Gold prices settled at a new record high yesterday, as unrest in North Africa and the Middle East pushed the safe haven currency to $1,435/oz. Silver surged to new 30-year record nominal highs at $34.74/oz. Prices surged in dollars and all major currencies and look set to reach record highs in other currencies.

Given the continuing strong fundamentals and the concerns of geopolitical instability spreading to Saudi Arabia and other autocratic oil producing nations, gold and silver look set to challenge $1,500/oz and $40/oz in the coming weeks.

Gold’s all time record nominal high yesterday was barely reported in most of the mainstream business and financial press today – slightly more online but there was little or no coverage in print.

This is an indication that gold and silver remain far from the “bubbles” that some have suggested. Speculative manias and bubbles are characterised by mass participation and widespread enthusiasm and “irrational exuberance” by all sectors of society including the media and particularly the retail investor and the “man in the street”.

As seen today, this is clearly not the case at the moment as there continues to be little or no reporting (let alone analysis) about gold and silver – even when they reach record nominal highs.

While the specialist financial press such as Bloomberg, Reuters. Dow Jones, the Wall Street Journal and the Financial Times did report the record highs; it was unreported in the mainstream press in most western countries.

In the UK and Ireland, none of the main papers (including the Times of London, The Guardian, the Daily Telegraph, The Irish Times, the Irish Independent, and the Irish Examiner) reported the record highs.

The Financial Times print edition reported the news with one sentence saying that “concerns were underlined by gold rising to a three-month high”. In fairness to the Financial Times, they do report on the gold market far more than most media outlets.

The media’s continuing non-coverage of gold and silver is a clear indication of the lack of animal spirits in the sector. It is proof, if any were needed, that the mainstream media and the man on the street remains far from bullish on gold and silver.

Indeed, recent years and recent months have seen many so called “experts” warning about the dangers of the gold “bubble”. They have been proven badly wrong and it would be interesting to read a story about how wrong they got it.

The majority of investors and savers in the western world do not know what gold bullion is and could not tell you the price of an ounce of gold or silver in dollars – let alone in pounds, euros or other local currencies.

The majority are unaware of the huge developments in the gold markets (only reported by specialist financial press) such as China’s emergence as one of the largest buyers of gold in the world (see news and our video below) and the fact that central banks and astute hedge funds are some of the largest buyers of gold in the world today.

A bubble only takes place when entire societies , including many – if not the majority – of journalists and media become convinced that you “cannot go wrong” with a certain speculation or investment and it is a risk free way of making returns.

This leads to gushing reportage and commentary about the “sure thing” that is a certain stock, bond, commodity or property market. It is characterised by widespread commentary and a belief not just in the financial press but in the mainstream media (day time radio and television etc) that one must speculate or “invest” by buying a certain security or asset class – whether that be tulip bulbs, Nasdaq, Apple or property in London.

Greed and buying motivated to make a profit or quick buck becomes widespread. This has not happened in the bullion markets as the majority of bullion buying has been safe haven buying for wealth preservation purposes rather than accumulation.

Concerns about a bubble in gold may be justified when it reaches its inflation adjusted high of $2,300/oz. Similarly with silver, concerns about a bubble may be justified when it reaches its inflation adjusted high of $130/oz.

Concerns about a bubble in gold will be justified when gold is covered in a regular manner in not just the specialist press but also in the mainstream. When vested interests selling gold regularly appear in mainstream media advising people to but all their money into gold because it is a sure thing, it will be time to become very cautious about the sector.

Near the top of the gold market (when the price is likely trading at thousands of dollars, euros and pounds per ounce) we are likely to see front pages in the business press (such as Fortune, Business Week etc) devoted to gold and snappy front page positive headlines about how “Gold is King”, “Why Gold is a Must” etc.

When that happens it will be time to be wary of the gold bubble and reduce allocations to gold and silver.

The lackluster, negligent media coverage of gold’s record highs yesterday suggests that we are a long way from there yet.

NEWS:

(Bloomberg) — Silver Climbs to $34.795 in London, Highest Since March 1980

Silver for immediate delivery climbed to $34.795 an ounce at 11:43 a.m. in London, the highest price since March 6, 1980.

(FT) — Gold touches all-time high

Gold hit an all-time high and oil surged higher after the US said it was moving military resources to the Mediterranean heightening fears of a full-blown war in the Middle East.

