– Why Scotland Has All The Leverage, In One Chart (ZeroHedge, Sep 15, 2014):

As Scotland prepares to vote for or against Independence from the Union on Thursday, it appears everyone has an opinion on what may, what should and what will happen. At the basis of every such opinion is some basis in fact, misguided as it may be in most cases, about who has all the leverage, with the dominant one being that Scotland would make a horrendous mistake if it says goodbye to the UK and puts a border around what is currently a third of UK’s landmass.

Some, such as Deutsche Bank, the bank that has the single greatest derivative exposure in the world and is therefore most leveraged to maintaining the status quo, saw its “Chief Economist & Member, Group Executive Committee, Deutsche Bank AG” David Folkerts-Landau personally put pen to paper on Friday and in rambling, demagogic terms, explain why it would be a “Wrong Turn” for Scotland to seek self-determination.

He says that, “A “Yes” vote for Scottish independence on Thursday would go down in history as a political and economic mistake as large as Winston Churchill’s decision in 1925 to return the pound to the Gold Standard or the failure of the Federal Reserve to provide sufficient liquidity to the US banking system, which we now know brought on the Great Depression in the US. These decisions – well-intentioned as they were – contributed to years of depression and suffering and could have been avoided had alternative decisions been taken.” Sure, there could have been no gold standard and the Fed could have gone full-Bernanke, and it would only have kicked the can a few years leading to an even greater depression, as the recent paradigm of “bubble to bubble” transitions, described by none other than Deutsche Bank, is where the world finds itself. In fact, it is DB that admitted last week that without a bubble, the western financial way of life is finished.

DB’s Landau concludes with the following outright propaganda:

Most importantly, the world as it is evolving in the 21st century is a highly uncertain place with unstable geopolitics and a stressed economic and financial outlook. Why anyone would want to exit a successful economic and political union with a G-5 country – a union which another part of Europe so desperately seeks to emulate – to go it alone for the benefit of… what exactly, is incomprehensible to this author.

Well, maybe let’s ask what is increasingly a majority of Europeans across the ill-fated and artificial Eurozone, whose fixed currency means the only devaluation possible is internal, read crashing wages. But of course, the head of something or another at Deutsche Bank has nothing to worry about in this regard.

And yet, as always, the bottom line is about leverage and bargaining power. It is here that, miraculously, things once again devolve back to, drumroll, oil, and the fact that an independent Scotland would keep 90% of the oil revenues! As we showed several days ago, Scotland’s oil may be the single biggest wildcard in the entire Independence movement.

It is this oil, and its interconnectedness within the UK economy, that as SocGen’s Albert Edwards shows earlier this morning, is what gives Scotland all the leverage.

From Edwards:

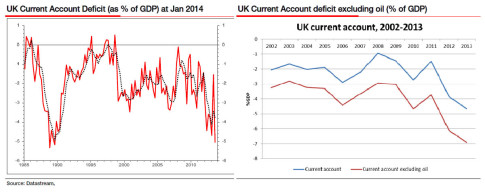

it is increasingly likely that it too it will be joining Scotland in permanently exiting the EU club. First of all, consider the vulnerability of sterling after a Yes vote for Scottish independence. Even without North Sea oil revenues, the UK current account situation is a mess. The left-hand chart below is one I put up at the end of our flagship conference in January this year. The point I made was it is absolutely extraordinary for the UK to be beginning an economic cycle with a current account deficit of around 5-6% of GDP. Normally this is a level the UK or any other developed countries get to at a height of a boom after years of overspending on consumer imports. I think I described the UK position as an economic abomination of the highest order and that this economic cycle was likely to end some years from now in a calamitous sterling crisis – just like we used to have in the past.

Our specialist macro salesperson, Richard Walker, thinks that it is in the rUK’s economic interest to retain some sort of currency union with Scotland after independence as he points out Ireland did after its own independence in 1922 until 1979. He believes the maths for the rUK just don’t add up – on the basis of an independent Scotland keeping 90% of the oil revenues the rUK current account deficit for the full year would have been around 7% of GDP instead of 4½% (also see right-hand chart above).

