– China Signs Non-Dollar Settlement Deal With Russia’s Largest Bank (ZeroHedge, May 20, 2014):

Slowly – but surely – the USD’s hegemony is being chipped away whether by foreign policy faux pas, crossed red-lines, or economic fragility. However, on Day 1 of Vladimir Putin’s trip to China it is clear that the two nations are as close as ever. VTB – among Russia’s largest banks – has signed a deal with Bank of China to pay each other in domestic currencies, bypassing the need for US Dollars for “investment banking, inter-bank lending, trade finance and capital-markets transactions.” Kirill Dmitriyev the head of Russia’s Direct Investment Fund notes, “together it’ll be possible to discuss investment in various projects much more efficiently and clearly,” as Russia’s pivot to Asia continues to gather steam.

As RT reports, Day 1 for Putin is going well…

VTB, Russia’s second biggest lender, has signed a deal with Bank of China, which includes an agreement to pay each other in domestic currencies.

“Under the agreement, the banks plan to develop their partnership in a number of areas, including cooperation on ruble and renminbi settlements, investment banking, inter-bank lending, trade finance and capital-markets transactions,” says the official VTB statement.

The deal underlines VTB Group’s growing interest in Asian markets and will help grow trade between Russia and China that are already close trading partners, said VTB Bank Management Board Vasily Titov.

But it’s not just the banking relationships…

In the first day of a two-day trip to China Russia’s President Vladimir Putin said the two countries will be increasing their bilateral trade to reach a new level.

“Our countries have done a huge job to reach a new historic landmark…. China has firmly settled in a position of our key trade partner,” Putin said.

Putin also said that trade turnover between Russia and China grew almost 2 percent during 2013 to reach about $90 billion.

“If we sustain this pace the level of bilateral trade of $100 billion will be reached by 2015 and we’ll confidently move on,” Putin said.

Increasing investment cooperation is crucial, Putin added.

…

“Together it’ll be possible to discuss investment in various projects much more efficiently and clearly,” as Interfax quotes Kirill Dmitriyev the head of Russia’s Direct Investment Fund.

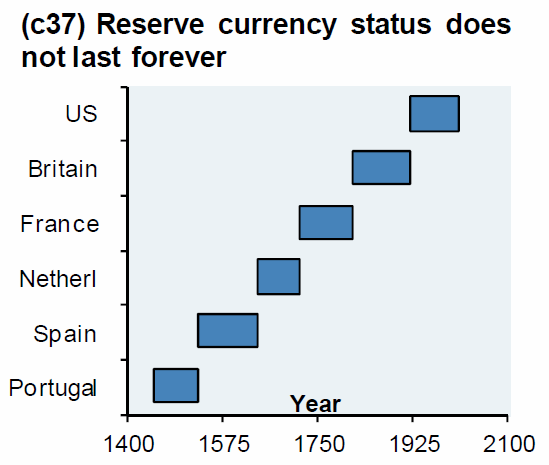

Nothing lasts forever… remember…

This is not new, they set up a trade agreement with each other using their own currencies in November, 2010. They modeled their agreement on Hugo Chavez’s South American Trade Alliance, using an electronic currency system similar in design to the Sucre. The Sucre was introduced into the SATA by Hugo Chavez in Summer of 2010. It allowed member nations to trade with each other, using their own currencies, leaving the dollar out. The Sucre translated the value of each currency, making the need for a reserve currency obsolete. It continues to this day. Russia and China were so impressed with it’s success, it signed the same agreement with each other in November.

Why they advertise it now, nearly four years later is a mystery to me. China, since the signing in 2010, went on to recruit Turkey, many middle eastern, African, South American and central American countries to their same system.

Today, less than half the world uses the dollar. Australia and New Zealand dumped the dollar last year. India and Japan joined their trade agreement after the US put more sanctions on Iran……Obama gave Japan a

pass, whatever that means.

So, I guess they feel secure enough to proclaim it……nearly 4 years later. It has been a big success, and the US has been mute on the subject.

With the advent of the Sucre, the first electronic currency, the entire concept of a world reserve currency is now obsolete.

I guess the public war against the US has finally begun…..boy, this is happening fast….faster than I thought

One more comment. The public war against the US is beginning in force. See this article.

http://rt.com/usa/160240-wikileaks-greenwald-intercept-phones/