– Moody’s Downgrades 16 Spanish Banks, As Expected (ZeroHedge, May 16, 2012):

As was leaked earlier today, so it would be:

- MOODY’S CUTS 16 SPANISH BANKS AND SANTANDER UK PLC

- MOODY’S CUTS 1 TO 3 LEVELS L-T RATINGS OF 16 SPANISH BANKS

- MOODY’S DOWNGRADES SPANISH BANKS; RATINGS CARRY NEGATIVE

In summary, the highest Moodys rating for any Spanish bank as of this point is A3. But luckily the other “rumor” of a bank run at Bankia was completely untrue, at least according to Spanish economic ministry officials, so there is no need to worry: it is all under control. The Banko de Espana said so.

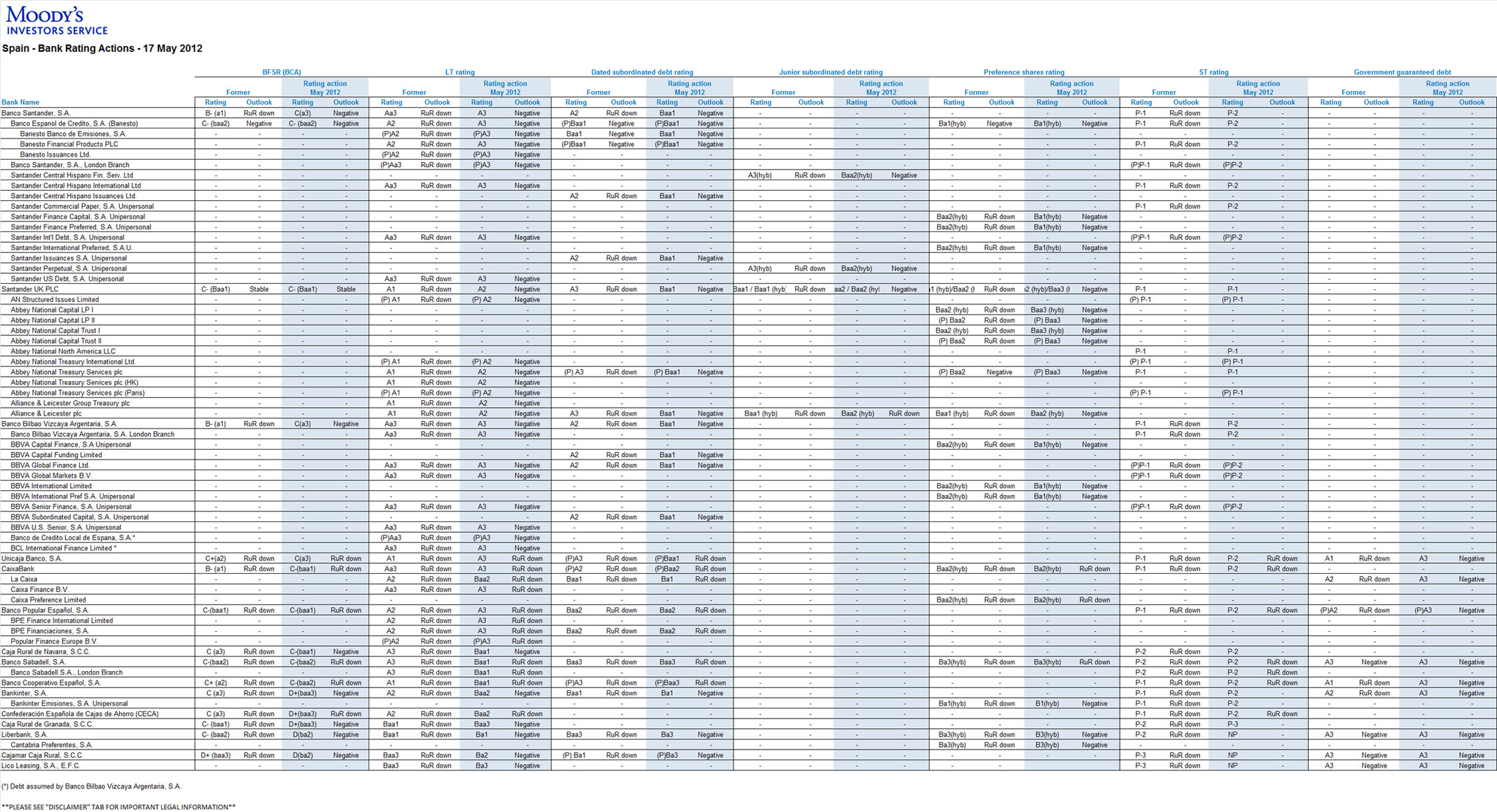

Complete summary downgrade grid:

