– How The Fed’s Latest QE Is Just Another European Bailout (ZeroHedge, Feb 2, 2013):

Back in June 2011 Zero Hedge broke a very troubling story: virtually all the reserves that had been created as a result of the Fed’s QE2, some $600 billion (which two years ago seemed like a lot of money) which was supposed to force banks to create loans and stimulate the US (not European) economy, ended up becoming cash at what the Fed classifies as “foreign-related institutions in the US” (or “foreign banks” as used in this article) on its weekly update of commercial banks operating in the US, or said simply, European banks.

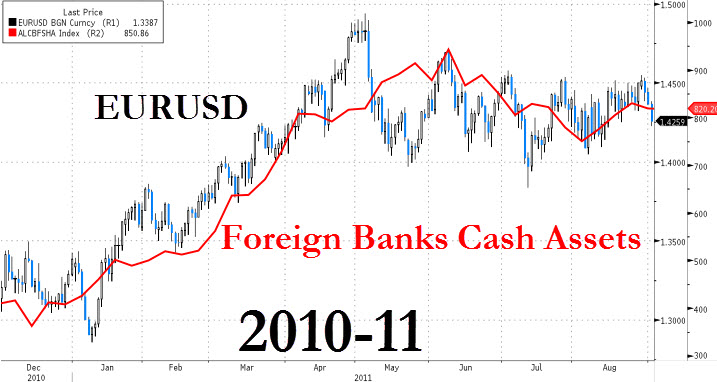

And while many, primarily the British press, demonstrated how simple it is to confuse cause and effect, and suggested, incorrectly, that the surge in cash was due to arbing the Fed’s IOER (it wasn’t, as otherwise all excess reserves would have migrated to European banks due to the open-ended arbitrage instead of merely tracking the ebb and flow of the Fed’s reserves), what we showed was that there a one to one correlation between the surge in foreign bank cash assets courtesy of the Fed, and the EURUSD exchange rate, a proxy for European stability, not to mention a key signal for virtually every ES correlation algo.

As the chart above shows, there was a clear and definite correlation, if not causation, between the $500 billion that the Fed added as cash to European foreign banks, and the nearly 2000 pip move in the EURUSD, at which point everyone was pronouncing the European crisis over. It also resulted in a wholesale surge in risk assets. Just like now (incidentally, a topic we covered last night).

So with the Fed’s open-ended QE in place for over 3 months now, or long enough for the nearly $200 billion in MBS already purchased to begin settling on Bernanke’s balance sheet, we decided to check if, just like during QE2, the Fed was merely funding European banks’ US-based subsidiaries with massive cash, which would then proceed to use said fungible cash to indicate an “all clear” courtesy of Bernanke’s easy money. Just like in 2011.

The answer, to our complete lack of surprise, is a resounding yes.

* * *

First, some basics.

While there is much theoretical confusion over what excess reserves are, which are merely the fungible cash-equivalent liabilities created on the Fed’s balance sheet whenever Ben Bernanke has to monetize the US deficit by purchasing Treasurys or MBS, and thus needs to create offsetting money-equivalent liabilities, especially by academics whose only job day and night is to debate endlessly just what constitutes “money” as their value added in any other field is negative, from a practical standpoint the answer is and has always been one and the same. Cash.

