– Bizarro Housing Bubble Spills Over Into “Overbid Madness”, $10 Million “Flips” In 24 Hours (ZeroHedge, May 10, 2014):

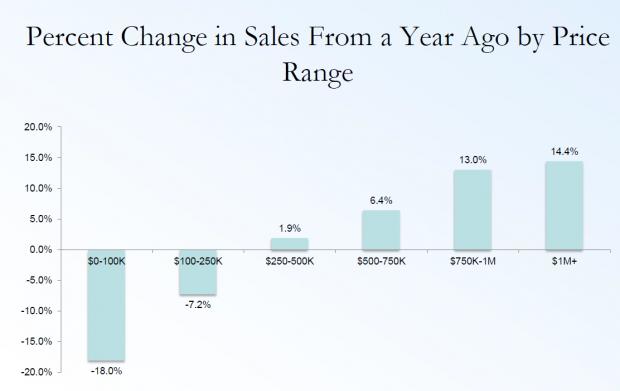

While the housing bubble for anything but the ultra luxury segment has long since popped with $1.1 trillion of student loans playing a significant role in the burst, (as explained in “Stick A Fork In The “Housing Recovery“), as can be seen in the chart below which shows that the only increase in existing home sales from a year ago is that for the $500 and over price range (which accounts for only 10% of all actual transactions)….

… when it comes to the luxury segment, things have moved beyond the simply bizarre and have entered outright surreal territory.

Case in point: San Francisco, where realtors have had to come up with a new term to explain what is happening when a house just sold for $600,000 above the $1.5 million asking price! The term: “overbid madness” and it explains well the buying frenzy that has engulfed the smallest portion of the housing market – that of the rarefied ultraluxury housing where the wealthy – almost exclusively offshore buyers – merely flip properties back and forth from each other without regard for price, comps or any other traditional valuation metrics. The underlying objective – parking illegal cash into the safety of the US housing market in which the NAR is a perfectly willing receptacle of laundered money.

Shrouded in fog, and swimming in cash a two bedroom, modern home in the Glen Park neighborhood was just snapped up for $2.1 million.

“That’s really unbelievable,” said Kendra Mastain of San Francisco.

The sleek home on Bosworth sold for $600,000 over asking price. “I’m a RN, I make a decent living,” said Tammy Elder of San Francisco. “I don’t ever picture myself buying a house here.”

Arrian Binnings of Christie’s / Pacific Union told KPIX 5, “That wasn’t even our highest offer.”

Binnings said it’s supply and demand, with most homes for sale commanding 12 percent over asking.

“That is a red hot market,” he said.

And while the bubble for most areas across the US has long since burst, in San Francisco it is raging like never before:

Real estate agents said if new property stopped coming on the market, San Francisco would run out of homes for sale in just five weeks. There were eight offers on the home, but only one person can win. It has turn San Francisco’s real estate market into contestant’s row on The Price Is Right, making the losing bidders desperate

Ridiculous? Yes. Insane? Absolutely.

But San Francisco has nothing on the the insanity that has gripped the ultra luxury housing segment in New York, where within 24 hours, an overzealous seller tried to flip a $31 million three-bedroom condo at One57 purchased on May 6, to an even more overzealous buyer on May 7 for… $41 million – a $10 million price increase in one day!

From Bloomberg:

A three-bedroom condo in the building sold for a record $31 million in April to a mysterious buyer known as Escape From New York LLC. The sale was officially memorialized in public real estate records on Tuesday. Then, on Wednesday, the new buyer put the property back on the market for $41 million, a miraculous 32 percent increase in value.

This is a sign of what real estate writers often describe as “a frothy” market. The Real Deal, which uncovered the fast-appreciating home, describes it as a “4,483-square-foot, 62nd-floor apartment [featuring] four bathrooms and floor-to-ceiling windows.” It must be adorable. But could such comforts be worth $10 million more overnight? We won’t know until the aspiring investor-escapee completes the flip of No. 62A.

A $10 million flip in a day? Why not – and if the greater fool for whom money is no object appears, others will promptly follow:

If the entity known as Escape From New York gets its asking price, there will be at least one other satisfied party in the tower: the owner of a three-bedroom unit on two floors below. That unit sold for $30 million last month, too, in a transaction that inspired a bit of real-estate porn in the New York Times:

“The apartment, No. 60A, has four-and-a-half marble baths and the ultimate view magnet, 60 feet of park frontage in the living/dining/entertaining area. The master suite has his-and-hers baths and bird’s-eye views of the city and the Hudson River. The custom eat-in kitchen by Smallbone of Devizes has hand-painted white cabinetry (although buyers at One57 do have the option of choosing a Macassar ebony color scheme).”

Throw in the optional room service—wouldn’t you expect it at this price?—and such opulence suddenly seems like a bargain at only $30 million.

How much longer can this undisputed housing bubble last? Going back to San Francisco, here is what a Christie’s real estate agent thinks:

Binnings believes there is an end to the real estate crazy train. “The type of growth we’re seeing right now is not sustainable year over year, I expect to see these types of prices tame down a little bit,” he said.

Then again, neither Binnings, noe anyone else, has seen what happens when central banks inject $10 trillion into a global economy with very finite real assets.

Expect the sheer idiocy created by Bernanke, the Charimanwoman et al to last at least a little bit longer: because why rush the epic amusement associated with the biggest bubble burst ever seen in human history?

If anything, the more terminal the destruction in its wake, the more certain that the Keynesian idiocy that has gripped the “very serious” people of the world with its final deathly grip, dies the slow and miserable death it so deserves.

Madness. Where does the money originate? Is it just laundering money made with illegal means? The US has become an oasis for crooks……someone ought to look more closely where this money originates.

I am a 4th generation San Franciscan, and I could not begin to afford something like this. My grandmother lived through the fire and earthquake of 1906, fortunately, on their side of O’Farrell Street, their home survived. On the other side of Van Ness, all were leveled.

She talked of women running down the street with their parakeets in cages, in their nightclothes completely hysterical. In those days, a lady never exited her bedroom without being completely clothed……the rules were very strict, the protocol set. It was shocking to see people in various stages of undress, but it was the beginning of a very terrible time for San Francisco.

I have been putting together a book on the subject based on memory (and reference books) as she related the experience to me. San Francisco is a beautiful city, and it is on the bay of the Pacific Ocean. Therein lies the rub. In a few more months, the Pacific will be dead. I wonder how many folks will want San Francisco properties then.

One last thing, when my grandfather died, she found a couple of deeds to flats in the Marina, and she sold them instantly. Nobody understood why until the earthquake of 1989. It had been the place where the homeless camped in the park had thrown their garbage, it was land fill, and very weak. The flats, along with others, were sinking into the mud. She remembered it was for trash, and knew what would eventually happen……and it did.

Our world is changing, and even the super rich cannot change it. The Pacific is dying, and nobody will want to live next to a dead ocean…….