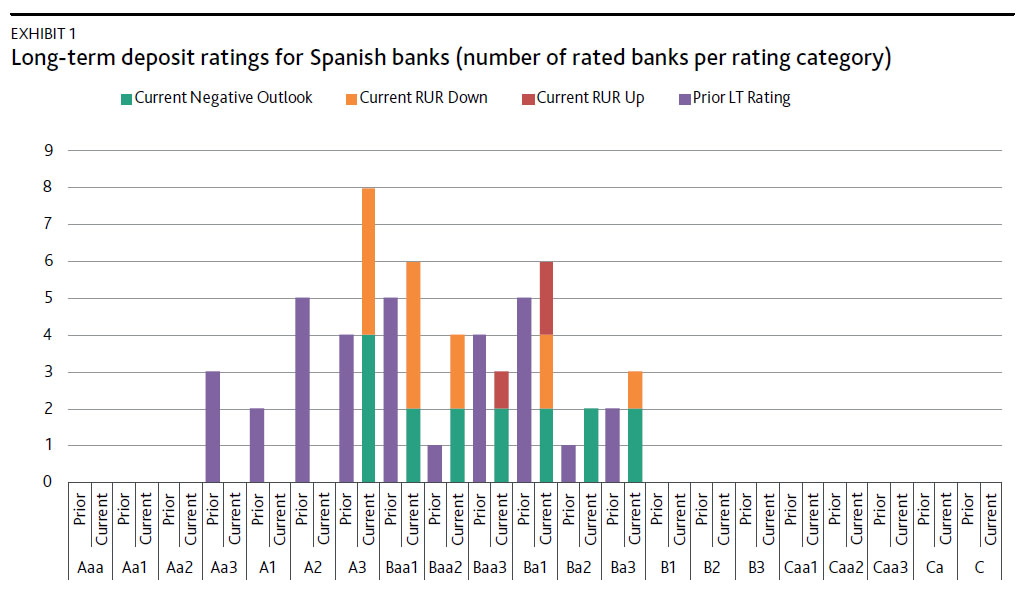

Another way to visualize the bloodbath as Spain no longer has any bank rated A2 or higher:

Full report below:

Actions follow rating reviews announced on 15 February 2012 and other dates

Madrid, May 17, 2012 — Moody’s Investors Service has today downgraded by one to three notches the long-term debt and deposit ratings for 16 Spanish banks and Santander UK PLC, a UK-domiciled subsidiary of Banco Santander (Spain) SA. The rating downgrades primarily reflect the concurrent downgrades of most of these banks’ standalone credit assessments, and in five cases also Moody’s assessment that the Spanish government’s ability to provide support to the banks has reduced.

Moody’s Investors Service has today downgraded by one to three notches the long-term debt and deposit ratings for 16 Spanish banks and Santander UK PLC, a UK-domiciled subsidiary of Banco Santander (Spain) SA. The rating downgrades primarily reflect the concurrent downgrades of most of these banks’ standalone credit assessments, and in five cases also Moody’s assessment that the Spanish government’s ability to provide support to the banks has reduced.

The debt and deposit ratings declined by one notch for five banks, by two notches for three banks and by three notches for nine banks. The short-term ratings for 13 banks have also been downgraded between one and two notches, triggered by the long-term ratings changes.

The outlooks on the debt and deposit ratings for ten of the 17 banks downgraded today are now negative. For the remaining seven banks affected by today’s actions, their ratings remain on review for further downgrade, for reasons specific to each bank (as discussed separately below).

Today’s actions reflect, to various extents across banks, four main drivers:

1.) Adverse operating conditions, characterised by the renewed recession, the ongoing real-estate crisis and persistent high levels of unemployment.

2.) Reduced creditworthiness of the Spanish sovereign, which weighs on banks’ standalone profiles and affects the ability of the government to support banks.

3.) Rapid asset-quality deterioration, with non-performing loans to real-estate companies rising rapidly, and Moody’s expecting other loan categories to deteriorate.

4.) Restricted market funding access, with the ongoing euro area debt crisis contributing to persistent investor concerns about Spanish banks and the sovereign.

Moody’s recognises several positive trends that have limited the extent and scope of today’s rating actions. These mitigants include (i) the strengthening risk-absorption capacity of banks, underpinned by stricter capital and provisioning requirements; (ii) liquidity support from the European Central Bank (ECB) and (iii) actual and prospective support from the Spanish government, within the constraints of the sovereign’s own reduced creditworthiness. However, Moody’s believes these positive factors are overwhelmed by mounting asset-quality challenges that weaken the earnings and threaten to erode the capital positions of many banks.

Moody’s debt and deposit ratings for publicly-rated Spanish banks now range between A3 and Ba3, with an (unweighted) average between Baa2 and Baa3. This average is below most Western European banking systems, reflecting the severe impact of both the difficult domestic environment and the ongoing euro area debt crisis on Spanish banks.

Please click on this link http://www.moodys.com/viewresearchdoc.aspx?docid=PBC_142024 for the list of Affected Credit Ratings. This list is an integral part of this press release and identifies each affected issuer. For additional information on bank ratings, please refer to the webpage containing Moody’s related announcements: http://www.moodys.com/bankratings2012.

Moody’s has also published today a special comment titled “Key Drivers of Spanish Bank Rating Actions” (http://www.moodys.com/viewresearchdoc.aspx?docid=PBC_141658) with more detail on the rationale for today’s actions.

AFFECTED BANK RATINGS CARRY NEGATIVE OUTLOOKS OR REMAIN ON REVIEW

The negative rating outlooks for nine Spanish banks affected by today’s actions reflect Moody’s expectation that banks will continue to face highly adverse operating and market funding conditions that pose a threat to their creditworthiness. In some cases, the outlooks additionally reflect the negative outlook on Spain’s A3 government bond rating, which incorporates downside risks to the government’s creditworthiness and therefore, to its ability to extend support to banks. The placement on review for further downgrade of the ratings for seven banks affected by today’s actions reflects drivers specific to each bank, including in some cases ongoing mergers

RATINGS RATIONALE — STANDALONE CREDIT STRENGTH

Following today’s actions, publicly-rated Spanish banks fall into four broad groups, based on their standalone creditworthiness:

– The first group consists of the two largest banks, Banco Santander (Spain) SA (deposits A3, BFSR C / BCA a3) and Banco Bilbao Vizcaya Argentaria SA (deposits A3, BFSR C / BCA a3). They retain the highest standalone credit assessments among Spanish banks, mainly because of the relatively stable earnings generated by their strong, geographically diversified franchises.

