Related info:

Flashback:

– Golden Showers As Goldman Tells Clients To Sell Gold

– Goldman Sachs Murders ‘Muppets’, Tells Them To Stay Long Spanish, Italian Bonds

– Goldman Sachs Does It Again: Muppets Slaughtered

– How To Lose All Your Money With Goldman Sachs

– Guess Who Was Buying HNZ Stock From Its Clients (ZeroHedge, Feb 13, 2013):

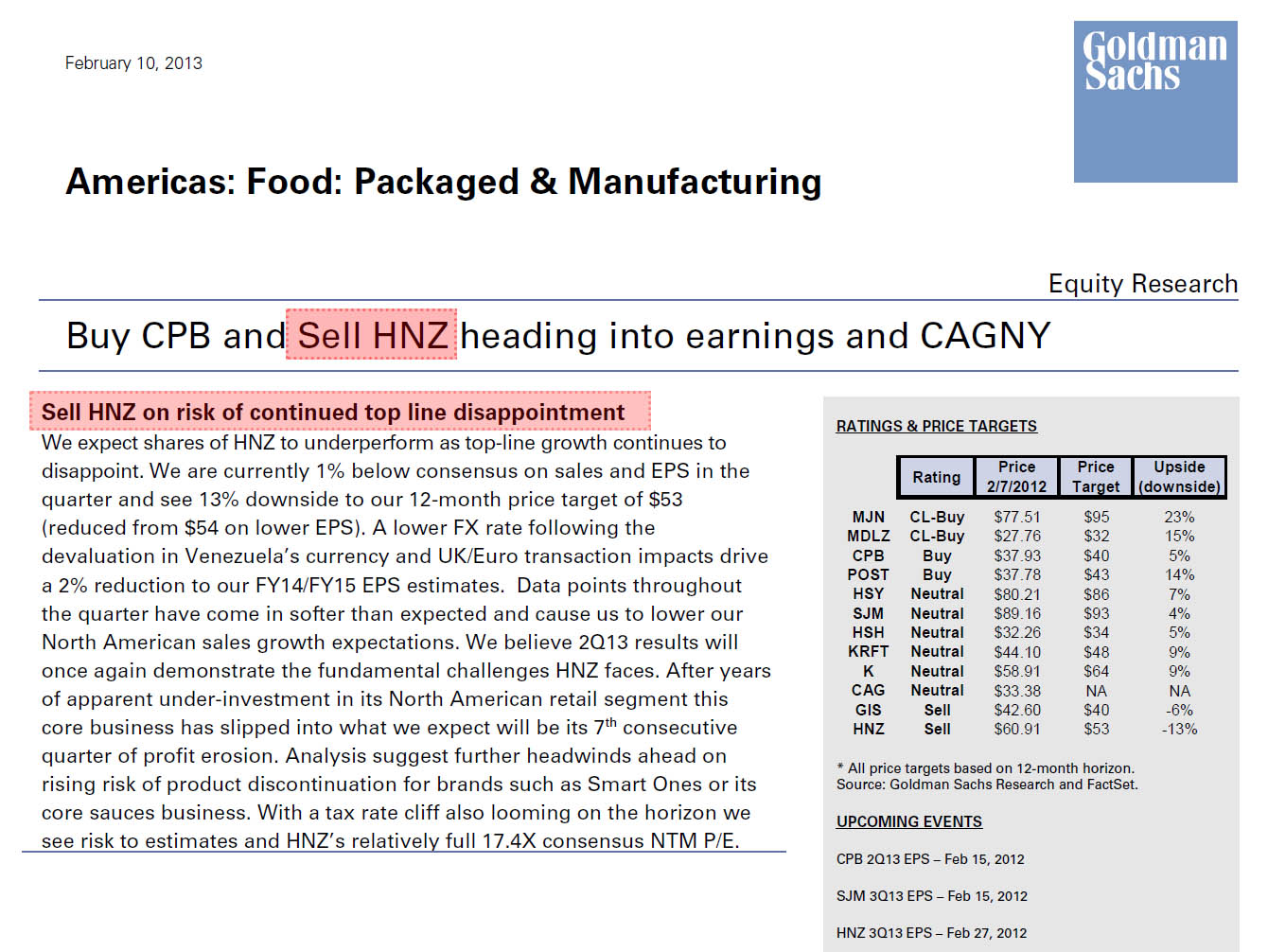

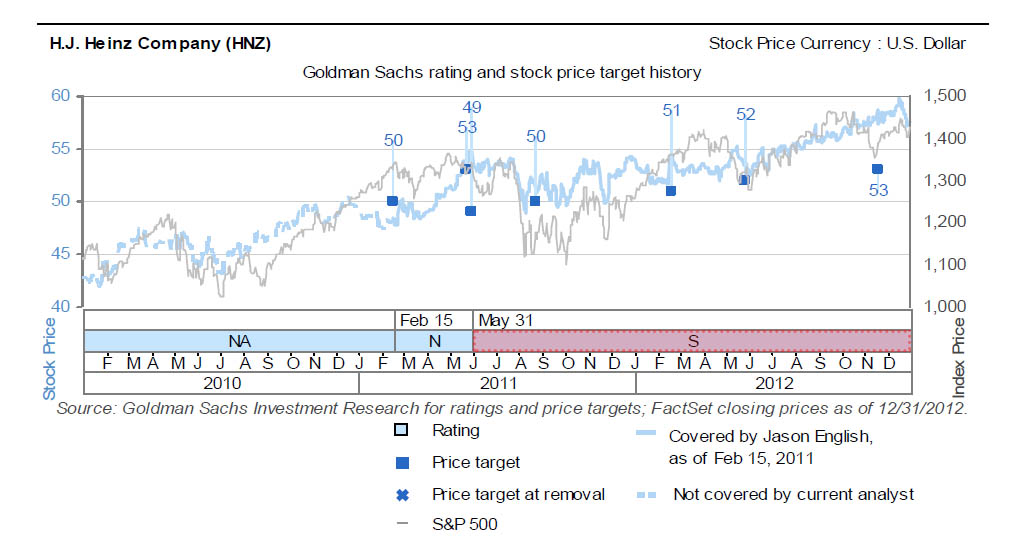

An investment bank having a Sell rating on a stock? Usually an unheard of thing: why alienate the management, why prevent future banking business – it’s not like banks are ethical creatures – and sure enough in this particular case, the bank in question had sell recos on just 14% of the stocks in its coverage universe. Which begs the question: what does a Sell rating really accomplish? Well, in this case, and in all such cases, it merely provides the firm’s prop, pardon flow, traders the opportunity to accumulate the shares its “clients” are advised by the same bank’s sellside group to Sell, preferably to the bank in question. Who are we talking about? Take a wild guess…

Bottom line: 20% gain for Goldman’s prop traders who bought all the HNZ stock they indirectly “advised” their client counterparts to sell to them.

Is it time to buy all other Goldman “Sells” on imminent Buffet takeovers?