– The Bank’s £200bn gamble (Independent):

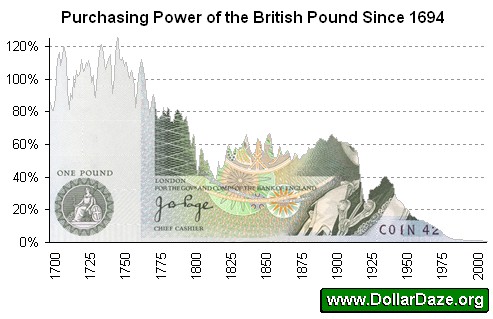

“The Bank of England will this week announce its intention to flood the economy with ‘helicopter money’, its latest attempt to tackle the recession. Won’t quantitative easing cause inflation? Yes – and that is the general idea. Warren Buffett, the world’s most successful investor, has warned of “an onslaught of inflation” as a result of current policies.”

Destroying the value of your money through inflation is the general idea?(!!!)

Quantitative easing = Increasing the money supply (by creating money out of thin air) = Inflation

Inflation is a hidden tax:

“By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

– John Maynard Keynes

Quantitative easing = Zimbabwe school of economics (Stealing)

– Former Northern Rock chief gets £800000 payout as repossessions soar (Guardian):

Northern Rock revealed yesterday that it was forced to pay disgraced former chief executive Adam Applegarth more than £800,000 last year in pay and pension top-ups following his departure from the bank after he failed to find another job. Applegarth was paid £731,000 after he quit the bank in November 2007 following a deal that awarded him a year’s pay until he found another job. The Newcastle-based bank also had to stump up an extra £108,000 to fund Applegarth’s guaranteed £305,000-a-year pension which pays out from the age of 60.(Failure is so rewarding these days!)

– Shares crash as savers raid £8bn from accounts (Independent):

The pressure of an intensifying recession saw British companies and households launch an £8bn raid on their savings in January, according to the figures from the Bank of England.

– Geithner Says US Financial Rescue ‘Might Cost More’ (Bloomberg):

March 3 (Bloomberg) — Treasury Secretary Timothy Geithner said the U.S. bank rescue program may cost more than the $700 billion Congress approved, and he pledged to crack down on companies and individuals who try to avoid paying taxes. (Surprise!)

– Medvedev rejects Obama missile defence deal (Financial Times):

Russia’s president Dmitry Medvedev on Tuesday rejected any suggestion that Moscow would “trade or exchange” in policies in order to dissuade the US from installing an anti-ballistic missile system near its borders in Eastern Europe.

– Japan to use forex reserves to fight credit crunch (AFP):

TOKYO (AFP) — Japan said Wednesday it would use five billion dollars from its currency reserves to help companies raise funds as auto giant Toyota Motor asked the government for financial aid. (Looks like Japan is starting to dump the dollar.)

– Ukraine: Nation on the brink of bankruptcy (Independent)

– Secret report reveals how MEPs make millions (Times Online):

Ukraine is so broke the nation is expecting to be cut off this week for failing to pay the gas bill.

– HSBC attacks ‘perverse’ pay as it awards banker £13m (Telegraph):

HSBC chairman Stephen Green attacked “perverse” pay practices in banking and called for a “more sober and reasonable approach to compensation” as it emerged the bank paid two senior employees almost £25m last year.

– GM urges EU states to come to its aid (Financial Times):

General Motors said on Tuesday that its European arm could run out of money by as early as next month, putting up to 300,000 jobs on the continent at risk.

– Fed launches new $200B consumer credit program (AP):

WASHINGTON (AP) — The Federal Reserve on Tuesday rolled out a much-awaited program aimed at boosting the availability of credit to consumers and small businesses. (Wow. First you create the money out of thin air, then you lend it to the people. Sounds like a plan to me.)

– The Obama Economy (Wall Street Journal):

As the Dow keeps dropping, the President is running out of people to blame.

– US Auto-Sales Rate Falls to 27-Year Low, Led by GM (Bloomberg)

– Harvard Losing AAA Benefit in Market Shows Swap Risk (Bloomberg)

– Eurozone ready to rescue members (Financial Times):

“If crisis emerges in one eurozone country, there is a solution before visiting the IMF,” Joaquín Almunia, the EU’s monetary affairs commissioner, said. “It’s not clever to tell you in public the solution. But the solution exists.”

– Brown to remain defiant on economy (Financial Times):

Gordon Brown has told aides he has no intention of admitting mistakes in his handling of the economy when he makes a keynote speech in Washington on Wednesday … (… everything Mr. Brown did was a economic disaster. He is the Bushbama of the U.K.)

– Madoff’s Wife Says $62 Million ‘Unrelated’ to Fraud (Bloomberg):

March 2 (Bloomberg) — Ruth Madoff, the wife of accused fraudster Bernard Madoff, said she owns a Manhattan apartment, $45 million in bonds, and $17 million in cash that are “unrelated” to her husband’s alleged Ponzi scheme.

(Oh, sure!)

– Rod Blagojevich signs six-figure book deal (Chicago Tribune):

Blagojevich, who was recently impeached for abuse of power, “plans on exposing the dark side of politics that he witnessed on both the state and national level,” Glenn Selig said in a statement.

– Stanford investors set to recover only millions (Times Online)

– Toyota’s car loan arm asks for $2bn in aid (Financial Times)

– Freddie Mac chief resigns after five months (Times Online):

Freddie Mac, which is due to report its fourth-quarter figures this month, is expected to ask for between $30 billion and $35 billion in Government aid, having already received almost $14 billion last November.

– Global recession will be ‘worse than forecast’ (Times Online)

– Taxpayers hit by expanding black hole of AIG (Telegraph)

– Asia markets gyrate on global financial fears (Times Online):

Fears over the global banking market dragged down shares across Asia overnight, sending Hong Kong’s benchmark Hang Seng below the critical 12,000 mark as Japan’s Nikkei briefly headed towards a 26-year low.

– Empty Containers Clog South Korea’s Busan Port as Trade Slumps (Bloomberg):

March 3 (Bloomberg) — South Korea’s biggest port is running out of room to store shipping containers, said Park Jung Ho, an official at one of Busan’s nine operators. The bigger concern is that the boxes are almost all empty.

– Russia Stock Gains Strengthen Putin as Ukraine Drops (Bloomberg):

March 2 (Bloomberg) — Russia, the worst-performing major stock market in 2008, was Europe’s best last month as the ruble rose and reserves stabilized. Every neighboring market crumbled.

– New ruling to force British voters to show ID before voting (Times Online):

In an historic shift, which comes after years of campaigning by the Electoral Commission and The Times, the Government finally agreed yesterday to end the system whereby one person in each household names all those eligible to vote in their property.

– This revolting trade in human lives is an incentive to lock people up (Guardian):

It’s a staggering case; more staggering still that it has scarcely been mentioned on this side of the ocean. Last week two judges in Pennsylvania were convicted of jailing some 2,000 children in exchange for bribes from private prison companies.

– To politicians, we’re little more than meaningless blobs on a monitor. Bring on the summer of rage (Guardian):

We’re the ants in their garden. The bacteria in their stools. Politicians have nothing but contempt for us

– Scientists make HIV strain that can infect monkeys (Reuters)

– Gypsy vaccination scheme starts (Financial Times):

Italy’s Red Cross has launched its biggest vaccination programme since the second world war, with the goal of immunising several thousand gypsy children living in camps around Rome.

– Scientists warn of drug-resistant ‘super-flu’ (Times Online):

Warn??? Want to get a shock?: Here

– Warning of attacks on Sri Lanka cricket team was ignored (Guardian)