Here is what happened to Mexico:

– Hedge Fund Manager Kyle Bass Explains The New World Order (Panel Presentation):

Don’t believe these governments when they tell you everything is going to fine. The day before Mexico devalued by 60% they denied that they would ever devalue. They can and will never tell you the truth. Find your own numbers.

Here is what happened to Belarus:

– Belarus Devalues Its Currency By 56% Overnight, Against Every Currency Out There:

Luckily for those who held their “money” in the form of gold and silver, they just got an instantaneous 56% value preservation and a relative boost in their purchasing power with just one central bank announcement.

Prepare for collapse.

– A Shocking First: Mainstream Media Rushes To Defend Dollar Reserve Status (ZeroHedge, July 16, 2014):

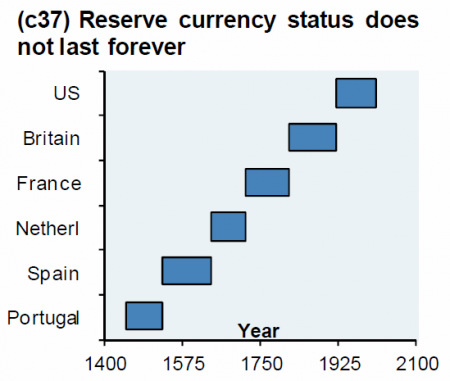

One can’t help but wonder just how concerned the powers that be are becoming when such an esteemed mainstream media outlet as Bloomberg News would deem fit to defend the almighty US Dollar. “There are always people who say the dollar is going to be replaced, but it hasn’t happened,” chides one strategist (clearly forgetting that nothing lasts forever). As growing concerns of “exorbitant privilege” spread from the usual anti-imperialist foes (Russia and China’s de-dollarization) to close allies like France and now to the world’s growth engine – BRICS, it seems defending what was previously unquestionable itself should be grounds for alarm…

The dollar hasn’t budged from its top spot for the past three decades, withstanding repeated efforts to unseat it. Almost 90 percent of the $5.3 trillion a day in foreign-exchange transactions last year involved the dollar, the same share as in 1989, data from the Bank for International Settlements show. More than 80 percent of trade finance was done in dollars in 2013, according to Swift, a global financial-messaging network.

…

A week after the BNP Paribas plea, French Finance Minister Michel Sapin urged European governments to promote the euro more in international transactions. While he said he wasn’t fighting “dollar imperialism,” his comments echoed those of predecessor Valery Giscard D’Estaing, who coined the term “exorbitant privilege” in 1965, referring to the benefits the U.S. received for the dollar’s status.

…

“The Fed is the central bank of the world,” said Joseph Quinlan, chief market strategist at Bank of America Corp.’s U.S. Trust, which oversees about $380 billion. “The rest of the world benefits from the dollar standard as well.”

…

“The U.S. dollar remains dominant in traditional trade finance, and we don’t see a replacement any time soon,” said Astrid Thorsen, the head of business-intelligence solutions at Swift in Brussels. “The yuan is gaining traction, and it has dethroned the euro from second place. But the competition has been between currencies other than the dollar.”

…

Companies, consumers and central banks around the world prefer the dollar to other currencies, including the euro and yen, because they trust the Federal Reserve and the U.S. government to back it, according to Marc Chandler, the chief currency strategist at Brown Brothers Harriman & Co.

“There are always people who say the dollar is going to be replaced, but it hasn’t happened,” said Chandler, who’s based in New York. “The biggest threat to the dollar’s dominance is the U.S. deciding to abdicate one day, not others complaining about it for this reason or that.”

But not everyone is so exuberant…

“The dollar’s role will decline gradually and modestly over time, but it will still remain as the dominant currency,” said Bergsten, founder of the Peterson Institute for International Economics in Washington and a former Treasury Department official. “The euro has already claimed a central role, and the yuan keeps getting more important. Neither will likely replace the dollar, though.”

* * *