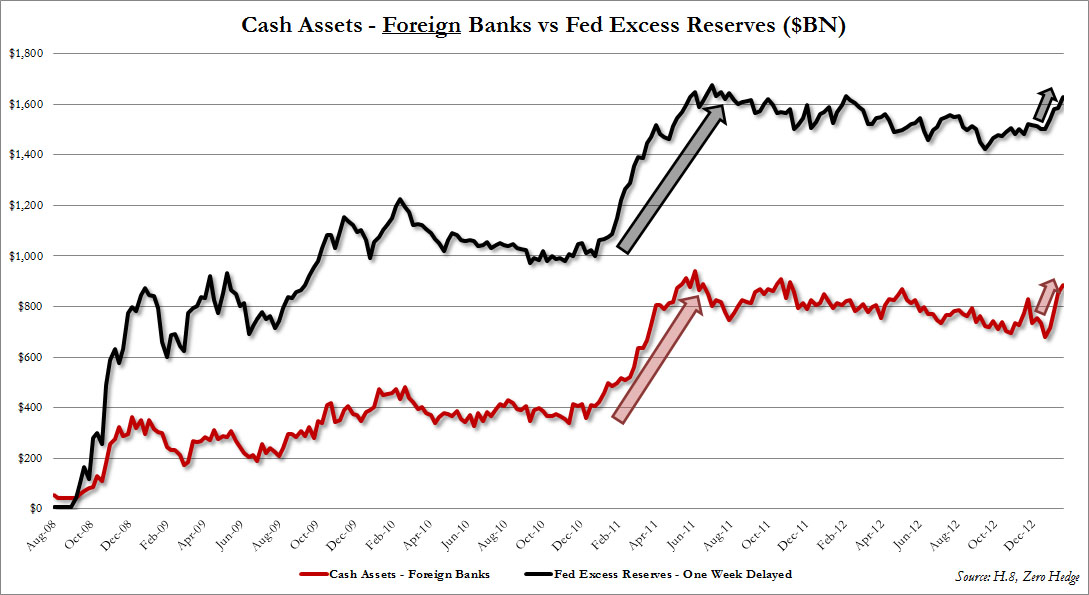

And because there is always confusion on this matter, especially by the monetary intelligentsia-cum-philosopshers club, here is the evidence. Excess reserves = bank cash. Bank cash = excess reserves.

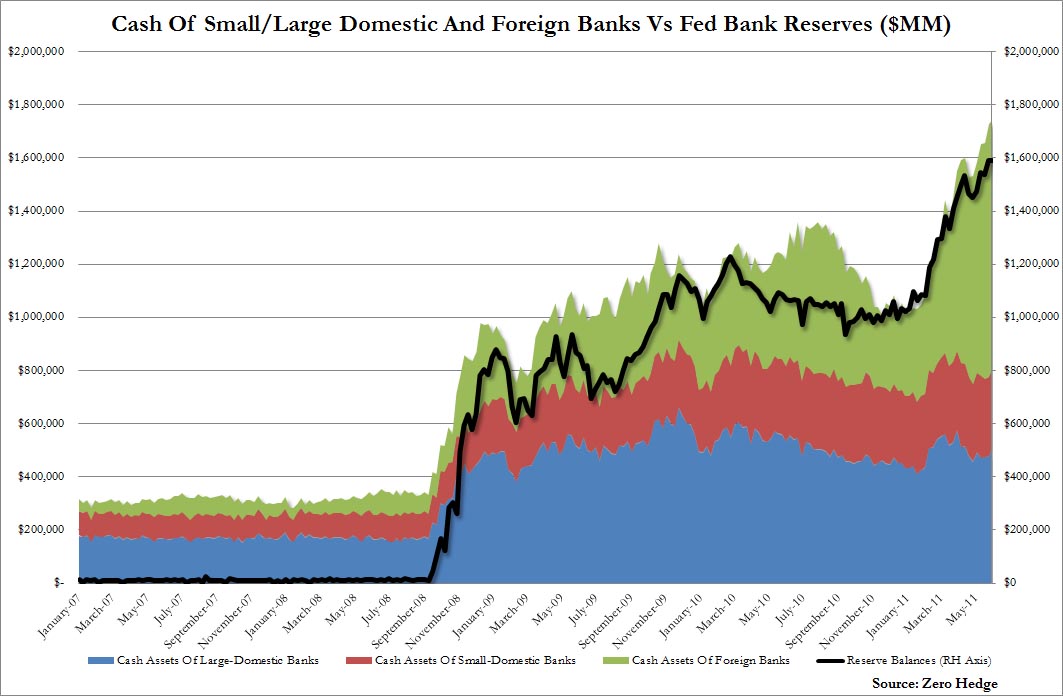

In the chart above, the black line is the surge in Fed excess reserves since September 2009 (source: St Louis Fed), while the shaded area chart shows the break down of bank cash between small domestic, large domestic commercial banks and foreign banks (source: H.8). The two are identical.

So that should remove any of the the confusion of where the the Fed’s main de novo created liability ends up as an asset on commercial banks operating in the US – both domestically-chartered and foreign ones.

