See also:

– Is Gold A Bubble? 14 Charts, The Facts And The Data Suggest Not

– Hilarious: Ron Paul: ‘Why Do Central Banks Hold Gold?’ Ben Bernanke: ‘Tradition’

– Central Banks Join Rush to Gold (Wall Street Journal, August 3, 2011):

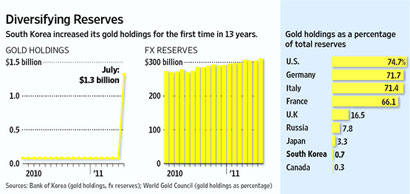

Central banks are ramping up their gold buying as they seek to diversify their reserves away from the dollar and other beleaguered currencies.South Korea became the latest government to disclose a big bullion purchase, saying Tuesday that it recently bought 25 metric tons – more than doubling its holdings to 39 metric tons. Mexico, Russia and Thailand have also been major buyers in 2011.

This year, governments have almost tripled their net gold purchases, increasing their holdings by 203.5 metric tons this year, up from a 76-metric ton rise last year, according to the World Gold Council, an industry group backed by miners.

The demand marks a major shift in central banks’ thinking about gold. Increasingly, they see bullion as protection against risks posed by declining paper currencies and global economic upheaval, and their vast resources and conservative bent make them a powerful force in the gold market.

While gold is an asset that does not generate income, that shortcoming is less glaring among historically low interest rates.Before 2010, governments had on balance been shedding their bullion for two decades, during which gold was seen by some as a relic. According to data from GFMS Ltd., a metals consultancy, 1988 was the last year that official holdings increased.

“We definitely have seen a sea change” in central bank attitudes toward gold, said David Greely, chief commodities strategist at Goldman Sachs Group. Central bank buying provides “longer-term support for gold prices,” he said.

The purchases have helped drive gold to record levels. Gold settled Tuesday at $1,641.90 per troy ounce, a new all-time high in nominal terms, though still far below the inflation-adjusted record of $2,395.03, hit in January 1980. Prices rose $22.90, or 1.4%, on Tuesday in New York trading, and are now up 16% this year. The recent rise is extending a rally that began in 2001, multiplying gold prices six-fold in that period.

By becoming net buyers, central banks are just starting to catch up with the private sector, which started to warm toward investing in gold years ago.

Private investor bullion holdings inched ahead of official holdings at the end of 2009, and comprised about 18.7% of total gold holdings at the end of 2010, compared to 17.4% for the official sector, which includes central banks and the International Monetary Fund, according to GFMS and the gold council.

But both individual investors and world governments are motivated by similar concerns, including a fear that economic woes in the developed world are eroding the value of the U.S. dollar and the euro, undercutting what had been seen as stores of wealth. That is reviving interest in gold as a safe haven.

Many emerging nations also have a relatively small percentage of their reserves in gold, compared to the developed world. The U.S. has 74.7% of its reserves in gold, compared to 1.6% for China and 8.7% for India, according to the gold council.

Rapidly-growing Asian nations have also seen their foreign currency holdings swell as their economies outpace the rest of the world, providing another motive for diversification.

[More from WSJ.com: Who Gets Drunk and Why]

In South Korea, which has the seventh-largest currency reserves in the world, the new move into gold reflects concerns about global economic instability, which have been exacerbated by the credit crisis in Europe and fears of a default in the U.S.

The Bank of Korea on Tuesday said it bought the gold from the global market in June and July. Its gold holdings now represent 0.7% of the country’s foreign-exchange reserves, which stood at a record $311 billion at the end of July. “The gold purchase, as a safety net, will help us cope with volatile global financial markets and enhance investor confidence in Korea in times of crisis,” said Hong Taeg-ki, chief of the BOK’s reserve management group.

The central bank says it wasn’t motivated by the U.S. debt ceiling negotiations and denied that it is specifically seeking to diversify away from the dollar. Nevertheless, the bank joins a growing list of central banks around the world that have been increasing their gold holdings in the wake of the global financial crisis.