The US said it was moving marines and two warships into the Mediterranean on Tuesday night amid growing international pressure on Muammer Gaddafi, the Libyan leader, to stand aside.

Spot bullion rose 1.5 per cent to a record $1,432.10 a troy ounce, surpassing the peak of $1,430.95 hit in December. ICE April Brent rose 3.2 per cent to $115.56 a barrel, the highest since a spike on Thursday that took the global oil pricing benchmark to within cents of $120.

“Guns and oil are a bullish mixture anywhere in the Middle East and north Africa,” said Michael Wittner, head of oil research at Société Générale in New York.

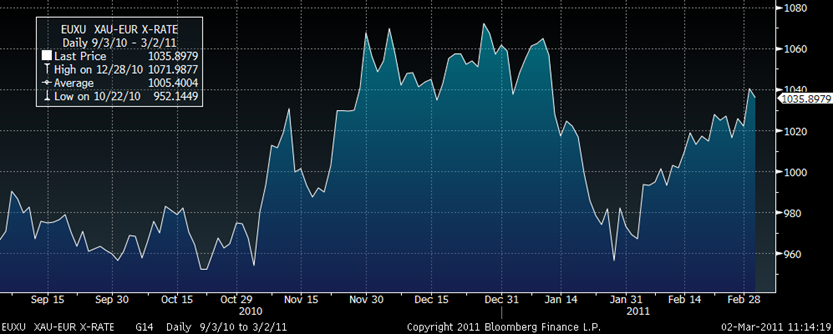

Gold glistens

Gold prices have jumped 9.5 per cent from a low of $1,308 in January, as investors have become increasingly jittery over escalating political unrest in the Middle East.

At the same time, silver has risen 30 per cent from its January lows, on Tuesday hitting a 30-year high of $34.59 a troy ounce.

Some investors trimmed their gold positions in January, believing a rosier outlook for the US economy would boost returns on other assets.

Traders said the switch in broader market sentiment triggered by the political uncertainty in the Middle East had driven investors back to the precious metals.

“The buying has accelerated, both institutional and individual,” said James Steel, precious metals strategist at HSBC. “The geopolitical thermostat has not fallen. The situation in Libya really is almost the worst of all worlds for markets because there’s no clear winner.”

At the same time, the jump in oil prices – up $20 since January – has raised concerns of rising inflation, increasing demand for precious metals as a means of wealth preservation.

The oil market is not only concerned about the loss of production in Libya, but also the spread of unrest to other oil-rich countries in the Middle East, particularly Saudi Arabia. Protests in Bahrain, Oman, Yemen, Iraq and Jordan mean that most of Saudi Arabia’s neighbours have been affected by the turmoil in the region.

Opposition groups in the country, the world’s top oil exporter and holder of the majority of the spare production capacity, have called for a “day of rage” to be held on March 11.

(Bloomberg) — Copper May Slump on Mideast Unrest as Gold Surges, UBS Says

Copper, corn and rubber may tumble in the next six months, while gold climbs to a record $1,500 an ounce as turmoil in the Middle East boosts oil, fuels inflation and weakens Chinese raw-material demand, according to UBS AG.

(Bloomberg) — Gold Buying in China Climbs on Inflation Concern, UBS Says

Gold purchases in China, the world’s largest producer, climbed to 200 metric tons in the first two months of 2011 as faster inflation boosted consumer demand, according to UBS AG, which said the price may gain to $1,500.

“China is the big buyer,” Peter Hickson, global commodities strategist at Switzerland’s largest bank, said by phone yesterday, without giving a comparable figure for 2010. The estimate for the two-month period compares with full-year consumer demand from China of 579.5 tons for last year, according to the World Gold Council, a producer-funded group.

Bullion, which rallied 30 percent last year, surged to a record yesterday as uprisings in the Middle East, quickening inflation and currency debasement boosted global demand. China’s consumer prices rose 4.9 percent in January from a year earlier, exceeding policy makers’ 4 percent ceiling for a fourth month.

“Chinese interest is huge,” said Peter Tse, Hong Kong- based head of precious metals at Bank of Nova Scotia. “Demand for physical gold and imports has increased substantially” due to the Lunar New Year holiday, Tse said today, referring to the week-long break that began Feb. 2.

