Dr. Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

– Poverty Report Contradicts GDP Claims (Paul Craig Roberts, Oct 2, 2014):

It is amazing how the government manages to continue selling Brooklyn Bridges to a gullible public. Americans buy wars they don’t need and economic recoveries that do not exist.

The best investment in America is a highly leveraged fund that invests only in large cap companies that are buying back their own stocks. Many of the firms repurchasing their stocks are borrowing in order to push up their stock prices, executive “performance bonuses,” and shareholders’ capital gains. The debt incurred will have to be serviced by future earnings. This is not a picture of capitalism that is driving the economy by investment.

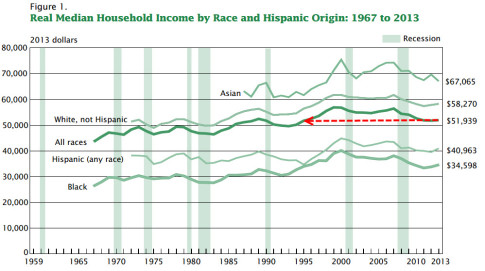

Neither is consumer spending driving the economy.The US Census Bureau’s 2013 Income and Poverty Report concludes that in 2013 real median household income was 8 percent below the amount in 2007, the year prior to the 2008 recession and has declined to the level in 1994, two decades ago!

Even though real household income has not regained the pre-recession level and has declined to the level 20 years ago, the government and financial press claim that the economy has been in recovery since June 2009.

Neither is an increase in consumer debt driving the economy. The only growth in personal debt is in student loans.

Real retail sales (corrected with a non-rigged measure of inflation) remain at the level of the bottom of the recession in 2009. Macy’s , J.C. Penny’s, and Sears store closings are further evidence of the lack of retail sales growth, as is the fact that two of the three dollar store chains are in trouble. Walmart’s sales are declining.

The basis of auto sales hype is subprime loans and leases taken by those who cannot qualify for a loan to purchase.

Housing starts remain far below the pre-recession level, which is not surprising when available jobs are part-time with no benefits. Such jobs cannot support the formation of households and purchase of homes.

Where does the government’s second quarter 2014 real GDP growth rate of 4.6 percent come from? It comes from an understated inflation measure and jiggled numbers. It is not a correct figure. Nothing has occurred in the economy to turn it from a first quarter decline of more than 2 percent into a second quarter growth of 4.6 percent.

The 4.6 percent number is pulled out of a hat to set the stage for the November election.

It is extraordinary that economists and the financial media permit the government to get away with its false economic reporting. Of course Wall Street likes good news . . . but fake news that misleads investors and covers up economic policy mistakes?

Clearly, something is wrong with the government’s economic reporting. It is not possible to have real GDP growth when real median family incomes are declining and business investment consists of corporations buying back their own shares. Either the government’s GDP estimate is incorrect or the Census Bureau’s Income and Poverty report is incorrect. Apparently Washington doesn’t understand that if it is going to rig the numbers, it must rig all the numbers.

The rigged inflation measures create illusionary real GDP growth. They also block cost-of-living adjustments to Social Security pensions. Indeed, the main purpose of the rigged inflation measures is to get rid of “socialistic” Social Security by allowing inflation to gradually erode away the real values of “entitlements.” Republicans always want to cut “entitlements” that people have paid for over their working lifetime with the payroll tax. But Republicans never want to cut the payroll tax. They need the revenues in order to bail out the big banks and to pay for never-ending wars.

Washington has been conducting needless wars abroad for 93 percent of the 21st century at a cost of trillions of dollars. More trillions have been wasted bailing out banks that deregulation permitted to become “too big to fail.” During the past seven years, millions of Americans have lost their jobs and their homes, and food stamp rolls have reached record numbers. These hurting Americans have been ignored by policy-makers in Washington.

Clearly, government in America is focused on something different from a healthy economy and the well being of citizens. We call it democracy, but it’s not.

My grandfather was a lawmaker for 40 years. In government, he used to say, “there are lies, damn lies and statistics.”

It is obvious we are not expanding in any way. The empty store fronts in strip malls and shopping malls deny the lies of these fool statistics. Without growth, how can there be inflation? Rising prices are from the falling value of the dollar.

In 2010, 100% of world economies used the dollar to complete all international trades. Today, that number is down to 33%. The dollar as the world reserve currency is finished, technology has made the need for any world reserve currency unnecessary and obsolete. The US has been riding on that status for years, and now, they are in deep trouble that won’t go away.

A bottle of aspirin now sells for over $23.00. A bottle of mineral oil is $10.00. Milk (in half gallon containers) is over $8.00 a gallon. Beef has gone up 400% since 2010, Chicken 300%, Fruit 300%…….I can go on, but I make my point. The dollar is losing value quickly.

I was a grown woman in recessions and inflations……and what is going on now is far worse. We are in a global depression that is happening all over the western world.

