– Don’t Show Bernanke This Chart Of Gold Loans In India (ZeroHedge, Jan 2, 2013):

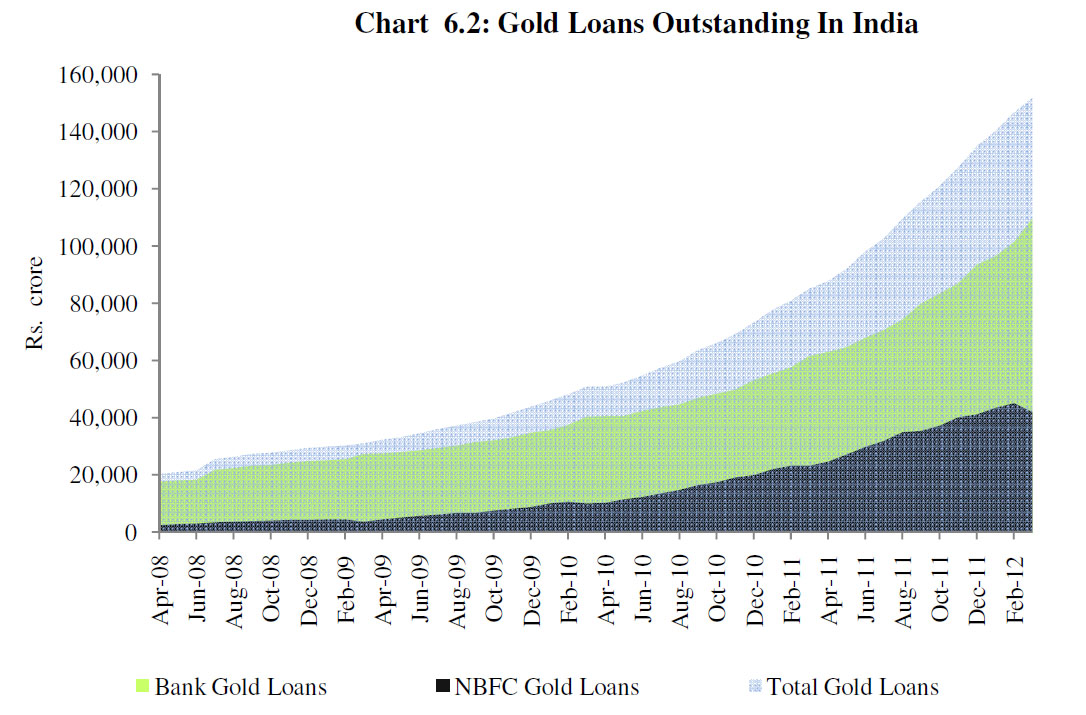

One of the Fed Chairman’s most memorable lines in recent history is that “gold is not money… it is tradition.” Perhaps he was merely listening to the Fed’s computers, Ferbus, Edo and Sigma, which we now know form the backbone of US central planning and whose DSGE model output is usually spot on until it happens to be catastrophically wrong, on the issue. Or perhaps that is merely what one is taught (and teaches) in the Princeton economics department. Whatever the reason for Bernanke’s belief, don’t show him this chart from a just released “Report of the Working Group to Study the Issues Related to Gold Imports and Gold Loans by NBFCs” in India, part of a coordinated campaign to minimize Indian gold demand and imports whose direct substitution to “(un)sound money” in the country is one of the reason being attributed for the nation’s high current account deficit (as reported earlier) and why the finance minister said “demand for gold must be moderated.” The chart shows the staggering eightfold increase in India’s gold loans “which monetize the idle gold in the country“, in just four short years. In short it proves that in India, gold is the only real money, and is the only fallback option in a country where inflation is still rampant, and where even simple peasants prefer to keep their wealth not in the local paper currency, which has been losing its value aggressively in recent years, but in the shiny metal. Must be “tradition.”

Here are some of the salient points from the report on the relentless surge of gold’s popularity in India where it is now effectively, a parallel currency, and is accepted as money good (and in many cases, better) collateral for those who need short-term liquidity and funding:

Possession of gold has been a symbol of prosperity in India and is considered a safest form of investment that provides hedge against inflation. Gold has always been a highly coveted product not only in the form of jewellery, gold bars or bullion, but also has the ready acceptability as collateral for the lenders because of its high liquidity character. According to an estimate of World Gold Council, about 10 per cent of world’s gold is in India’s possession. Accumulated Gold stock in India is around 18,000 to 19,000 tonnes as per independent estimates. During 2002-2012, annual gold demand has remained relatively stable at around between 700 to 900 tonnes despite the rise in prices from Rs. 13,333 to Rs. 86,958 per troy ounce (as on May 25, 2012). In India, the demand for gold has not been adversely impacted by rising prices.