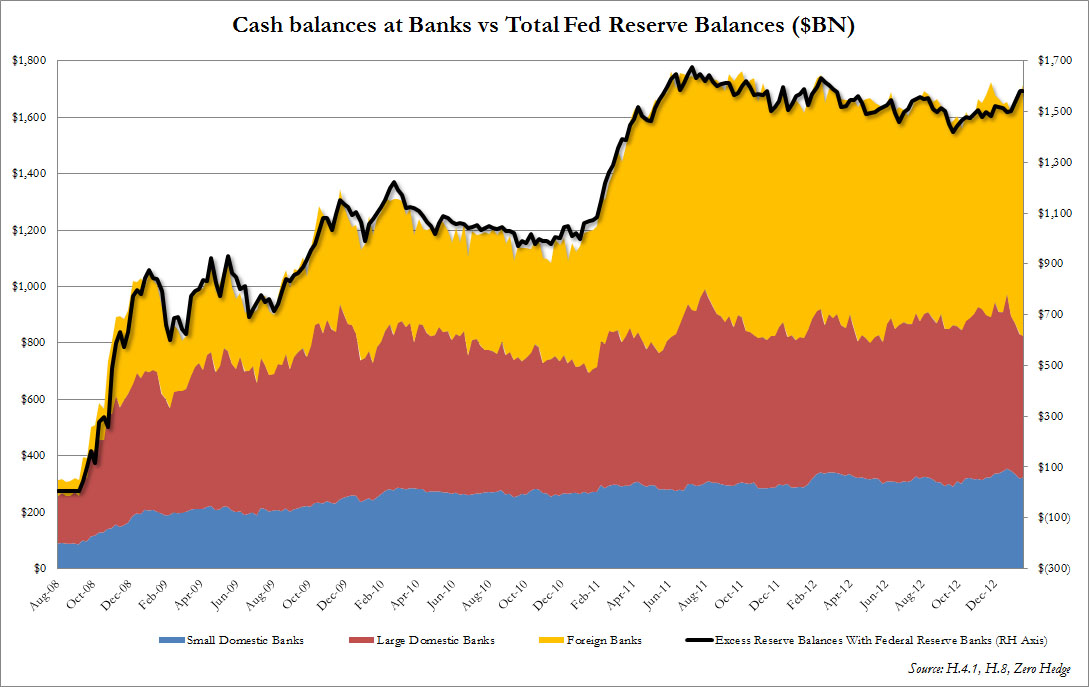

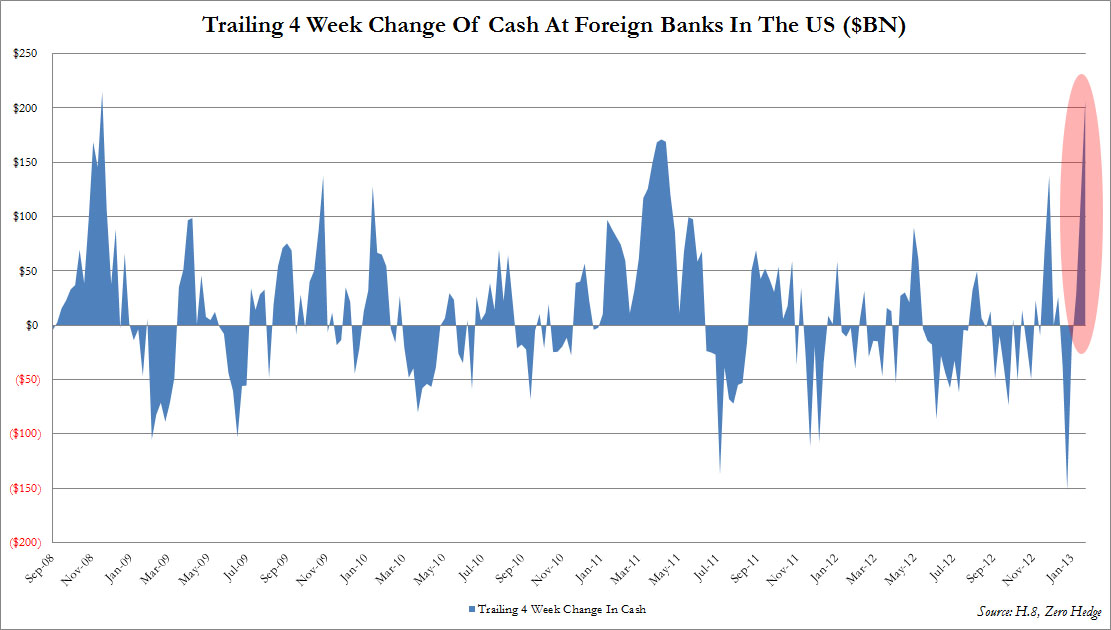

But the focus of this post is the foreign banks. And it is foreign banks that have seen their cash soar by some $207 billion in the past four weeks (and $216 billion using not seasonally adjusted numbers). This is the second highest monthly surge into “foreign-related” institutions since the bailout of AIG, and is even less on a running 4-week basis than the maximum $171 billion posted in the spring of 2011 when the Fed was injecting some $500 billion into foreign banks as well.

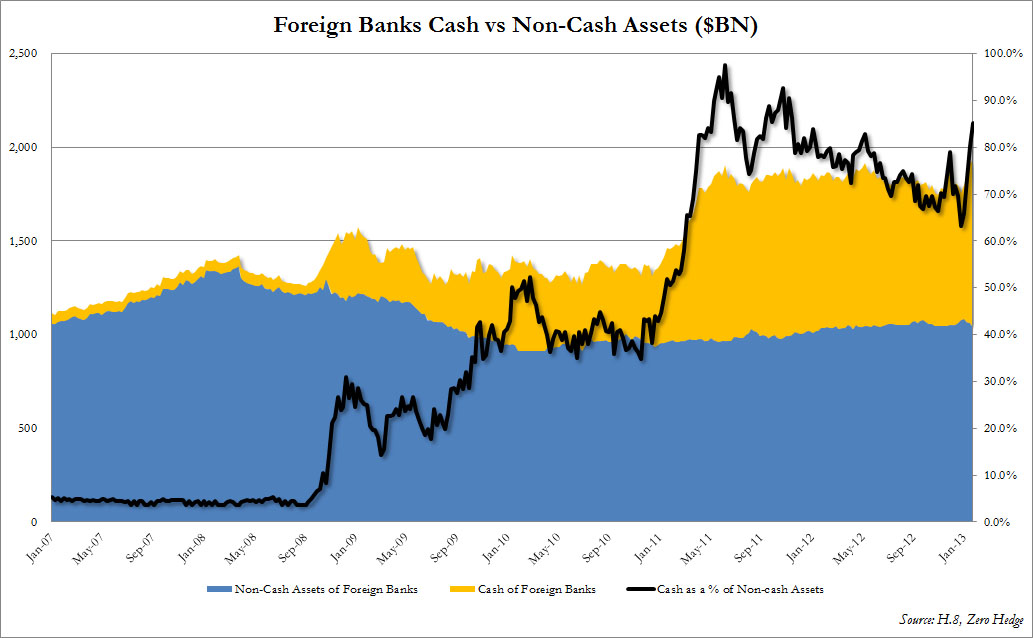

Another exhibit showing just how generous the Fed has been to foreign bank is a chart of cash compare to all non-cash assets. After nearly hitting 100% as a result of QE2, the ratio has once again soared from 60% to just over 80% in the span of four weeks, or since the settlement of MBS monetizations started hitting the Fed’s balance sheet.

Perhaps all of this soaring cash is merely the result of a massive inflow of deposits (a liability) into foreign banks without a matching increase in loans (the much discussed previously excess deposits over loans topic), which only leaves cash? The answer is no, as excess deposits over loans at foreign banks has kept flat over the past year, at between $200 and $300 billion.

And in case the big picture is still not obvious, here is the chart that ties it all together: a comparison of the spike in Fed excess reserves and the cash held by foreign banks. Thank you open-ended QE, and Fed Chairman, for injecting over $200 billion in US Dollars into foreign banks operating on US soil.

