– Goldman Implicated In Heinz Insider Trading Probe (ZeroHedge, Feb 15, 2013):

When the news broke of the SEC’s action against the HNZ call option insider traders, and we posted the full SEC charge against the perpetrators whose actions Zero Hedge reported on first, we asked this regarding one of the entities named: “the trade occurred through an “omnibus account located in Zurich, Switzerland in the name of GS Bank IC Buy Open List Options GS & Co c/o Zurich Office (the “GS Account”).” Does GS stand for Goldman Sachs one wonders?” This followed our prior post, rhetorically titled “Guess Who Was Buying HNZ Stock From Its Clients“, with the answer of course being Goldman Sachs, which had had HNZ stock at a Sell rating for months, and which just days before reiterated its negative sentiment. But for the most part the post was written in jest. Turns out the joke was on everyone else, because just as we feared, or rather knew, Goldman was indeed implicated all along.

From Reuters:

Goldman Sachs Group Inc is cooperating with a U.S. Securities and Exchange Commission probe into insider options trading in H.J. Heinz Co before the food company announced it was being acquired, Goldman said on Friday.

Earlier in the day, the SEC filed suit against unknown traders using an account in Switzerland to buy options in Heinz before the company was purchased. The SEC suit does not explicitly name Goldman Sachs but refers to the account in Switzerland as the “GS Account.”

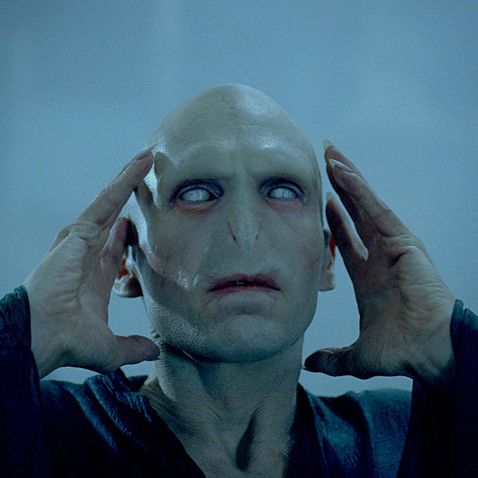

While none of this is surprising, we do find it curious that from “Vampire Squid”, Goldman Sachs has now metastasized into “he who must not be named.”