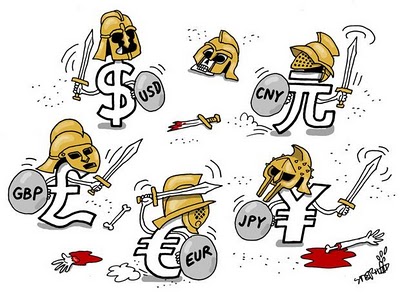

– World War Is Coming, Currency War That Is – Russia Warns (ZeroHedge, Jan 16, 2013):

It will not come as a surprise to anyone who has spent more than a few cursory minutes reading ZeroHedge over the past few years (back in 2009, then 2010, and most recently here, and here) but the rolling ‘beggar thy neighbor’ currency strategies of world central banks are gathering pace. To wit, Bloomberg reports that energy-bound Russia’s central bank chief appears to have broken ranks warning that “the world is on the brink of a fresh ‘currency war’.” With Japan openly (and actively) verbally intervening to depress the JPY and now Juncker’s “dangerously high” comments on the EUR yesterday, it appears 2013 will be the year when the G-20 finance ministers (who agreed to ‘refrain from competitive devaluation of currencies’ in 2009) tear up their promises and get active. Rhetoric is on the rise with the Bank of Korea threatening “an active response”, Russia now suggesting reciprocal devaluations will occur (and hurt the global economy) as RBA Governor noted that there is “a degree of disquiet in the global policy-making community.” Critically BoE Governor Mervyn King has suggested what only conspiracists have offered before: “we’ll see the growth of actively managed exchange rates,” and sure enough where FX rates go so stocks will nominally follow (see JPY vs TOPIX and CHF vs SMI recently).

Via Bloomberg:

The world is on the brink of a fresh “currency war,” Russia warned, as European policy makers joined Japan in bemoaning the economic cost of rising exchange rates.

“Japan is weakening the yen and other countries may follow,”

…

The push for weaker currencies is being driven by a need to find new sources of economic growth as monetary and fiscal policies run out of room. The risk is as each country tries to boost exports, it hurts the competitiveness of other economies and provokes retaliation.

Yesterday “will go down as the first day European policy makers fired a shot in the 2013 currency war,” said Chris Turner, head of foreign-exchange strategy at ING Groep NV in London.

…

The skirmish may lead to a clash of G-20 finance ministers and central banks when they meet next month in Moscow, three months after reiterating their 2009 pledge to “refrain from competitive devaluation of currencies.”

While emerging markets have repeatedly complained about strong currencies as a result of easy monetary policies in the west, the engagement of richer nations is adding a new dimension to what Brazilian Finance Minister Guido Mantega first dubbed a currency war in 2010.

…

…and as we warned over two years ago:

“We feel sad for the central banks, who apparently don’t realize that in this war of attrition there are no losers, and the final outcome is the end of Keynesianism. We hope someone promptly discovers the FX equivalent of the nuke, and a global exchange occurs, as we, for one, can’t wait for this most destructive experiment in economic fundamentalism to end already.”

The currency war was launched in June of 2010 by the South American Trade Alliance with their introduction of the first electronic currency, the Sucre. It was meant for member nations only. For the first time, member nations could trade with each other using their own currencies without conversion to the US dollar. The Sucre translated the value of each nation’s currency, making conversion to the World Standard obsolete. In November of that same year, China and Russia set up a similar trade agreement between each other, using their own currencies, leaving the US dollar out. Japan, India, Turkey, Brazil, and other nations have followed suit.

We have gone from involvement in 100% of world international trade down to 60% in the past 18 months. By this time next year, it will be worse.

I have been saying for some time this is the real World War, and we are losing.