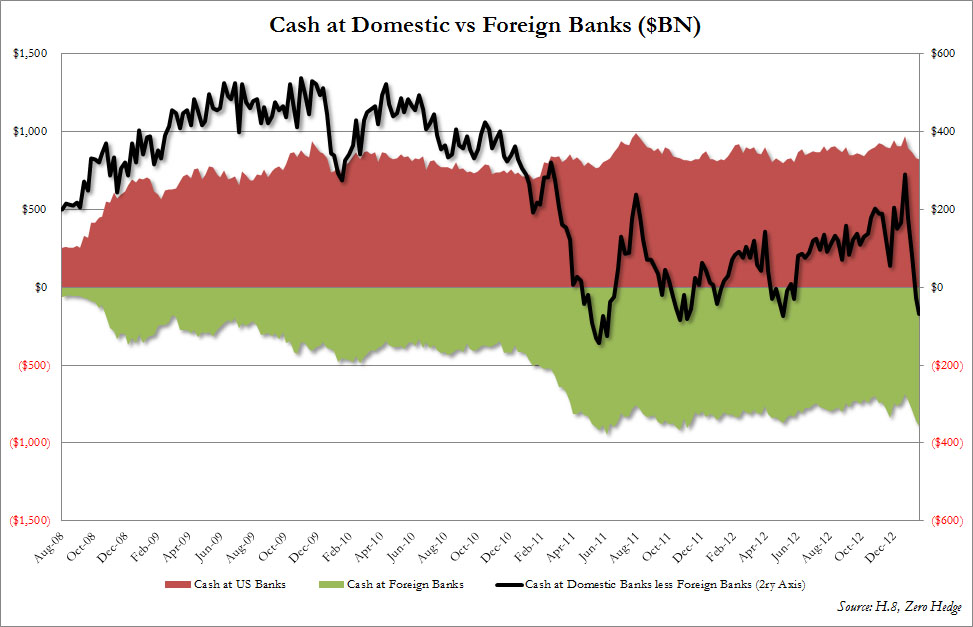

What is interesting about the chart above is that while cash and small domestic banks has barely budged since 2009 and has been flat at just over $200 billion, and that cash at Large US Domestic banks, or those that hold the bulk of US financial assets, has also been relatively flat in the $500-600 billion area, it is the foreign banks that any new incremental reserves created by the Fed always inevitably end up at ever since QE2.

As shown above, cash held by foreign-related branches operating in the US has surpassed that of domestic banks only for the fourth time in history, the first being the end of QE2 when Europe was again “fixed” (just before it broke), the second was just before the coordinated central bank bailout of Europe in November 2011, the third was May 2012 just before Spanish spreads soared to record highs, and now.

With all of the above, anyone who was wondering where all those hundreds of billions in Fed cash created out of thin air were going now knows the answer: straight into the coffers of mostly European banks operating in the US.

* * *

The only answer that is still missing is precisely what these foreign banks are using said cash for. Because remember that as JPM’s CIO showed, a bank can “indicate” it has cash on its books, when in reality it is using said fungible asset for anything: funding one’s prop operations, including selling IG9 CDS in a borderline illegal attempt to corner the entire corporate bond market. Or it can perhaps buy the USDJPY, in the process sending the Nikkei soaring and “indicating” that Abe’s reflation plan is working. Or it can simply buy the EURUSD as it did in the spring of 2011, crushing the USD and sending the S&P500 soaring, as can be seen on the chart below showing the correlation between the cash on foreign banks and the recent surge in EURUSD.

And while we are confident that the “British press”, which is now reliant on Wall Street banks to help it find the highest bidder to which it can sell itself, will promptly come up with contrarian theories all of which will be wrong as they were in 2011, the reality is simple, and can easily be tracked in real time.

We urge readers to check the weekly status of the H.8 when it comes out every Friday night, and specifically line item 25 on page 18, as we have a sinking feeling that as the Fed creates $85 billion in reserves every month to offset its other key task – the ongoing monetization of the US deficit, it will do just one thing: hand the cash right over straight to still hopelessly insolvent European banks to push the EURUSD higher, until, as in the summer of 2011 it goes far too high, crushes German, and any other net European exports, and precipitates yet another wholesale bailout of Europe by the global central bankers. Just as the Fed did in 2011.

Because remember: it is never different this time.