Immediate-delivery gold was at $1,429.05 an ounce at 5:08 p.m. in Singapore compared with yesterday’s peak of $1,434.93. Yuan-denominated bullion rose 0.5 percent to 303.58 yuan ($46.19) a gram in Shanghai, approaching the record 314 yuan, set Nov. 9.

‘Gold Is Attractive’

“Gold is attractive,” Hickson said. “The more the market becomes concerned about inflation or concerns about unrest in Africa, more and more people will look to gold.” The price may rise to $1,500 an ounce in the next six months, said Hong Kong- based Hickson, who’s worked for UBS since 1996.

Blackstone Group LP’s Byron Wien said in January that gold may rise to more than $1,600 this year “as investors across the world place more of their assets in something they consider ‘real’.” The price may reach $1,600 this year, Wayne Atwell, a managing director at Casimir Capital LP said the same month.

Protests partly linked to record food prices have erupted across North Africa and the Middle East this year, toppling leaders in Tunisia and Egypt and boosting oil prices. Libyan rebels braced for renewed clashes today with forces loyal to leader Muammar Qaddafi. Iranian protesters have clashed with security forces in Tehran, Al Arabiya reported.

Gold investment in China, the largest buyer of the precious metal after India, may gain 40 percent to 50 percent this year amid a lack of alternatives, Wang Lixin, China representative for the World Gold Council, said last month. He called that forecast a “conservative estimate.”

Bars and Coins

China’s investment demand in 2010 jumped 70 percent to 179.9 tons, surpassing Germany and the U.S., as buyers sought out bars and coins, the London-based industry group said. Consumption by the jewelry sector rose to a record 399.7 tons, it said. China imported more than 300 tons last year, People’s Bank of China Vice Governor Yi Gang said on Feb. 26 in Beijing.

China may be the “next big buyer” of gold, driven by institutional and retail demand, Credit Suisse Group AG analyst Tom Kendall said in Cape Town on Feb. 7. “If you’re sitting there in China with money in a deposit account, you’re losing between 1-2 percent a year through inflation,” Kendall said.

The boom in gold demand in China is driven by concern about inflation pressure and the poor performance of alternative investments, the producer-funded council has said. Premier Wen Jiabao pledged on Feb. 27 to boost food supplies to hold down costs, and to tackle surging property prices.

Spooked by Inflation

Jewelers at shopping malls across Beijing are witnessing a gold rush as residents spooked by inflation look to protect their money, the China Daily reported on Feb. 28.

Statistics from Beijing Caibai, the city’s largest jewelry store, show sales of gold and other jewelry have totaled about 4 billion yuan so far this year, a 70 percent increase from a year ago, the report said.

China displaced South Africa as the world’s biggest gold producer in 2007. Imports through last October rose almost fivefold to 209 tons from the total shipped in the previous year, according to the Shanghai Gold Exchange. Mine output reached a record 340 tons last year, the China Gold Association has said.

The Industrial and Commercial Bank of China Ltd., the world’s biggest lender by market value, started physical-gold linked savings accounts in December with the World Gold Council. Account openings have surpassed 1 million, with more than 12 tons of gold stored on behalf of investors, it has said.

(Wall Street Journal) — India Spot Silver Hits Record High

The spot price of silver in Mumbai rose Tuesday to an all-time high of 51,005 rupees ($1,127) a kilogram, the Bombay Bullion Association said, tracking firm …

(BBC) — Gold price hits record high on Libya unrest

The price of gold has hit a record high as investors worry about the political turmoil in Libya and spreading tensions across the Middle East.

The price on the London Bullion Market jumped more than $14 to $1,434.50 an ounce, topping the previous mark of $1,431.25, set in December.

Gold is traditionally seen as a haven for investors in times of uncertainty.

Unrest across the Middle East and North Africa fuelled a 6% rise in gold prices during February.

Analysts said that the political problems were pushing oil prices higher and fanning concerns about inflation and slower global economic growth.

“What gold needed was a catalyst, and it found it in the form of tensions that are surfacing in the Middle East and rising oil prices,” said Mark Luschini from the brokerage Janney Montgomery Scott.

Mr Luschini added that investors saw gold giving them greater protection from inflationary pressures and political instability.

