– JPM To Lay Off 17,000 Mortgage Bankers In 2013 And 2014, Because The “Housing Recovery” (ZeroHedge, Feb 25, 2104):

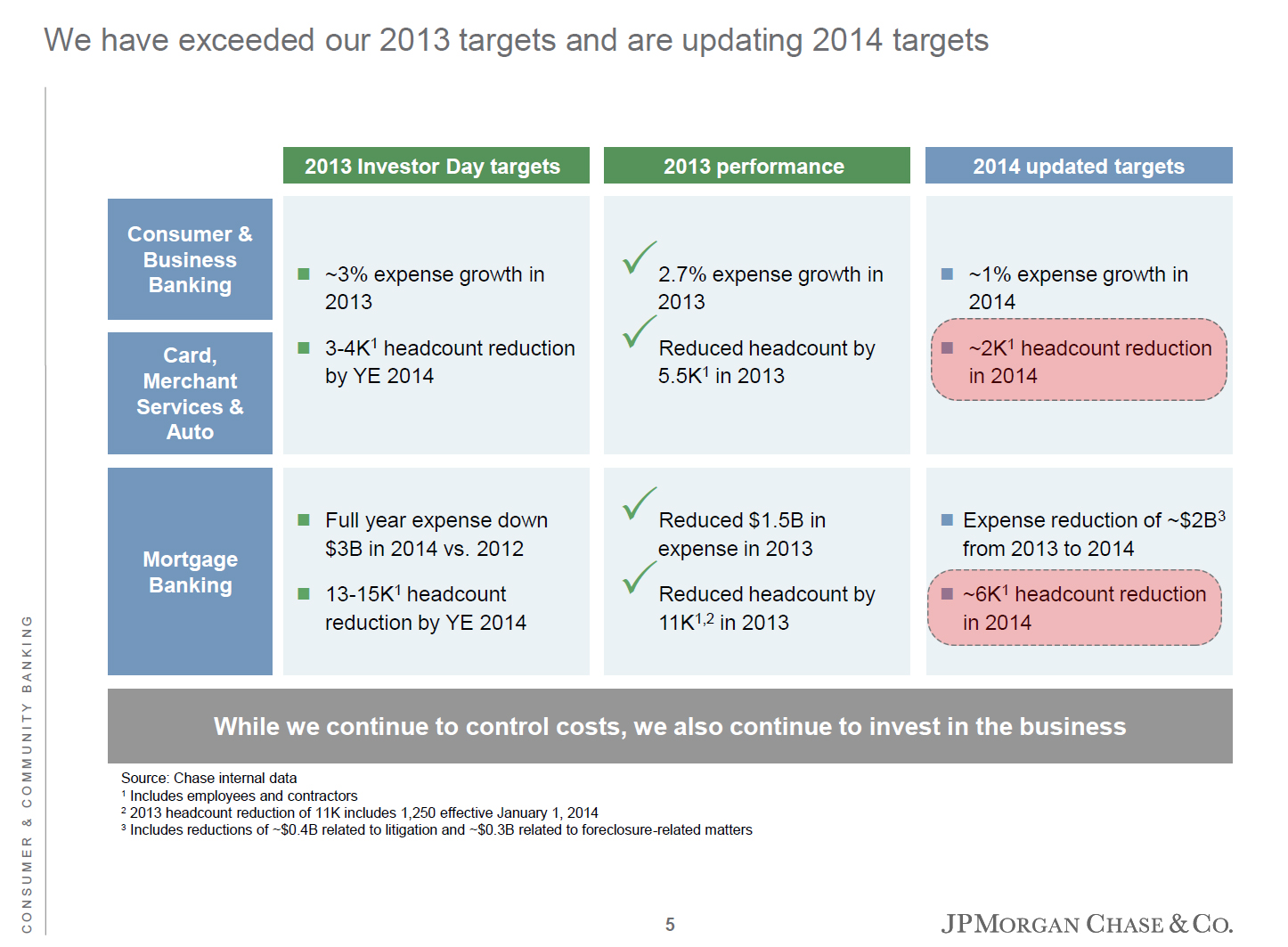

The last time JPMorga had an investor day, Jamie Dimon explained to Mike Mayo why he is richer than him (and pretty much anyone else). This year, Jamie will be more focused on explaining to 8,000 JPM workers why after firing 16,500 people in consumer and mortgage banking, the bank will now let go another 2K and 6K in those same two groups (which will bring total mortgage and consumer banking headcount reductions between 2013 and 2014 to at least 17K and 7.5K, respectively). This may be tricky especially in the context of, you know, the housing and economic recovery, and stuff.

Source: JPMorgan

Housing recovery that doesn’t exist. The greedy guts have stolen all our real estate, the low value has destroyed our holdings in the properties, and the only ones who benefit are the greedy gut bankers.

I had a couple of homes, but no longer. They are not worth holding on to any longer because real estate values are not going to come back to CA. Reason: no market, good paying jobs continue to go offshore, there are so many foreclosures they keep the market at rock bottom despite all their tricks.

They tried holding all the foreclosures off the market to re-inflate it that way….it didn’t work. So, they brought in these people to handle short sales, but found out it was better for the greedy few to grab the real estate in foreclosure than short sales…..someone else might benefit.

Excessive greed. That has taken America down. All the regulations that made our markets the best in the world are gone.

I spoke with a person the other day. Asked him if his mortgages on his many homes are fixed rate or ARM. All eight of them are ARMs…….he cannot get fixed rates regardless he has sterling credit.

My guess is that will be the next thing the greedy guts will go after…..interest rates on homes will go through the roof, and many people who think they are okay right now will find out for themselves the vicious and voracious greed of these bankers.

The next part to dis-assemble is the upper middle class…..and they will fall hard.

But, there is an unknown here……Fukushima, and the places I refer to are here in CA. How soon will it be before CA is unlivable? I give it two years or until the Pacific ocean is completely dead.

It is something we have never faced before. Now, New Mexico has a problem with a nuclear reactor as well. We already have one in San Diego.

How much longer can corporate greed supersede human life? That is the real question.