– The second group includes institutions with baa standalone credit assessments. The banks within this group have generally solid underlying earnings and franchises relative to Spanish peers, but are more exposed to the domestic economy and less resilient than the two largest banks.

– The third group comprises institutions with standalone credit assessments of ba1 and lower, reflecting elevated vulnerability to the current challenging conditions.

– The fourth group is made up of those banks whose ratings remain on review and can therefore not be allocated to the above groups. In addition to the seven banks downgraded today whose ratings remain on review, the ratings for nine other banks also remain on review.

FIRST DRIVER — ADVERSE OPERATING CONDITIONS

The Spanish economy has fallen back into recession in first-quarter 2012, and Moody’s does not expect conditions to improve during 2012. Moreover, the real-estate crisis that began in 2008 is ongoing, and unemployment has risen to very high levels, with rising risks to white-collar employment (in addition to extremely-high youth unemployment) affecting the outlook for banks’ household lending. As a result, Moody’s expects bank asset quality to deteriorate further in coming quarters, causing persistently high loan-loss provisioning expenses that erode bank earnings and, in some cases, might erode capital levels.

SECOND DRIVER — REDUCED CREDITWORTHINESS OF THE SPANISH SOVEREIGN

Amidst the ongoing euro area debt crisis, the Spanish government’s rising budget deficit and the renewed recession, sovereign creditworthiness has declined. This decline is a driver of today’s bank rating actions, and it is reflected in the recent two-notch downgrade of the government bond rating to A3, with a negative outlook (see 13 February 2012 press release “Moody’s adjusts ratings of 9 European sovereigns to capture downside risks”: http://www.moodys.com/research/Moodys-adjusts-ratings-of-9-European-sove…). Moody’s says that the standalone credit strength of many Spanish banks has weakened, as they are linked in multiple ways to the sovereign. These linkages include (i) the impact of the government’s financial position on the domestic economy; and (ii) the large exposures of most banks to their domestic government and to other counterparties who depend on the government.

Reduced government creditworthiness also affects the ability of the government to support banks, as discussed under “Ratings Rationale — Senior Debt and Deposit Ratings” below.

THIRD DRIVER — RAPID ASSET-QUALITY DETERIORATION

Another factor underpinning today’s rating actions is the sharp increase of problem loans already observed and Moody’s view that loan delinquencies will continue to rise in coming quarters. The rating agency bases this view partly on the very weak performance of loans to companies in the real-estate and construction sectors, which accounted for 23% of Spanish banks’ lending to the private sector at year-end 2011. Moreover, Moody’s expects the recession and very high unemployment to cause asset-quality deterioration also for loans to households and non-real-estate-related businesses. These loan categories have shown only moderate weakening to date.

Accelerating problem loans in the real-estate sector have already driven total domestic non-performing loans of the Spanish banking system to 8.2% of total loans at the end of February 2012, up from less than 1% at year-end 2007 (source: Bank of Spain). Moody’s notes that the amount of non-paying assets is even higher, if real estate acquired as payment-in-kind from troubled borrowers is included.

FOURTH DRIVER — RESTRICTED MARKET FUNDING ACCESS

Contributing to today’s rating actions, Spanish banks are facing less cost-effective, volatile and at times restricted access to wholesale funding markets. Moody’s recognises that Spanish banks on average funded 46% of total assets with deposits at year-end 2011 (source: ECB), a high level compared with other Western European banking systems. Nonetheless, banks rely to varying degrees on market funds, leaving most susceptible to the persistent market tensions.

Partly due to market tensions, Spanish banks have increased their ECB borrowings by more than six times since June 2011, to the highest level in absolute terms among euro area banking systems as of April 2012. The availability of three-year funds from the ECB has mitigated near-term funding stress. However, significant central bank reliance raises the issue of how Spanish banks will be able to reduce their ECB funding reliance over time. Whilst Spanish banks have deleveraged in 2011 by not fully renewing maturing loans, the scope for further deleveraging is unclear.

RATINGS RATIONALE — SENIOR DEBT AND DEPOSIT RATINGS

For five banks, today’s downgrades of their debt and deposit ratings reflect not only reduced standalone credit profiles, but also Moody’s assessment that the ability of the Spanish government to provide future support to Spanish banks has declined. Moody’s recognises the Spanish government’s supportive actions to address banking sector challenges, most recently through stricter provisioning requirements and a plan for banks to transfer real-estate assets acquired from troubled borrowers to special-purpose vehicles.

However, Moody’s believes the Spanish government’s ability to support its bank’s debt and deposit ratings is consistent with the level implied by the sovereign’s debt rating, currently A3. That is, the Spanish government is unlikely to choose to prioritize its available funds to provide capital for banks over paying its own sovereign debt investors. Moody’s had previously assumed that the government’s willingness and capacity to support banks in a crisis could exceed its capacity to service its own debt and thus lift a bank’s ratings up to one notch above the sovereign.