Genesis of Gold Loan Market in India

In India, it is believed that most of the gold is held by people in rural areas and in many cases this is the only asset they have in their possession though in small quantity. All the while, rural Indians know that if his crop fails or his family is sick, he can raise cash in a moment from the goldsmith or may be pawnbrokers and moneylenders, because the rural India lags in availing banking facilities. Therefore, even the pattern of saving in India differs for various income groups. While richer sections diversify their portfolio according to risk-return equation, the poor rely more on commodities like gold as well as silver. The jewellery bought in times of prosperity has been pawned or sold for cash in periods of distress or need. Over the years, some portion of this is being used as collateral for borrowing in the informal market, though estimates is not available. It is a common practice in India that gold is pawned, bought back and re-pawned to manage day-to-day needs of the poor and middle class. The pledging of gold ornaments and other gold assets to local pawnbrokers and money lenders to avail loans has been prevalent in the Indian society over ages. Due to the increased holding of gold as an asset among large section of people as also the borrowing practices against gold in the informal sector have encouraged some loan companies to provide loans against the collateral of used gold jewelleries for years and over a period to emerge as ‘specialised gold loan companies’.

Some independent estimates indicate that rural India accounts for about 65 per cent of total gold stock in the country. At times of emergency, gold ensures a loan almost instantaneously for the poor and without any documentation process. Most of the loans are for meeting unforeseen contingencies and may be categorized as personal. Further, growth in middle income classes and increase in the earning capacity of women, a core customer group for gold is expected to further boost the demand of gold. The demand for gold has a regional bias with southern Indian states accounting for around 40 per cent of the annual demand, followed by the west (25 per cent), north (20-25 per cent) and east (10-15 per cent). Accordingly, even the gold loan market has also developed on the same lines where a large portion of market is concentrated in southern India. India continues to be one of the largest gold markets in the world. The attraction towards gold in India stems from varied historical and cultural factors and its perceived safety in times of economic stress.

Since 1990, with the repeal of Gold Control Act, Indians have been allowed to hold gold bars. In the year 1993, the provisions of Foreign Exchange Regulation Act (FERA) relating to gold were repealed and imports were allowed by NRIs and since 1997 gold imports were brought under Open General License. All these gave fillip for the development of not only the gold market but also the gold loans market. With a view to bring the gold holdings to the core financial market, several gold based financial products have been made available to retail consumers in the Indian market from time to time. Recently, Exchange Traded Gold Funds (ETF) has also been allowed in the Indian markets, which have received a positive response from investors.

Structure of the Players in Gold Loan Market

Borrowing against gold is one of the popular instruments based on physical pledge of gold and it has been working well with Indian rural household’s mindset, which typically views gold as an important saving instrument that is liquid and can be converted into cash instantly to meet any urgent needs. The market is very well established in the Southern states of India, which accounts for the highest accumulated gold stock. Further, traditionally gold holders in Southern India are more open to accept and exercise the option of pledging gold as compared to other regions in the country which are reluctant to pledge jewellery or ornaments for borrowing money.

All of the above is purely on the regulated side of things. It is in the gold “black market” in India where things get really exciting:

In addition to a growing organised gold loans market, there is a large long-operated, un-organised gold loans market which is believed to be several times the size of organised gold loans market. There are no official estimates available on the size of this market, which is marked with the presence of numerous pawnbrokers, moneylenders and land lords operating at a local level. These players are quite active in rural areas of India and provide loans against jewellery to families in need at interest rates in excess of 30 percent. These operators have a strong understanding of the local customer base and offer an advantage of immediate liquidity to customers in need, with extreme flexible hours of accessibility, without requirements of any elaborate formalities and documentation. However, these players are completely unregulated leaving the customers vulnerable to exploitation at the hands of these moneylenders and pawn-brokers.