There’s that pesky “mathematics” again. Here is what the math reveals:

Personally I don’t believe that the rUK will conceive it possible that any continued currency union is feasible after independence having observed the eurozone mess. That means the yawning fault line in the UK’s economic situation will be revealed for all to see. Indeed since we used that chart of the UK’s current account mess in January this year, the deficit in Q3 last year was revised from 5% to 6% of GDP! That horrendous deficit persisted in Q4 at just under 6% of GDP but improved somewhat in Q1 of this year to 4.4% of GDP. That improvement though to me looks erratic and liable to reverse, most especially as the trade deficit through July continued to deteriorate. So, if rather than the 2013 full-year UK current account deficit of 4½% of GDP; the underlying situation is more reflective of the almost 6% deficit seen in H2, then the rUK current deficit will be nearer to 8 1/2% of GDP! The UK is due to release its 2014 Q2 Current Account data on 30 Sept.

For the UK as a whole the current account deficit is awful. For the rUK it is simply untenable. If investors are selling sterling in anticipation of a Yes vote, the economic reality of a rump rUK will see sterling quite rightly plunge into the abyss way before the end of the economic cycle (where we previously expected the turmoil would come).

Which also means that contrary to the UK’s fire and brimstone, it is the UK that has much more to lose in a world in which Scottish oil output is suddenly unavailable to plug current account deficit gaps, something the US has been able to do in the past 5 years courtesy of the transitory shale boom.

The vulnerability of sterling in a rUk world is made much worse as investors come to grips with the increasing prospect that the rUK will be leaving the EU. Capital will not be moving from north of the Scottish border to the south. It will be moving out of the UK altogether. And, with the rUK needing to attract capital at an unprecedented avaricious rate for this point in the cycle, this ain’t going to be pretty. Interest rates, which are probably set to rise next year anyway, may be set to rise a whole lot faster than anticipated if we get a good old-fashioned sterling crisis, with the good old-fashioned inevitable recessionary consequences thrown in.

The bottom line, at least to Edwards, is that Thursday’s vote will set in motion the independence not only for Scotland, but for the UK from the EU club:

So in the event of a Yes vote in the imminent Scottish referendum I would expect both Scotland (involuntarily) and the rUK (voluntarily) to find themselves outside of the EU club.

And should that happen, all bets are off for the continued existence of the greatest “unionization” experiment in modern history: Europe itself.

We saw similar trends towards political extremes to a greater or lesser extent in the beleaguered GIIPS (Greece, Italy, Ireland, Portugal and Spain) during the crisis. As Dylan has previously explained, political extremism becomes a very attractive proposition when a country comes under stress. Europe has a long history of such tendencies. Separatist and nationalist movements throughout Europe are gaining a stronger foothold with nationalist fault lines previously thought dormant awakening in unison right across Europe – see for example this interesting article from Ambrose Evans-Pritchard – link. The outcome of a Yes vote in Scotland may have as unpredictable consequences as did events in Eastern Europe in the late 1980s. A yes vote will send the EU bicycle (or if you prefer, shark) into reverse for the first time since the 1957 Treaty of Rome, with wholly unpredictable consequences.

Good luck, Scotland. The fate of a century of globalization and wealth-transfer efforts suddenly lies on your shoulders.

This is but a bankster’s overview.

The feelings are even and mutual. The only people who are concerned are the global corporations like the oil companies, and the elite establishment who stole land from the celts as gang members of William the Conqueror.

Queen Elizabeth, on behalf of Lord Evelyn de Rothschild will not allow their ownership of most of Scotland to be jeapordised.

It will be interesting, but going back to the EU issue, it’s collapse is overdue. The only ones fearful of that are the ones with their noses deepest in the trough.

To Squodgy: If the EU collapses, so goes the American government……at least the currency. Right now, it is the EU keeping the dollar afloat. 33% of nations still use the dollar, down from 100% in Jan, 2010. Technology has rendered the need for any world reserve currency obsolete…..67% of nations no longer use the dollar at all.

Prices here are through the roof…..a bottle of aspirin now costs $23.00 +, a box of plastic trash bags runs close to $20.00…milk runs about $9.00 a gallon, if you drink the stuff in cartons. If you buy it in gallon jugs, you can pay less, but it tastes like plastic…..so I won’t touch them.

It isn’t inflation, there is no economic growth to cause it. It is the fact the dollar is dropping like a stone in value.

Just read the FED is halting purchases of the US bonds, ie:dollars, in November…..a lot sooner than they said a few months ago.

The FED isn’t part of the US government, it is a private bank, and they are cutting the US loose. When that happens, it won’t be pretty.