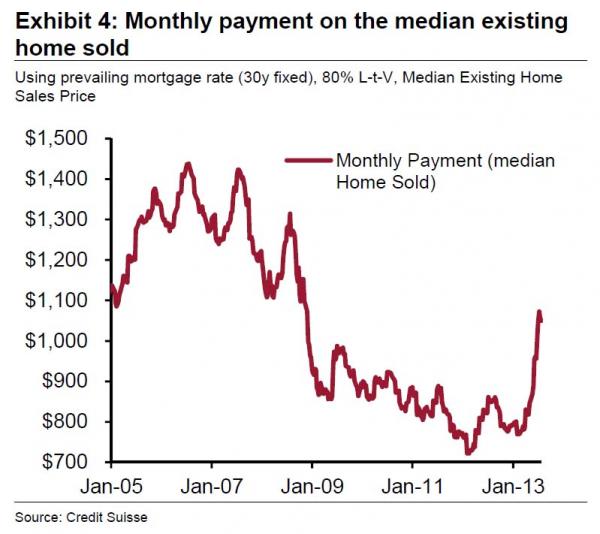

– Chart Of The Day: Monthly Home Payment Soars 40% To 2008 Levels (ZeroHedge, July 29, 2013):

The following chart from Credit Suisse fully explains why the US housing “recovery” has just ground to a halt: in a few short weeks, US housing affordability (a topic we first covered a month ago) has collapsed as a result of the monthly payment on the median home sold soaring by nearly 40% from under $800 to just shy of $1100, a level not seen since 2008. Now if only US personal incomes would keep pace, instead of doing this…

Mortgage rates have gone up 12 basis points in the last 40 days. Yesterday, they were at 4.6%. That isn’t bad in a normal, growing economy such as we used to enjoy before the Greedy Guts got in to steal everything. But, in an economy that continues to bleed jobs, wages continue to fall while food and energy costs continue to skyrocket……not surprising.

There are a lot of people who have enjoyed low interest rates on their homes for some time and have gambled on the ARM. At 1%, its a good deal, at 5%, considerably more expensive. Wait until it goes to 8%…..and it will.

The world economic powers are losing control of the world economy. They have all printed money nonstop without thought for tomorrow. When you print money that far exceeds the wealth generated in the world economy, you lose control as the money becomes less valuable. Soon, it becomes excessive and drops sharply in value. Look at Germany after WWI.

This is happening to all the money printers, not just the US treasury at the behest of the FED, but the IMF, ECB, BOJ, and China……all are playing the same paper game. The FED stopped publishing how much money they print somewhere in the 1980s, but if standard business practices can be a measuring stick, 1000:1 is the average level of leveraging.

In 1929, leveraging was 9:1, and it was a mess.

Looks like the tiger they have held by the tail is getting fed up, and the reaction won’t be pretty.