Quantitative Easing works just as intended by the elitists.

This article originally appeared in The Daily Capitalist.

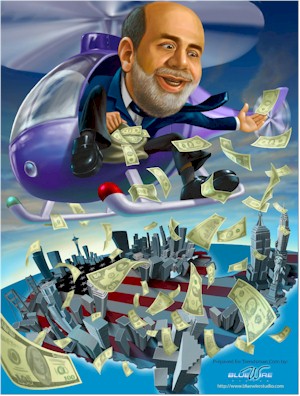

Ben Bernanke is speaking at the National Press Club today and his pre-released speech says basically that QE2 is working:

Since August, when we announced our policy of reinvesting maturing securities and signaled we were considering more purchases, equity prices have risen significantly, volatility in the equity market has fallen, corporate bond spreads have narrowed, and inflation compensation as measured in the market for inflation-indexed securities has risen from low to more normal levels. Yields on 5- to 10-year Treasury securities initially declined markedly as markets priced in prospective Fed purchases; these yields subsequently rose, however, as investors became more optimistic about economic growth and as traders scaled back their expectations of future securities purchases. All of these developments are what one would expect to see when monetary policy becomes more accommodative, whether through conventional or less conventional means. Interestingly, these developments are also remarkably similar to those that occurred during the earlier episode of policy easing, notably in the months following our March 2009 announcement of a significant expansion in securities purchases. The fact that financial markets responded in very similar ways to each of these policy actions lends credence to the view that these actions had the expected effects on markets and are thereby providing significant support to job creation and the economy.

I have mentioned this kind of reasoning before: Post hoc, ergo propter hoc. It means that first A happened and then B happened, then A must have caused B. I think the fallacy in such reasoning is rather obvious. Let me translate what he is really saying:

Since August when we began to flood our primary dealers in Wall Street with newly printed money the market went up because they used the money to buy financial products, including stocks. We are trying to cause price inflation because the majority of the FOMC is concerned about price deflation. If we cause price inflation then we will fool everyone into thinking that because prices are going up, such as in the stock markets, that it is real growth even though it’s just price inflation. Even better the national debt can be paid down with cheap dollars. Yields on Treasurys initially went up because the bond vigilantes aren’t stupid: they know it will cause inflation so they wanted higher yields. But, ha, ha, the Euro went into the tank because of the PIIGS and money flooded back in to the US and drove Treasury yields back down, for the time being. Screw the vigilantes. The same thing happened when we tried QE1, but as we all know, that failed and we are desperately trying again because we don’t have too many arrows left in our quiver. Hey, if it had worked, would we be doing QE2? We are desperate because if unemployment doesn’t come down, the Obama Administration will be screwed and I’ll lose my job. We are ready to do QE3 because we don’t have a clue what else to do.

Submitted by Econophile on 02/03/2011 14:47 -0500

Source: ZeroHedge