The downgrades of 13 banks’ short-term ratings followed the downgrades of their long-term ratings, consistent with Moody’s standard mapping of short-term to long-term ratings.

RATIONALE FOR DOWNGRADE OF GOVERNMENT-GUARANTEED DEBT

Following the two-notch downgrade on 13 February of the Spanish government’s bond rating to A3, Moody’s has today downgraded to A3 the government-guaranteed senior debt of five Spanish banks whose (unguaranteed) senior debt ratings were previously higher than the government rating. The A3 ratings assigned are based on the unconditional government guarantee, which directly links them to the ratings of the Spanish government.

RATINGS RATIONALE — SUBORDINATED DEBT AND HYBRID RATINGS

Moody’s has today downgraded the subordinated debt and hybrid ratings of nine Spanish banks in line with the downgrades of their standalone credit assessments. Moody’s had previously removed government support assumptions from its ratings of subordinated debt and hybrid instruments of Spanish banks on 12 December 2011, see “Rating Action: Moody’s reviews Spanish banks’ ratings for downgrade; removes systemic support for subordinated debt” (http://www.moodys.com/research/Moodys-reviews-Spanish-banks-ratings-for-…).

ACTIONS FOLLOW REVIEW ANNOUNCEMENTS ON 15 FEBRUARY 2012 AND OTHER DATES

Today’s rating actions follow Moody’s decision to review for downgrade the ratings for many European financial institutions, including Spanish banks, see “Moody’s reviews ratings for European Banks”, 15 February 2012 (http://www.moodys.com/research/Moodys-Reviews-Ratings-for-European-Banks…). On 7 May 2012, Moody’s extended the review for Santander to its short-term ratings (see “Announcement: Moody’s extends Santander’s current ratings review to include its short-term ratings” (http://www.moodys.com/research/Moodys-extends-Santanders-current-ratings…). Moody’s previously placed several Spanish bank ratings on review on 12 December 2011, see “Rating Action: Moody’s reviews Spanish banks’ ratings for downgrade; removes systemic support for subordinated debt” (http://www.moodys.com/research/Moodys-reviews-Spanish-banks-ratings-for-…); “Announcement: Moody’s reviews Banco Popular’s ratings for downgrade and ratings of Banco Pastor for upgrade (Spain)”, 10 October 2011 (http://www.moodys.com/research/Moodys-reviews-Banco-Populars-ratings-for…); “Announcement: Moody’s reviews Unicaja’s ratings for downgrade and Caja España’s ratings for upgrade following merger agreement”, 27 September 2011 (http://www.moodys.com/research/Moodys-reviews-Unicajas-ratings-for-downg…ñas-ratings–PR_226509).

WHAT COULD MOVE THE RATINGS UP/DOWN

Moody’s believes that rating upgrades are unlikely in the near future for banks affected by today’s actions, for the reasons given above. Whilst the current rating levels and outlooks incorporate a degree of expected further deterioration, the rating agency is of the opinion that the banks’ ratings may decline further if (i) operating conditions worsen beyond Moody’s current expectations; (ii) the Spanish sovereign’s creditworthiness declines further; (iii) asset-quality deterioration exceeds Moody’s current expectations; and (iv) pressures from market-funding restrictions intensify.

However, Moody’s believes that a limited amount of upward rating momentum could develop if the banks substantially improve their credit profiles and resilience to the prevailing conditions. This may occur through increased standalone strength, for example as a result of bolstered capital and liquidity buffers, work-out of asset-quality challenges, improved earnings or improved funding conditions. Ratings could also benefit from increased external support.

RESEARCH REFERENCES

For further information refer to:

– List of Affected Issuers http://www.moodys.com/viewresearchdoc.aspx?docid=PBC_142024, 17 May 2012

– Special Comment: Key Drivers of Spanish Bank Rating Actions, 17 May 2012 (http://www.moodys.com/viewresearchdoc.aspx?docid=PBC_141658)

– Press Release: Moody’s Reviews Ratings for European Banks, 15 Feb 2012 (http://www.moodys.com/research/Moodys-Reviews-Ratings-for-European-Banks…)

– Special Comment “How Sovereign Credit Quality May Affect Other Ratings”, 13 Feb 2012 (http://www.moodys.com/viewresearchdoc.aspx?docid=PBC_139495)

– Special Comment: Euro Area Debt Crisis Weakens Bank Credit Profiles, 19 Jan 2012 (http://www.moodys.com/research/Euro-Area-Debt-Crisis-Weakens-Bank-Credit…)

– Special Comment: European Banks: How Moody’s Analytic Approach Reflects Evolving Challenges, 19 Jan 2012 (http://www.moodys.com/research/European-Banks-How-Moodys-Analytic-Approa…)

Moody’s webpages with additional information:

– http://www.moodys.com/bankratings2012

– http://www.moodys.com/eusovereign

METHODOLOGIES USED

The methodologies used in these ratings were Bank Financial Strength Ratings: Global Methodology, published in February 2007, and Incorporation of Joint-Default Analysis into Moody’s Bank Ratings: Global Methodology, published in March 2012. Please see the Credit Policy page on www.moodys.com for a copy of these methodologies.

