Following yesterday’s news that Bank of America’s D-grade traders eked out a perfect trading quarter in Q1, it would be a massive embarrassment to anyone who did not follow suit and also report of quarter of trading perfection.

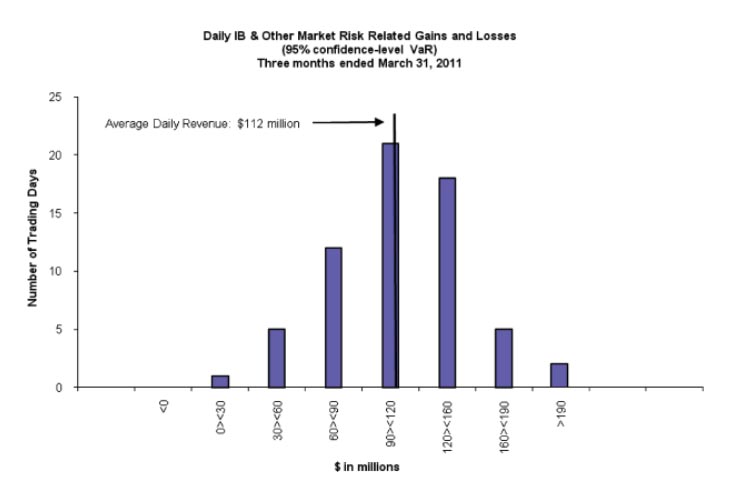

No such worries for JP Morgan, which just reported that it lost money on exactly zero days in Q1, averaged $112 million in daily trading revenue and had 7 days in which the firm had trading profits of “more” than $160 million, including 2 days unbounded by an upper limit range.

Next, we expect Goldman and Citi to do the same. It is a good thing markets are not zero sum, or else someone may ask just who (or rather which taxpayer) is the loser to all these “trading perfection” days…

From JPM’s just released 10Q:

And for those curious what “efficient” central planning looks like here is the list of total trading loss days by year for JPM:

- 2008: 97

- 2009: 42

- 2010: 8

- YTD 2011: 0

In other news, this is perfectly normal!

Submitted by Tyler Durden on 05/06/2011 08:15 -0400

Source: ZeroHedge

1 thought on “JP Morgan Banksters Report PERFECT Trading Quarter, Make $112 Million In Average Daily Trading Revenue”