On the New York Comex exchange, the price of gold reached $1,434.40, a record for that market, before pulling back slightly.

Meanwhile oil prices, which have also been on the up since unrest broke out in North Africa and the Middle East, rose again on Tuesday.

In London, Brent crude rose 4.2% to $116.46, while US light, sweet crude rose 3.7% to $100.52.

Published in Market Updates Precious Metals Update on 2 March 2011

Source: GoldCore

I would buy every silver Maple Leaf, American Eagle or Wiener Philharmoniker I could get my hands on.

Only physical gold and silver are real, everything else is an illusion.

– Exposed: The iShares Silver Trust (SLV) Scam

More on gold and silver:

Silver:

– CNBC: Total Silver Demand At 127% ! – The Case For $130 Silver

– Dollar Ready to Collapse, Silver Squeeze to Continue

– Even The Royal Canadian Mint Now Says It’s Difficult To Secure Silver

– Unprecedented: Silver Backwardation Surges To Over $1.00

– Eric Sprott on Silver: ‘THERE IS NOTHING LEFT’

– Fractal Analysis Suggests Silver to Reach $52 – $56 by May – June 2011

– Short Squeeze in Silver, Manipulators Getting Overrun

– Silver Takes Out Hunt Brothers High … When Priced In Euros

– Silver Backwardation Now ‘Unprecedented 73 Cents’

– Short Squeeze Takes Silver To Fresh 31 Year High

– Silver: Short Squeeze Could Be the Big One – Reaches New Multi-Decade High – Still In Backwardation

– Massive Short Squeeze in Silver, Gold to Hit New Highs

– London Source: Asians Buying SLV to Take Delivery of Silver

– COMEX Silver Inventories Drop To 4 Year Low. COMEX Default Or Hunt Brothers Redux?

– This Past Week in Gold and Silver

– ‘US Silver Term Structure Inverts As Supply Tightens’ – Reuters Article On Silver Backwardation

– JP Morgan Silver Manipulation Explained (Part 1-4)

– Silver Bullion Backwardation Suggests Supply Stress

– Silver Lease Rates Rise Sharply – Bond Yields in Portugal Rise to Record

– Perth Mint Has Run Out of 100 Ounce SILVER Bars for at least 6 Weeks!!!

– Silver Breaks Its Golden Shackles And More Signs of Silver Shortages

– $6,000 Silver and the ONE BANK

– Canada’s Biggest Bullion Bank Scotia Mocatta: ALL SILVER BARS SOLD OUT

– Eric Sprott: Expect $50 Silver, Gold Possibly $2,150 by Spring

– US Mint Reports Unprecedented Buying Spree Of Physical Silver

– BullionVault.com Runs Out Of Silver In Germany

– Silver: Shortage This Decade, Will Be Worth More Than Gold (!!!)

– Silver Derivatives – China and JP Morgan

– Max Keiser: Want JP Morgan to Crash? Buy Silver!

– Max Keiser: Crash JP Morgan – Buy Silver!

– JPMorgan Silver Manipulation Explained (Must-See!)

Gold:

Gold:

– Probable Black Swan Event Equals Gold Explosion

– Richard Russell: Possibility of Gold Breaking to New Highs

– Brazilian Billionaire Eike Batista Reaffirms $1 Billion Bid for Ventana Gold

– Americans Will Flock Into $5,000 Gold and $500 Silver

– ‘GoldNomics’: Cash or Gold Bullion?

– George Soros’ and John Paulson’s Biggest Holding Is GOLD

– China, Russia, Iran are Dumping the Dollar, Buy Gold And Silver

– Gold and Gold Mining Shares As a Percentage of Global Assets or ‘The Once In a Lifetime Ride’

And don’t forget to do this (!!!)…

– James G. Rickards of Omnis Inc.: Get Your Gold Out Of The Banking System

… or …

Related information:

– Marc Faber: ‘I Think We Are All Doomed’

– The Market Is Telling Us That The US Dollar Is Finished

– Tungsten Outperforms Gold, Returns 70 Percent In Last Year (And we all know exactly why!)

– Alert: Get Out of Your Dollar Assets Now!!!

– The Ultimate Cost of 0% Money

– These Central Banks Are Printing Money – Prepare Yourself

– Quantitative Easing Explained

Summary:

?