– The New Retirement Normal: The Average American Must Work For Two Extra Years After Death (ZeroHedge, Nov. 17, 2011):

While Italy is bickering over just how inhumane it is to raise the retirement age by 2 years in a 15 year span (which works out to a whopping 48 days per year) and will likely lead to mass riots and bloodshed in Rome before the idea is ultimately scrapped, things in America’s own back yard, the country that now that the EFSF is finished will have no choice but to come to Europe’s rescue via the IMF, are looking horrendous to quite horrendous. In fact when it comes to retirement, 80 is, we are sad to say, the new 65, at least according to Wells Fargo. And with average life expectancy in the US peaking at 78.1, it means that the typical American will have to work for an additional 2 years after death to pay for not only not having any retirement savings (thank you Bernanke ZIRP and VIX>30 stock market), but to make sure Europeans have theirs. You think we jest? Nope.

“Eighty is the new 65,” Joseph Ready, executive vice president of Wells Fargo Institutional Retirement & Trust, said in an interview at Bloomberg headquarters in New York before the survey was released today. “It’s a real sea change.”

About 76 percent of respondents said it’s more important to reach a specific dollar amount before retiring, compared with 20 percent who said it’s more important to retire at a given age, regardless of savings, according to the survey of adults with household incomes or assets from about $25,000 to $100,000.

About 74 percent expect to work in retirement, according to the survey, with about 39 percent working because they’ll need to and 35 percent because they want to. And 25 percent of those surveyed said they expect they’ll need to work until at least age 80 because they don’t have sufficient savings.

“People are starting to move toward understanding the different levers of what they’re going to have to do to make it in retirement,” Ready said.

About 68 percent of those surveyed said they’re not confident the stock market is a good place to invest their retirement savings. About 45 percent of respondents said if they were given $5,000 they would buy a certificate of deposit, and 50 percent said they’d invest it in stocks or mutual funds.

It’s still not too late to jump on the board the Ponzient Express:

“Even though there’s a lack of confidence, I don’t know that they see there’s a good alternative,” to investing in stocks, said Laurie Nordquist, executive vice president of Wells Fargo Institutional Retirement & Trust.

Obviously prepare to work for at least 20 or so years after death if one wishes to go long Netflix and short GMCR.

As for the math: oops.

Survey respondents had saved a median of $25,000 towards retirement and estimated they’d need a median of $350,000 to support themselves in retirement. About 42 percent expect to receive a pension or already receive one.

“The numbers don’t add up,” Nordquist said. “The gap is probably larger than what they self identified.”

Those surveyed expect to withdraw about 18 percent on average from their savings each year in retirement.

“We would recommend typically 4 percent or less, in terms of withdrawals,” Nordquist said.

About 57 percent of respondents said they’re confident they’ll have saved enough for retirement.

“You used to just save blindly, but I think the blinders are coming off,” Ready said.

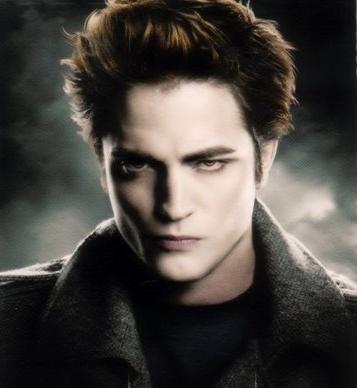

And the key one blinder being that if America agrees to fund the IMF’s bailout of Europe, which make no mistake is coming any day now, not only will future generations of Americans be China’s debt slaves in perpetuity or at least until China makes the fatal mistake it can do whatever insanity it wishes just because its currency has “reserve” status and MMT said so, but the existing one will have to find a way to work efficiently in a rather zombified condition, or else get bitten by Robert Pattinson and live forever, if with a slight bias toward SPF 100,000,000 tanning lotion.