Recessions have always been ended by housing starts, but this time with millions of empty foreclosed homes, that won’t happen. Also, wages don’t fit with the rising housing prices, there can be no recovery with housing as expensive as it is, and the rising interest rates are choking out the few who were trying to buy.

This depression has been going on since 2001, it was masked with a real estate bubble in the US, our markets were still trusted completely, so selling subprime mortgages, mixed in with auto loans, credit card debt, and a few grade A mortgages to show a 15-20% return on investment worked well. Interest rates were at zero, and investors wanted better returns, so they bought them.

After the crash of 2007-08, causing entire nations to go bankrupt, things changed radically. By 2010, it was apparent to all that the US was not going to change a thing, nobody would be prosecuted or put in jail, no laws enacted to restore the credibility of the stock market. Subprime is still alive and struggling along today, but it isn’t booming.

I say struggling because the activity in the market today is made up of M&A’s and 85-90% of all activities are High Frequency skim and sell transactions. Foreign investment has slowed to a trickle, the US market is no longer trusted at all.

Money is leaving the US market every day regardless of the false numbers showing growth. As the market contracts, it is easier to show growth with the right statisticians. But, contracting it is……

About 10% of the market is made up of real investors.

In the Great Depression, the market lost 90% of its value between 1929-1933. This could well happen again because the market is only worth what real money is being put into it, not out…… and, 10% is about all that is in this market.

The banks, just as in 1929, are shells of debt. Unlike 1929, the dollar has nothing behind it but ink. In 1929, the dollar was backed with gold, we were the largest lending nation and the world’s largest emerging MFG economy. A huge difference from today where we are the largest debtor nation, and all MFG has gone offshore.

Now, interest rates are going up. Mortgage rates for ARMs are firmly over 5%, Jumbos at 6%, Auto loans 9% and climbing, the banks are starting to squeeze the system.

The FED has been carrying the interest rate payments on the national debt. It is a private bank. How long before they cut their losses? Higher interest rates indicate instability and questionable trustworthiness.

Unemployment was 40-50% in 1933. Right now, 100 million working age Americans are unemployed. Another 53 million work part time in dead end jobs with starvation wages. That totals 153 million out of a total population of 335 million……..even worse than unemployment was in the Great Depression…….it was well over 40%.

Companies started by individuals are the ones that create 80% of all new jobs in the US. Today, they have vanished, they have been choked out of existence by greedy corporations. Any company that shows up with a money making product or idea that pays a good return is bought up by corporations. Look what they did to coffee, dress shops, auto repair stores, auto agencies, gas stations, restaurants……….most outlets today are corporate owned.

People scratch for jobs everywhere, it now requires a college degree to sell cars, work in a restaurant, or any other corporate owned business.

This built up a huge financial opportunity for greedy guts on the stock market for a while. People cannot get out of paying their student loans, they are like taxes, they cannot be forgiven. So, they sold them on the stock market bundled in with other debt. The average debt of the graduating student today is a minimum of $29K. When the average job working for greedy gut corporations only pay $11-13 dollars an hour, they can never repay. So, they go on payments, with interest combining all the way. Wonderful, ongoing income for greedy guts.

It is only recently students are beginning to realize the cost isn’t worth the return, so are no longer going that route. As a result, the US will have people with less education…..easier to exploit. But, less opportunities for greedy guts.

All over the EU, unemployment is obscenely high, costs of living continue to skyrocket, and the only ones making money are the greedy guts. It is reaching a point of no return. People are fed up, and I think we are very close to a reset. This isn’t working for anyone, and unless the world wants to be torn to pieces, some radical changes have to be made.

In the US debt to GDP is 99%. In the UK, it is over 400%, and in nations in the EU itself, all nations have debt to GDP in multiple hundreds, like the UK.

Now, look at BRICS. Except for China, all of those countries have strong debt to GDP. China has the blueprints for everything ever built there, that was their price for slave labor for greedy corporations. So, Russia can stop buying vehicles, or anything from the west, and China and India can provide identical products, along with the rare earth minerals China stopped providing the west in 2010. Brazil can provide food, and South Africa, gold and other good things.

Putin has established a sister economy to that of the west, only far more solvent. The basket of currencies makes it far easier for all member nations to trade with each other without the dollar. Switzerland just joined last month. The east is rising, the west is collapsing.

I just found a website called layoffs dot org…….it does not look very impressive, so I am not passing it on as a good resource. Their totals were way different than mine, and all I did was add the numbers they listed.

Anyway, according to this website, including the 5000 more HP layoffs this morning (thanks Meg Whitman), so far in October, the layoff numbers total 12,069….they didn’t include any weekend numbers.

However, according to new jobless claims, it is in the hundreds of thousands so far this October, but it did include two days in September.

Unemployment continues to climb regardless of the lies told by US media.