– Bundesbank’s Weidmann Warns: Debt Monetization Is An Addictive Drug (ZeroHedge Aug 25, 2012):

It is one thing for various anti-Central Planning (and thus central bank) outlets to warn, over 3 years ago, that easy monetary policy is merely an enabling substance, and is addictive as any drug to a dysfunctional political establishment which is more than happy to avoid fiscal prudence if monetary policy is readily available to delay the inevitable day of reckoning when monetizing the debt will no longer work. It is a different matter entirely when the head of the world’s only solvent central bank – the German Bundesbank, which happens to be the biggest guarantor of that other mega hedge funds the ECB, and which of all developed economies also happens to have had the closest recent encounter with hyperinflation (unlike all the “other” theoretical experts who enjoy talking extensively about matters they have zero experience with). In an interview with German Spiegel magazine, Buba head Jens Weidmann, once again has loudly warned what as recently as 2009 very few dared to even think: namely that rampant and gratuitous deficit plugging using central bank debt issuance, and thus explicitly monetizing the debt, “can be addictive as a drug.” Obviously, like any drug overdose, the aftereffects are always fatal.

Bundesbank President Jens Weidmann has strongly criticized of the plans of the European Central Bank to launch a new program to purchase government bonds. “Such a policy is for me too reminiscent of public funding via printing,” Weidmann warns in an interview with SPIEGEL. “In democracies it is parliaments that should decide on such an extensive pooling of risks, and not central banks.”

If you buy the Euro-banks government bonds of individual countries, “the papers end up in the balance sheet of the Eurosystem,” Weidmann warns: “Ultimately, the taxpayers of all other countries pay.” The basic problems are not solved in this way, the Bundesbank president – on the contrary: “The blessing of the central banks would raise persistent monetization demands,” said Weidmann in SPIEGEL. “We should not underestimate the risk that central bank financing can be addictive like a drug.”

Is Weidmann insane? After all, central banks are known to always end their futile unconventional and massive monetization programs on cue and when promised, because they are always so well attuned to the threat of runaway inflation when the assets of global cental banks account for 30% of global GDP. Naturally, this explains why after two failed Quantitative Easing episodes, and two additional Curve shaping, flow-facilitating exercises by the Fed, there is not even a peep of more NEW QE on the horizon – after all Ben has certainly learned his lesson that the Fed is powerless to do anything when the political authorities are bickering and will do nothing to reach a consensus until the market is in free fall mode, as it was in August 2011 when the only catalyst that led to a debt ceiling hike was a market plunge.

Oh wait…

Spigel continues.

Weidmann also provides for the independence of the ECB at risk. At second glance, to trap it in the plans “amounts to concerted actions of government bailouts and the Federal Reserve. This creates a link between fiscal and monetary policy.” He wanted to “avoid, that monetary policy is under the dominance of fiscal policy.”

Does the BUBA head see an imminent inflationary threat? No, and thank god. Because if the time comes that real inflation does finally arrive (as opposed to soaring prices only in things that “nobody” needs like food and energy) and the major central banks have to some how offload about $20 trillion in asset between them, then say goodbye to the status quo…. and any fiat reserve status.

Weidmann does not see an immediate threat of inflation. “But if the monetary policy can be pegged as comprehensive political problem solvers, the central banks’ real goal is threatening to drift more and more into the background.” Weidmann warns therefore against commitments of the ECB to “guarantee the whereabouts of member countries in the euro zone at any price”. When deciding on a possible exit of Greece “must surely play a role that no further damage is done to the trust framework of monetary union and keep the economic conditions of the assistance programs credibility.”

All of the above, and the fact that German now singlehandedly calls all the shots in Europe, also explains why the ECB’s latest rumored actions have slipped into the twilight zone: bond yield thresholds, though not just any bond yield thresholds, but of dodecatuple “secret” type which are completely not public (and thus do not hinder reelection chances): in other words, Schrodinger monetary policy, where CBs get the effect of the policies they (but not Germany) would like to enact, but are terrified to launch the cause.

