiots running at top speed towards their own demise.