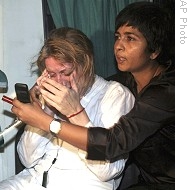

Apichart Weerawong / Associated Press Suvarnabhumi International Airport is the site of anti-government protests that have halted flights, stranding scores of travelers.

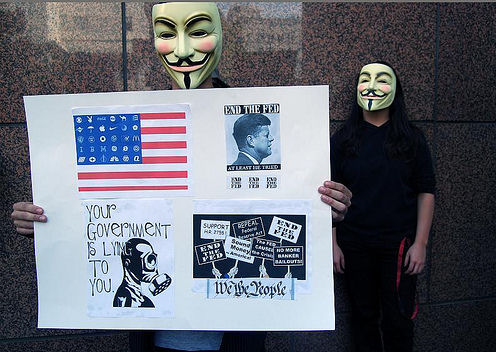

The action avoids broader restrictions that many Thais had feared. Protesters are demanding the ouster of Prime Minister Somchai Wongsawat.

Reporting from Bangkok, Thailand — Thailand’s beleaguered Prime Minister Somchai Wongsawat on Thursday declared a state of emergency around two Bangkok airports occupied by protesters but insisted he wanted a peaceful resolution to the crisis.

“I do not have any intention to hurt any members of the public,” he said in announcing the targeted restrictions on civil liberties aimed at reopening the country’s main international airport.

By declaring the state of emergency, the government can suspend civil liberties, ban public gatherings and take other measures to restore order without imposing broader restrictions that many Thais have feared.

Thousands of People’s Alliance for Democracy demonstrators on Tuesday seized the newly built Suvarnabhumi Airport, one of the busiest airports in Asia, marooning thousands of foreign travelers.

Read moreThai government declares state of emergency at two Bangkok airports

View Larger Image

View Larger Image