Prepare for collapse.

– Global Debt Crosses $100 Trillion, Rises By $30 Trillion Since 2007; $27 Trillion Is “Foreign-Held” (ZeroHedge, March 9, 2014):

While the US may be rejoicing its daily stock market all time highs day after day, it may come as a surprise to many that global equity capitalization has hardly performed as impressively compared to its previous records set in mid-2007. In fact, between the last bubble peak, and mid-2013, there has been a $3.86 trillion decline in the value of equities to $53.8 trillion over this six year time period, according to data compiled by Bloomberg. Alas, in a world in which there is no longer even hope for growth without massive debt expansion, there is a cost to keeping global equities stable (and US stocks at record highs): that cost is $30 trillion, or nearly double the GDP of the United States, which is by how much global debt has risen over the same period. Specifically, total global debt has exploded by 40% in just 6 short years from 2007 to 2013, from “only” $70 trillion to over $100 trillion as of mid-2013, according to the BIS’ just-released quarterly review.

It should come as no surprise to anyone by now, but the only reason why global stocks haven’t plummeted since the Lehman collapse is simple: governments have become the final backstop for onboarding risk, with a Central Bank stamp of approval – in other words, the very framework of the fiat system is at stake should global equity levels collapse. The BIS admits as much: “Given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers,” according to Branimir Gruic, an analyst, and Andreas Schrimpf, an economist at the BIS.

It should also come as no surprise that courtesy of ZIRP and monetization of debt by every central bank, debt has itself become money regardless of duration or maturity (although recent taper tantrums have shown what will happen once rates start rising across the curve again), explaining the mindblowing tsunami of new debt issuance, which will certainly never be repaid, and whose rolling will become impossible once interest rates rise. But of course, under central planning that is not allowed. As Bloomberg reminds us, marketable U.S. government debt outstanding has surged to a record $12 trillion, up from $4.5 trillion at the end of 2007, according to U.S. Treasury data compiled by Bloomberg. Corporate bond sales globally jumped during the period, with issuance totaling more than $21 trillion, Bloomberg data show.