BANK-SPECIFIC RATING CONSIDERATIONS

BANCO SANTANDER S.A. (A3/C/a3, negative outlook)

The two-notch downgrade of Santander´s BFSR and standalone credit assessment to C/a3 from B-/a1 is driven primarily by the expected negative impact on earnings and asset-quality indicators stemming from the bleak economic prospects in many of Santander’s core markets, namely Spain and Portugal (and, to a lesser extent, the UK) that together account for 67% of the group’s loan book. The downgrade is also driven by Santander’s reliance on market funding which, albeit partly mitigated by manageable debt maturities, exposes the bank to changes in market sentiment.

Moody’s believes that these credit-negative factors outweigh the group’s significant geographical diversification that makes Santander the Spanish bank that is least exposed to the challenging domestic operating environment as well as its proven capacity to strengthen its risk absorption capacity during the current crisis. Moody’s expectation that these rating drivers may persist for some time — and possibly intensify — underpins the negative outlook on the bank’s standalone BFSR.

Regarding the potential support that Santander could receive from the Spanish government — and which could influence the ratings uplift for the debt and deposit ratings from its a3 standalone strength — Moody’s believes the Spanish government’s ability to support Spanish banks’ debt and deposit ratings is now constrained by the level of the sovereign rating itself, currently A3. For this reason, the government’s debt rating does not provide uplift to Santander’s standalone rating, even though Santander benefits from a very high expectation of systemic support.

The outlook on the A3 long-term deposit rating is negative, reflecting both the negative outlook on the Spanish government bond rating and the negative outlook on Santander’s standalone C/a3 ratings.

BANCO ESPAÑOL DE CRÉDITO (BANESTO) (A3/C-/baa2,negative outlook)

The downgrade of Banesto’s rating to A3/P-2 from A2/P-1 is driven by the downgrade of its parent (Banco Santander) to A3/Prime-2 from Aa3/Prime-1. The standalone baa2 credit assessment was not on review and retains a negative outlook.

SANTANDER UK (A2, negative outlook; C-/baa1, stable outlook)

The downgrade of Santander UK’s long-term bank deposit and senior debt rating to A2 from A1 is driven by the downgrade of the standalone BFSR of its parent (Banco Santander) to C/a3 from B-/a1. The P-1 short term rating and the standalone BFSR of C-/baa1 (which has a stable outlook) were not on review and have been affirmed. This concludes the rating review initiated on February 21, 2012.

Moody’s says that because of the downgrade of Banco Santander’s standalone rating, Santander UK now benefits from only one notch of rating uplift from parental support. However, Santander UK continues to benefit from one notch of uplift from UK systemic support given (i) its nationwide network; (ii) its important role in the UK payments system; and (iii) its large market shares in UK deposits and loans. This means that Santander UK is now rated one notch higher than its parent. Moody’s believes that this is appropriate, because (i) it reflects Santander UK’s general funding independence from Banco Santander; (ii) Santander UK has no direct exposure to the Spanish government (or regional governments); and (iii) as a systemically important bank in the UK, Moody’s believes there is a low likelihood that the FSA would allow Santander UK to substantially weaken itself in order to support the parent.

Moody’s has also downgraded by one notch Santander UK’s subordinated debt, junior subordinated debt and preference share ratings, as they are driven by the bank’s “adjusted” standalone rating, which is now a3 (including parental support), previously a2. The outlook on the long-term debt and deposit rating of Santander UK is negative, reflecting the negative outlook on the standalone financial strength rating of Banco Santander.

BANCO BILBAO VIZCAYA ARGENTARIA, S.A (BBVA) (A3/C/a3, negative outlook)

BBVA’s revised ratings and negative outlook reflect its sensitivity to a further deterioration of the operating environment. This is reflected by a vulnerability under Moody’s more stressed scenario, given the 55% weight of BBVA’s loan book in its domestic market. However, Moody’s notes that the relatively solid performance of BBVA’s domestic book, compared with those of its peers, is largely due to the early recognition of losses that the bank incurred in 2009 in its domestic real-estate book, which partly stabilised its asset-quality indicators. Although BBVA has significant geographic diversification with 72% of its earnings generated in developing markets (with a particular strong franchise in Mexico), Spain remains its single largest market by loan distribution; conditions within Spain therefore significantly affect the group’s performance.

With Spain now in recession, there is potential for profitability and asset quality to weaken further during 2012. Moody’s notes that BBVA has a relatively robust liquidity framework, including a substantial portfolio of central bank eligible assets that are sufficient to cover wholesale maturities for a period exceeding 12 months. However, the rating agency notes that BBVA relies significantly on confidence-sensitive market sources, and there is a risk that the current more restricted and costly market access will continue for an extended period. Uncertainty regarding when BBVA will again be able to fund itself regularly — and on an economic basis — is therefore a key credit risk and rating driver.

BBVA’s A3 long-term deposit and debt rating is now at the same level as the Spanish sovereign. Moody’s believes that the Spanish government’s ability to support Spanish banks’ debt and deposit ratings is now constrained at the level of the sovereign rating, currently A3. For this reason, although BBVA benefits from a very high expectation of systemic support, its debt rating does not receive any uplift from its a3 standalone credit assessment. The outlook on the A3 long-term deposit rating is negative, reflecting both the negative outlook on the Spanish government bond rating and the negative outlook on BBVA’s standalone BFSR.

