– 40 Central Banks Are Betting This Will Be The Next Reserve Currency (ZeroHedge, April 8, 2014):

As we have discussed numerous times, nothing lasts forever – especially reserve currencies – no matter how much one hopes that the status-quo remains so, in the end the exuberant previlege is extorted just one too many times. Headline after headlines shows nations declaring ‘interest’ or direct discussions in diversifying away from the US dollar… and as SCMP reports, Standard Chartered notes that at least 40 central banks have invested in the Yuan and several more are preparing to do so. The trend is occurring across both emerging markets and developed nation central banks diversifiying into ‘other currencies’ and “a great number of central banks are in the process of adding yuan to their portfolios.” Perhaps most ominously, for king dollar, is the former-IMF manager’s warning that “The Yuan may become a de facto reserve currency before it is fully convertible.”

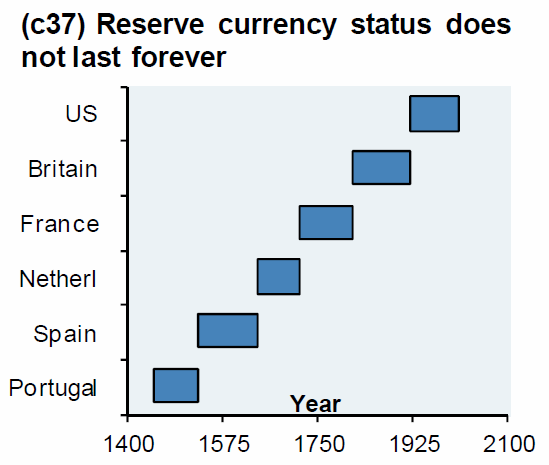

The infamous chart that shows nothing lasts forever…

Nothing lasts forever… (especially in light of China’s recent comments)

As The South China Morning Post reports, Jukka Pihlman, Standard Chartered’s Singapore-based global head of central banks and sovereign wealth funds (who formerly worked at the International Monetary Fund advising central banks on asset-management issues), notes that:

At least 40 central banks have invested in the yuan and several others are preparing to do so, putting the mainland currency on the path to reserve status even before full convertibility

The US dollar remains in charge (for now)…but

The US dollar is still the world’s most widely held reserve currency, accounting for nearly 33 per cent of global foreign exchange holdings at the end of last year, according to IMF data. That ratio has been declining since 2000, when 55 per cent of the world’s reserves were denominated in US dollars.

The IMF does not disclose the percentage of reserves held in yuan, but the emerging market countries’ share of reserves in “other currencies” has increased by almost 400 per cent since 2003, while that of developed nations grew 200 per cent, according to IMF data.

As SCMP goes on to note, the rising popularity of the yuan among central bankers is probably mainly due to Beijing’s extremely favourable treatment of them as it has sought to encourage investment in the yuan.

For example, central banks enjoy preferential treatment in the qualified foreign institutional investor category, both on the size of the quota and the length of the lock-up period. The QFII quotas given to central banks are not publicly known, but some of those announced by investing central banks are up to 10 times larger than others in the programme and, most importantly, free of any capital controls.

“Central banks and sovereign funds have special treatment,” Pihlman said. “They have the ability to invest in a way that any other investor does not have. When it comes to convertibility, there is nothing formally out there, but it is fully convertible.”

As Pihlman explains, things are accelerating…

Pihlman said “a great number of central banks are in the process of adding [yuan] to their portfolios”.

“The [yuan] has effectively already become a de facto reserve currency because so many central banks have already invested in it,” he said. “The [yuan] may become a de facto reserve currency before it is fully convertible.”

The central banks more likely to add yuan holdings in the future were the ones with “strong trade linkages to China” and those which had relatively large levels of reserves which could consider diversifying more for return-related reasons, he said.

“The [yuan’s] convertibility may be already there for central banks in a way that has got them comfortable to start investing in the currency,” Pihlman said.

We leave it to a former World Bank chief economist, Justin Yifu Lin, to sum it all up…

“the dominance of the greenback is the root cause of global financial and economic crises,”

It appears the world is beginning to listen

The Yuan? What a joke. Following the Chinese economy as I have been doing, I can say with certitude that China will not be the world reserve currency. The reason they won’t be (besides their shaky economic system) is because the entire concept of a world reserve currency is obsolete. Electronic currencies have taken over.

The Sucre, the world’s first electronic currency, was launched in Summer of 2010 by Hugo Chavez for the South American Trade Alliance. The SATA is made up of 12 small countries, including Cuba. Their total GDP was about $500 billion, and it flew under the radar because it was so small.

Each member nation was able to trade with each other using their own currencies. The Sucre translated the value of their currency, making the need to convert to the dollar obsolete.

China and Russia formed their own trade agreement in November of 2010, using their own currencies, leaving the dollar out. They went on to recruit other nations in Africa, South America and the middle east.

When the US put more sanctions on Iran, India and Japan joined with them, and dumped the dollar. New Zealand and Australia dropped the dollar in 2011.

In Jan, 2010, 100% of all international trades were completed in US dollars. Today, it is less than half. More nations have adopted the electronic currency model, and prefer to use their own currencies without dealing with the dollar at all.

Had the US been more vigilant about the crooks in control, cleaned up it’s own mess, the process would have happened much more slowly. As it is, the world is moving away from the US, and dumping the dollar is a quiet way to do it.

We don’t need world reserve currencies any longer. It is typical of China to chase something obsolete……..