So in other words, in India gold is the most fungible asset, and the most rapidly converted into other forms of liquidity, to the point where it is not only the currency but also the true store of value. Sure enough:

Gold as an asset is liquid and can be readily exchanged for cash even in the informal market. With the gold market getting more organized within a formal setup, in recent years there has been rapid growth in the gold loans market particularly in gold loans disbursed by Banks and NBFCs (Table 6.1). Both demand and supply side factors have played important roles in bringing about this growth. From the demand side, holders of gold were able to get cash in lieu of their gold in a formal setup and at higher loan to value ratios at relatively less rate of interest with better terms when compared with the informal segment. From the supply side, banks and NBFCs were able to disburse loans against collateral whose value was stable even in times of financial turmoil.

There’s more:

As gold loans are issued solely on the basis of gold jewellery as collateral, the high growth rates observed for gold loans in recent years could be reflecting the emergence of a liquidity motive apart from the conventional saving motive to acquire gold. The strengthening of liquidity motive over time could result in increased demand for gold loans. The rapid growth in gold loans in recent years indicates unleashing the latent demand for liquidity from significant proportion of the population who faced severe borrowing constraints in the past. This could also be viewed as an offshoot of the huge rise in gold price along with liberal loan to value ratios that existed till the recent past. The prospects of gold value appreciation together with easy and flexible availability of gold loans increase the demand for gold and thereby to gold imports.

It is known that the gold demand in India is influenced strongly by the feature of gold as an attractive investment option. The recent gold loan growth phase coincided with the rise in growth of imports of gold, which grew, despite the rise in gold prices. A quiet swing in savings from financial products to assets, showing propensity for further growth, is visible in the Indian economy. There were apprehensions that liberal loan to value ratio and consistent rise in gold prices could result in an incentive for individuals, to consider investment in gold jewellery as an arbitrage opportunity, by pledging the purchased jewellery and use the proceeds to buy gold jewellery to take advantage of future appreciation. Thus, gold loans and demand for gold (jewellery) can theoretically become mutually reinforcing in the long term.

But don’t worry, it is not money. It is only “tradition.”

Needless to say, the overarching theme of this report, whose purpose is to isolate the attractiveness of gold to the general population, and most importantly, prevent it, is that gold demand must be limited as the only control a collapsing central-bank based statist system has is in controlling “money” that is infinitely dilutable and can inflate away debt, not the type that actually has value, and that a central bank can’t create out of thin binary air. Hence the report’s conclusion:

Summing-up:

There is a need to moderate the demand for gold imports, as ensuring external sector’s stability is critical. But, it is necessary to recognise that demand for gold is not strictly amenable to policy changes and also is price inelastic due to varied reasons. What is critical is to ensure provision of real returns to investors through various financial savings products. What is also relevant is the need for banks to introduce new gold-backed financial products that may reduce or postpone the demand for gold imports. The Working Group believes that providing real rate of return to investors through alternative instruments holds the key to reducing the excessive demand for gold. Meanwhile, there is also a need to increase monetisation of idle gold stocks in the economy for productive purposes. As of now, there appears to be no close substitute to wean away investors’ attention from gold. Investors’ awareness and education is important, in this context, to channel the investment to gold-backed financial products. Banks and NBFCs may continue to deliver gold jewellery loans, which monetises the idle gold in the country. The gold loan market has grown well in recent years. It is time for consolidation of the operations of the gold loan NBFCs. The gold loans NBFCs need to transform themselves into institutions free of complaints, have proper documentation and auction procedures, with rationalised interest rate structure and have a branch network that is fully safe and secure. Gold loans NBFCs’ linkage with formal financial institutions may be reduced gradually. Such transformation ensures the gold loans NBFCs’ future growth more robust, besides making them a contributing segment to the financial inclusion process.

One can almost feel the panic.

And yet the real message here is between the lines: just like the US government’s veiled threat to curb gun sales, and/or to adjust the second amendment altogether resulted in precisely the opposite reaction to that intended, i.e., a record surge in purchases of all gun related products, so India’s ever more aggressive attempts to curb gold as a monetary equivalent will simply force the population to hoard ever more gold, result in even greater gold imports, both using legal and less than legal means, but most importantly, lead to a surge in the gold black market as the government’s more explicit intervention in the definition of what is and isn’t money forces more and more Indians to seek the safety of the yellow metal in ever greater numbers.

What this means for the supply and demand dynamics of not paper, but real physical gold, we leave to our readers to decipher. Failing that, they can always just sunmit an inquiry into the Princeton economics department.