CAIXABANK (A3/C-/baa1, review for downgrade)

Moody’s says that the domestic focus of CaixaBank’s loan book is the main driver for the three-notch downgrade of the bank’s ratings. The loan-book focus on the domestic market will continue to weigh on the bank’s profitability and asset-quality metrics until economic conditions in Spain become more favourable, which Moody’s believes is unlikely in the near-term. At end-2011, CaixaBank reported a material increase in problem loans of 32% reaching a problem loan ratio of 5.1% — which is nevertheless below the system’s average of 7.6% — and a further increase by 30% at end-March 2012, year-on-year. With a 28.16% real estate problem-loan ratio, the bank’s exposure to this sector (at 17% of its loan book) has a particularly weak credit profile. However, Moody’s acknowledges the sound performance of CaixaBank’s book of mortgages to individuals, with a problem loan ratio of 1.57% at end-March 2012.

Moody’s notes that CaixaBank has the strongest liquidity and funding profile amongst the largest rated Spanish banks, underpinned by a strong retail funding base (69% of total funding), manageable debt maturities and a sizeable portfolio of ECB eligible assets that are sufficient to cover wholesale maturities for a period significantly exceeding 12 months. However, the rating agency notes that there is a risk that restricted and costly market access might continue for an extended period. As a result, uncertainty regarding when Caixabank will again be able to fund itself regularly in the markets — and on an economic basis — is a key credit risk and an important rating driver.

Despite the relatively good performance of the bank’s pre-provision income, Moody’s expects that the bank will find it difficult to improve its recurring profitability given the low interest-rate environment and subdued business growth. Moreover, further downward pressure on CaixaBank’s recurring and bottom-line profitability will be exerted by (i) Moody’s expectation of further asset-quality deterioration; (ii) the associated loan-loss provisions and increased pressure on funding costs; and (iii) Spain’s weakening operating environment.

In terms of capital adequacy, at 12.4% core capital, CaixaBank is resilient to Moody’s base-case scenario; however, given its domestic focus, the bank is somewhat vulnerable to the more stressed scenarios.

Moody’s decision to extend the review for downgrade of CaixaBank’s ratings is driven by the ongoing merger process with Banca Civica, which is not sufficiently progressed at this stage to conclude the review. The review will focus on the credit profile of the combined entity emerging after the integration with Banca Cívica, which is likely to have a weaker credit profile than CaixaBank’s standalone credit strength.

Furthermore, the rating review will focus on (i) the strategic fit of this acquisition for CaixaBank in the challenging economic domestic market; (ii) an assessment of the losses Moody’s expects will be embedded in the new bank’s asset portfolios. This will provide a key input to the determination of the new entity’s risk absorption capacity, its ability to withstand deterioration in its loan book and its sovereign exposures, and its capacity to generate capital through stressed core earnings and other capital-growth initiatives. Moody’s notes that at the inception of the merger, the combined entity is set to take EUR3.4 billion pre-tax fair value adjustments against Banca Civica’s shareholders equity that, consequently, will be reduced to zero. The EUR3.4 billion comprises EUR2.8 billion associated to its loan book, EUR300 million to acquired real estate and EUR300 million to other items. This clean-up will significantly increase the coverage level of existing problem loans, reducing the need for further impairments; (iii) the pro-forma risk-adjusted recurring profitability and cost efficiency indicators of the combined entity; and (iv) the ability of the new entity to address debt maturities — which will close to double the amount of maturing debt for 2012 (EUR4.3 billion at Cívica versus EUR2.3 billion at CaixaBank) accounting for 2% of the combined balance sheet — in light of the ongoing system-wide constraints to access the capital markets for term funding.

CAJA DE AHORROS Y PENSIONES DE BARCELONA (LA CAIXA) (Baa2, review for downgrade)

Moody’s rating actions on La Caixa follow those of CaixaBank’s; La Caixa’s issuer rating has thus been downgraded to Baa2 from A2. Although La Caixa has the legal status of a savings bank, it neither takes deposits nor carries out any banking activities. La Caixa’s rating is two notches below CaixaBank’s ratings — its main operating subsidiary — reflecting the structural subordination of La Caixa’s current creditors to those of the operating bank (i.e., CaixaBank). This notching also reflects the risk stemming from La Caixa’s portfolio of real-estate assets, which Moody’s believes could be subject to additional impairments.

CAJA RURAL DE NAVARRA (Baa1/C-/baa1, negative outlook)

Moody’s says that the one-notch downgrade of Caja Rural de Navarra’s (CRN) BFSR and standalone credit assessment to C-/baa1 from C/a3 reflects Moody’s expectation of further pressure on CRN’s credit fundamentals stemming from the weak operating environment. Despite this, Moody’s notes that the entity operates in (and is predominantly focused on) the region of Navarra, one of the wealthiest regions in Spain. In 2011, the debt-to-GDP ratio of this region amounted to 12.9% (68.5% for Spain) and GDP per capita increased by 1.5% (compared with a 0.7%). This region is also less affected by the global financial crisis than other areas of Spain, with an unemployment rate of 13.8%, compared with the national average of 22.8% (as of December 2011).

The downgrade captures CRN’s modest profitability indicators — with a pre-provision income to risk-weighted assets ratio of 1.19% as of December 2011– together with its weakening asset-quality indicators. The ratio of problem loans as a percentage of gross loans was 4.0% at end-December 2011, compared with 3.6% a year earlier (7.6% for the system).