According to recent SPIEGEL information, European central bankers would establish interest rate thresholds above which the ECB would intervene with bond purchases. This would ensure that interest rates on government bonds issued by countries such as Spain and Italy do not rise above a certain level. This proposal was, however, missing some central bankers’ and the federal government’s approval. A spokesman for Finance Minister Wolfgang Schaeuble called the discussed variant as “burdened with problems.” Therefore, some central bankers argue now apparently for the caps to be set internally, and remain unpublished. Some central bankers would prefer this approach to a recently discussed official ceiling, the newspaper reported.

The Governing Council will decide at its 6 September meeting what the promised bond purchases could look like.

Spoiler alert: they will look like nothing, because the ECB will not go ahead and enact any bond caps, secret or otherwise. Unless they want to conduct monetary policy in the absence of Germany, who have about had it with the Goldman alumnus’ attempt to make European monetary policy merely an add on to Goldman year end bonus policy.

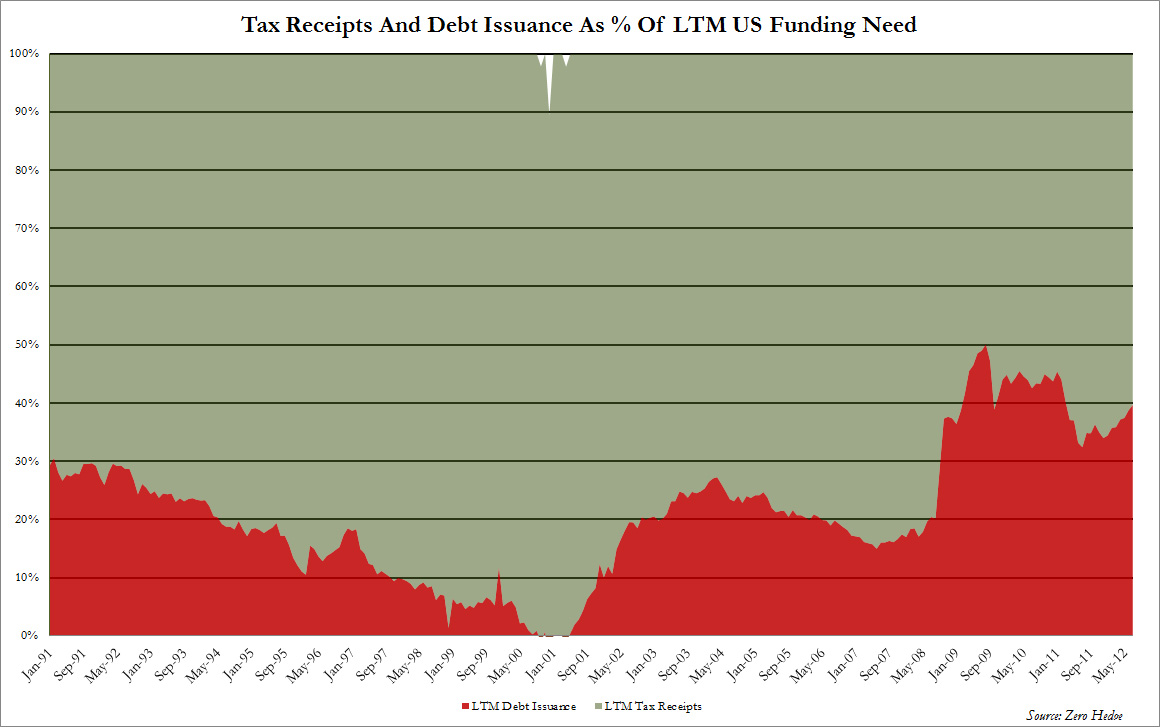

Finally, for those who think the US is immune from any of this, look at the chart below. It shows that most recently, a whopping 40% of US funding needs were “met” through debt issuance.