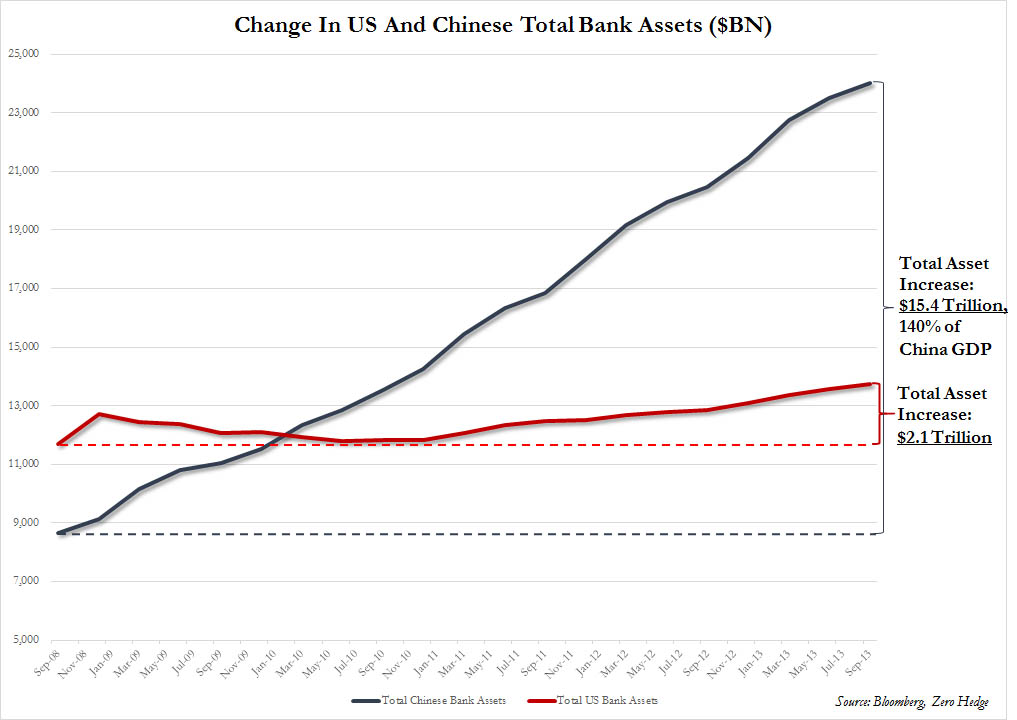

And as we won’t tire of pointing out, China’s credit expansion over this period is easily the most important, and overlooked one. Which is why with China out of the epic debt issuance picture, and with the Fed tapering, all bets are slowly coming off.

Bloomberg also comments, humorously, as follows: “concerned that high debt loads would cause international investors to avoid their markets, many nations resorted to austerity measures of reduced spending and increased taxes, reining in their economies in the process as they tried to restore the fiscal order they abandoned to fight the worldwide recession.” Of course, once gross government corruption and incompetence made all attempts at austerity futile, and with even the austere nations’ debt levels continuing to breach record highs confirming there was never any actual austerity to begin with, the push to pretend to reign debt in has finally faded, and the entire world is once again engaged – at breakneck speed – in doing what caused the great financial crisis in the first place: the issuance of record amounts of unsustainable debt.

All of the above is known. What may not be known is just who is issuing, and respectively, purchasing, this global debt-funded spending spree, especially in a world in which one’s debt is another’s asset. Here is the BIS’s answer to that question:

Cross-border investments in global debt markets since the crisis

Branimir Grui? and Andreas Schrimpf

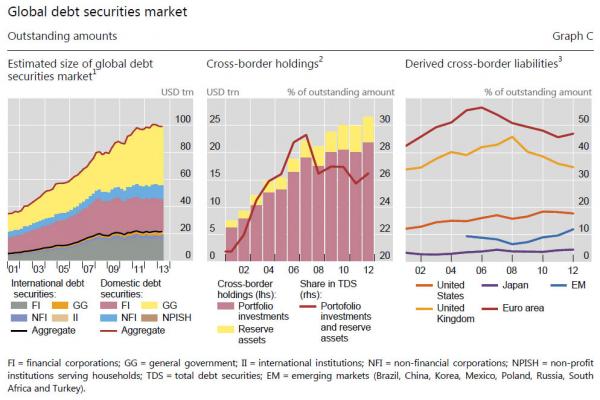

Global debt markets have grown to an estimated $100 trillion (in amounts outstanding) in mid-2013 (Graph C, left-hand panel), up from $70 trillion in mid-2007. Growth has been uneven across the main market segments. Active issuance by governments and non-financial corporations has lifted the share of domestically issued bonds, whereas more restrained activity by financial institutions has held back international issuance (Graph C, left-hand panel).

Not surprisingly, given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers (Graph C, left-hand panel). They mostly issue debt in domestic markets, where amounts outstanding reached $43 trillion in June 2013, about 80% higher than in mid-2007 (as indicated by the yellow area in Graph C, left-hand panel). Debt issuance by non-financial corporates has grown at a similar rate (albeit from a lower base). As with governments, non-financial corporations primarily issue domestically. As a result, amounts outstanding of non-financial corporate debt in domestic markets surpassed $10 trillion in mid-2013 (blue area in Graph C, left-hand panel). The substitution of traditional bank loans with bond financing may have played a role, as did investors’ appetite for assets offering a pickup to the ultra-low yields in major sovereign bond markets.

Financial sector deleveraging in the aftermath of the financial crisis has been a primary reason for the sluggish growth of international compared to domestic debt markets. Financials (mostly banks and non-bank financial corporations) have traditionally been the most significant issuers in international debt markets (grey area in Graph C, left-hand panel). That said, the amount of debt placed by financials in the international market has grown by merely 19% since mid-2007, and the outstanding amounts in domestic markets have even edged down by 5% since end-2007.