Moody’s expects the deterioration in asset quality to continue. However, the rating agency believes that it should be moderate and manageable for CRN, given (i) CRN’s limited exposure to risks outside of Navarra; (ii) the relative strength of the regional economies where it operates; and (iii) the diversified nature of its loan book, with relatively low exposure to the real-estate sector.

In addition, Moody’s notes that CRN has very limited reliance on wholesale funding, and it has a very strong retail-customer base, which would allow the bank to withstand a disruption in capital markets over the next 12 months. Furthermore, CRN displays higher-than-average capital ratios, with the Tier 1 ratio standing at 12.6% at end-December 2011, up from 12.0% a year before.

BANCO COOPERATIVO ESPANOL (Baa1/C-/baa2, review for downgrade)

The three-notch downgrade of Banco Cooperativo Espanol’s (BCE) BFSR and standalone credit assessment to C-/baa2 from C+/a2 reflects its vulnerability to the weak operating environment, due to its role as service provider and central treasury provider for the Spanish rural credit cooperatives sector. As such, BCE’s credit-risk concentration to the rural cooperatives sector is high, while the sector’s credit profile is weakening.

In addition, the downgrade captures BCE’s relatively high exposure to sovereign risk, when weighed against its capital base. BCE’s Tier 1 ratio stood at 13.2% at end-December 2011. However, Moody’s notes that BCE’s risk weighting of its assets is very low, given that it is a wholesale oriented institution acting on behalf of the rural credit cooperatives. Its ratio of shareholders’ equity to total assets amounted to 1.8% at the end of 2011, and the ratio of risk-weighted assets to total assets was 13.6%, revealing the low risk weighting of BCE’s assets. Notwithstanding this low risk weighting, Moody’s believes that BCE’s high leverage poses a significant risk, as it provides BCE with a very insufficient cushion against any unforeseen, unexpected losses.

Furthermore, Moody’s has maintained the review for downgrade of BCE’s ratings to account for longer-term impact on BCE’s business stemming from the adverse macro-economic environment and the potential shift in BCE’s activity. BCE’s main task has traditionally been that of managing excess liquidity for its member banks, although Moody’s notes that over recent months, most of BCE’s activity has related to the issuance of government-guaranteed debt and access to ECB funding on behalf of its member banks.

Moody’s review will focus on (i) the wider effects on BCE’s customer base stemming from the persistent pressures and uncertainties caused by the very difficult operating environment; and (ii) the sustainability of BCE’s franchise in light of the consolidation movements in the rural cooperatives sector and the changes in its traditional treasury role.

BANKINTER (Baa2/D+/baa3, negative outlook)

Despite displaying one of the strongest asset quality indicators among Spanish banks with an NPL ratio of 3.3% as of year-end 2011 (7.6% for the system) and a relatively low exposure to the commercial real estate segment — which makes the bank somewhat more resilient to the adverse domestic operating environment –, the downgrade of Bankinter’s BFSR to D+/baa3 from C/a3 is mainly driven by the bank’s substantial dependence on wholesale funding in the current context of restricted access to market funding. Such reliance exposes Bankinter to market disruptions and makes it difficult to meet scheduled maturities without deleveraging or resorting to greater central bank funding (ECB funds plus outstanding wholesale funds totalled 45% of total funding as of February 2012).

Weighing also negatively on the BFSR, Moody’s believes it will be difficult for Bankinter to achieve or even maintain its already modest profitability levels, in light of the high unemployment level and the contraction expected for the Spanish economy in 2012 and given the domestic nature of the bank’s operations.

Despite the better-than-average quality of Bankinter’s loan book, its capital position would not be entirely resilient to Moody’s conservative but plausible scenarios or further deterioration in economic conditions in Spain.

CECA (Baa2/D+/baa3, review for downgrade)

The downgrade of CECA’s BFSR and standalone credit assessment to C/a3 to D+/baa3 reflects the pressures stemming from its business model as provider of financial services to Spanish savings banks. CECA is heavily exposed to the savings banks industry — in terms of the largest exposures and by revenues. The concentration towards savings banks represents a major rating constraint, which is unlikely to change in the near term given the sector’s weakening credit quality and our expectations of further deterioration in the country’s operating environment.

While the three notch downgrade of CECA’s standalone credit assessment is driven by the weaker credit profile of its traditional clients, there are other factors that further challenge the long-term sustainability of CECA’s business model and which have caused Moody’s to maintain the ratings on review for further downgrade. The ongoing consolidation and restructuring process of the savings banks segment — combined with the declining level of economic activity in Spain — indicate a reduced demand for financial services that constrains CECA’s recurrent revenue generation capacity. The breaking-up of the savings banks segment exerts further pressure on CECA’s critical role as leading services provider for a segment that, pre-crisis, represented half of Spanish banking assets.

In addition to these challenges, Moody’s notes that a significant part of CECA’s revenues are generated from capital-market activities. Whilst Moody’s acknowledge the good performance of this revenue line in recent years and the conservative stance CECA has taken on capital markets investments, it is subject to volatility because it relies on the performance of financial markets as well as to inherent vulnerabilities, such as confidence-sensitivity. During the review process, Moody’s will focus on the extent to which all the aforementioned factors weaken CECA’s credit profile in order to assess whether it is consistent with the lower BFSR currently assigned.

CAJA RURAL DE GRANADA (Baa3/D+/baa3, negative outlook)

The two-notch downgrade of Caja Rural de Granada’s (CRG) BFSR and standalone credit assessment to D+/baa3 from C-/baa1 reflects its vulnerability to an adverse domestic environment, namely its weakening asset quality and profitability indicators. The ratio of problem loans as a percentage of gross loans increased to 5.87% at end-December 2011 from 4.89% a year earlier (compared with 7.6% for the system). This was mainly driven by a deterioration of the exposures related to commercial real estate, although Moody’s notes that these exposures are relatively low compared with those of its peers. In addition, CRG has other non-earning assets related to real-estate acquisitions that result in a very high non-performing asset ratio of 12.2%.

The downgrade also captures the bank’s modest profitability indicators, with the already low PPI-to-risk-weighted assets ratio declining slightly further to 1.05% at end-December 2011 from 1.08% a year earlier. Moody’s believes there is likely to be further pressure on CRG’s profitability and asset-quality indicators, given the rating agency’s expectation of a weaker macro-economic environment in Spain.

Notwithstanding these pressures on some of the bank’s credit fundamentals, Moody’s notes that the bank has very limited reliance on wholesale funding, having a strong retail-customer base. As a result, CRG maintains a comfortable liquidity position and could withstand a disruption in capital markets over the next 12 months. Furthermore, the bank’s capital ratios are sound, with a Tier 1 ratio of 12.9% at end-December 2011, up from a 11.9% a year before.

LIBERBANK (Ba1/D/ba2, negative outlook)

The downgrade of Liberbank’s BFSR and standalone credit assessment to D/ba2 from C-/baa2 captures the effects of the very weak operating environment and constrained access to market funding on the bank’s credit profile.

Liberbank’s performance deteriorated significantly throughout 2011 in terms of asset quality, with the NPL ratio raising to 7.3% as of year-end 2011 (year-end 2010: 4.2%). Profitability also declined, with the net interest income declining by 27% year-on-year, which makes the bank’s standalone profile no longer consistent with a baa2 standalone credit assessment.

The bank’s sizeable dependence on wholesale funding (31% of total funding as of march 2012) exerts further pressure on the ratings given the lack of refinancing options, other than central bank funding or severe deleveraging measures. Weighing also negatively on the BFSR is the bank’s capital position, despite recent capital strengthening (it increased its core capital to 10.1% by year-end 2011 from 8.8% a year before), which is vulnerable to Moody’s scenarios of further economic deterioration. According to these scenarios, the bulk of credit losses to be recognised by the bank would stem from its significant exposure to the commercial real estate segment.

CAJAMAR (Ba2/D/ba2, negative outlook)

Moody’s says that the downgrade of Cajamar’s BFSR and standalone credit assessment to D/ba2 from D+/baa3 reflects the bank’s weakening fundamentals in terms of profitability and asset quality.

The NPL ratio rose to 6.03% at year-end 2011 from 4.8% by year-end 2010, mainly driven by the deterioration of the commercial real-estate loan book; real-estate acquisitions from troubled borrowers raises the non-earning assets ratio to 10.7%. The bank’s traditionally modest profitability indicators declined in 2011, with the risk-weighted recurring earnings power ratio declining to 0.69% (2010: 1.05%).

Given the domestic nature of Cajamar’s operations, Moody’s expects that further deterioration is likely for the bank’s profitability and asset quality in the coming months, in light of the low level of activity and the high levels of unemployment within the Spanish economy. In addition, Cajamar has some reliance on wholesale funding, at 24% of total funding as of February 2012, mainly in the form of covered bonds and securitisation. This exerts further pressure on the bank’s standalone credit assessment, given the difficulties to rollover market maturities and the lack of funding alternatives besides central bank funding or deleveraging. Cajamar’s BFSR is also constrained by the vulnerability of its capital position to scenarios of further losses, under Moody’s scenario analysis.

LICO LEASING (Ba3, negative outlook)

For Lico Leasing, the deposit ratings downgrade to Ba3/Not-Prime from Baa3/Prime-3 reflects the bank’s very weak financial fundamentals evidenced by (i) a high NPL ratio of 17% at the end of 2011 (raising from 12.5% a year before); (ii) very weak profitability indicators, with a severe contraction of the recurrent earning generation power throughout 2011 (a 91% decline year-on-year) and a reported net loss of 0.2% over average risk-weighted assets; and (iii) a weak funding profile, due to its high reliance on unsecured funding sources (mainly interbank deposits). Moody’s believes that the funding-profile issues pose a material credit risk to Lico, because of the lack of liquidity available in the system.

In addition, Lico has incurred a significant drop in the level of business volume, as companies’ investments and the need for financial leases have declined dramatically since the current economic crisis started (its lending volumes have reduced by almost 60% since 2007).

However, Moody’s acknowledges that Lico is a strategic provider of leasing services to the savings banks. Therefore, its ratings benefit from a high probability of support from its shareholders and provides an uplift to the deposit ratings from a standalone credit profile that would otherwise be lower.

Finally, the sovereign’s reduced creditworthiness contributed to ratings downgrades for Unicaja Banco SA (Unicaja, A3 on review for downgrade; C/a3 on review for downgrade), Banco Popular Espanol SA (Banco Popular, A3 on review for downgrade; C-/baa1 on review for downgrade) and Banco Sabadell SA (Baa1 on review for downgrade; C-/baa2 on review for downgrade). For the aforementioned banks, reduced sovereign creditworthiness was the only rating drivers of today’s actions. Moody’s continues to assess other relevant credit factors for these banks.