Who are the investors that have absorbed the vast amount of newly issued debt? Has the investor base been mostly domestic or have cross-border investments grown at a similar pace to global debt markets? To provide a perspective, we combine data from the BIS securities statistics with those of the IMF Coordinated Portfolio Investment Survey (CPIS). The results of the CPIS suggest that non-resident investors held around $27 trillion of global debt securities, either as reserve assets or in the form of portfolio investments (Graph C, centre panel). Investments in debt securities by non-residents thus accounted for roughly one quarter of the stock of global debt securities, with domestic investors accounting for the remaining 75%.

The global financial crisis has left a dent in cross-border portfolio investments in global debt securities. The share of debt securities held by cross-border investors either as reserve assets or via portfolio investments (as a percentage of total global debt securities markets) fell from around 29% in early 2007 to 26% in late 2012. This reversed the trend in the pre-crisis period, when it had risen by 8 percentage points from 2001 to a peak in 2007. It suggests that the process of international financial integration may have gone partly into reverse since the onset of the crisis, which is consistent with other recent findings in the literature.

This could be temporary, though. The latest IMF-CPIS data indicate that cross-border investments in debt securities recovered slightly in the second half of 2012, the most recent period for which data are available.

The contraction in the share of cross-border holdings differed across countries and regions (Graph C, right-hand panel). Cross-border holdings of debt issued by euro area residents stood at 47% of total outstanding amounts in late 2012, 10 percentage points lower than at the peak in 2006. A similar trend can be observed for the United Kingdom. This suggests that the majority of new debt issued by euro area and UK residents has been absorbed by domestic investors. Newly issued US debt securities, by contrast, were increasingly held by cross-border investors (Graph C, right-hand panel). The same is true for debt securities issued by borrowers from emerging market economies. The share of emerging market debt securities held by cross-border investors picked up to 12% in 2012, roughly twice as high as in 2008.

* * *

Source: BIS

World annual GDP (if one believes the numbers given by all nations, including China, who is famous for their financial lies) averages $50-65 trillion.

Right now, China’s debt to GDP is anywhere (depending on whose site you read) from 5X-12X annual GDP. Germany is over 200%, Spain, Portugal, Italy……all over 200%…….some twice that high.

Russia is 36% of GDP, relatively healthy in relation to the rest of the world. Makes one wonder why the US wants an economic war with them……….

The US is being run by fools. This always happens to a civilization when group rule takes over……..and the printing press party is about over. Nobody trusts the dollar anymore, and that is the worst news out there.

Russia and China will NOT dump the dollar as some fear mongers claim, they have to protect their own investment. They will continue what they have been doing over the past several years…….slowly and methodically divesting themselves of US debt……….when they have finished……that might well be when the dollar does crash. They are not interested in losing their money, but the dollar is losing value and buying power markedly, and it won’t recover.

I don’t understand why any government would give their entire national survival over to bankers, but that is what the US and other nations have done, and the bankers do what they always do…….destroy.

I am not referring to the bankers in your local credit union or bank who just does his job, I mean the evil ones like Greenspan and Bernanke who acted for profit without a care what would happen to the nations involved. The IMF and ECB is controlled by the same types.

They are the type that cause revolutions and social breakdown. Why they get into power again and again demonstrates mankind’s inability to learn from his mistakes or history.

The printing party is about over. Interest rates are going to start skyrocketing……real money has become very scarce…..and the only way to get deposits is to raise rates paid for the use of their money. It will be deadly for the millions who have ARMs and high credit card debt. It will be terrible for those on fixed incomes, and people working at low wages.

Our economy is going south for good. I went by a shopping mall yesterday to see they are putting in a Target where a nice department store used to be……..the quality of retail continues to decline as people have less and less disposable income.

The US has a debt level of 99% of annual GDP according to the US debt clock dot org. If you go to the site, and click on world……it will give you a breakdown of each nation. That tells me the US government has no disposable income, either. All the money that comes in goes out to service the debt…..until the paper dollar is no longer accepted, and interest rates will have to go up…….from there, it is downhill all the way.