Related article: Fed Pledges Top $7.4 Trillion to Ease Frozen Credit

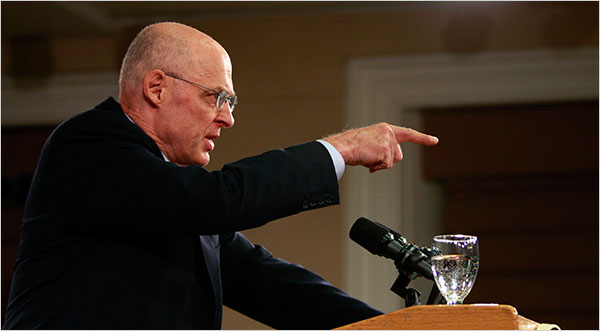

Treasury Secretary Henry M. Paulson Jr. spoke at a news conference at the Treasury Department on Tuesday in Washington.

The federal government unveiled $800 billion in new loans and debt purchases on Tuesday, hoping another infusion of cash can help unfreeze troubled credit markets and make borrowing easier for homebuyers, small businesses and students.

The Federal Reserve said that it would buy up to $600 billion in mortgage-backed assets from the government-sponsored mortgage finance giants Fannie Mae and Freddie Mac. The agency would also buy up to $100 billion in debt directly from the companies and up to $500 billion in mortgage-backed securities.

“This action is being taken to reduce the cost and increase the availability of credit for the purchase of houses, which in turn should support housing markets and foster improved conditions in financial markets more generally,” the Federal Reserve said in a statement.

Separately, the Fed and Treasury Department announced a $200 billion program to ease commercial lending on debts like student loans, car loans or business loans. The Fed would lend up to $200 billion to holders of asset-backed securities supported by car loans, credit card loans, student loans, and business loans guaranteed by the Small Business Administration.

The action by the Federal Reserve on buying mortgage-backed securities brings the full force of monetary policy to bear on the credit markets. Having already reduced the benchmark federal funds rate to just 1 percent, the central bank is now effectively using what economists call “quantitative easing” to reduce the costs of money.

Instead of trying to reduce overnight lending rates in the hope of influencing longer-term interest rates for things like mortgages, the Fed is directly subsidizing lower mortgage rates. It is doing so by printing unprecedented amounts of money, which would eventually create inflationary pressures if it were to continue unabated.

For the moment, Fed and Treasury officials made it clear that the sky was the limit.

Treasury Secretary Henry M. Paulson Jr. emphasized Tuesday that the $200 billion was just a “starting point” for a program that could become substantially larger, possibly including other assets like commercial mortgage-backed securities.

“It’s going to take awhile to get this program up and going and then it could be expanded and increased over time,” he said at a news conference. “The first thing is to get it up and going.”

The program would be seeded with $20 billion in “credit protection” from the Treasury Department, which is drawing the money from the original $700 billion bailout.

“It gives institutions liquidity and it’s clearly direct lending that will help consumers,” Mr. Paulson said. The announcements came one day after President-elect Barack Obama unveiled his economic team and tried to assure Americans that he was seeking to fill any leadership vacuum, and said his advisers would begin working “today.”

The advisers include Timothy F. Geithner, his choice for Treasury secretary. Mr. Paulson said that because Mr. Geithner is the president of the New York Federal Reserve Bank, he had been intimately involved in the latest rescue planning, and he vowed to continue cooperating “seamlessly” with Mr. Geithner in his new role, and with other members of the Obama economic team.

“We will obviously work seamlessly with the next administration on a first-rate transition, and we will discuss with them very, very carefully any programs that we are developing and any programs that we implement,” Mr. Paulson said. “Tim is very well-positioned for that because he understands everything that we have in place today.”

As if to underscore the transfer of power now under way, Mr. Obama introduced his economic team at a news conference in Chicago on Monday shortly after Mr. Bush made brief remarks outside the Treasury Department.

Mr. Obama expressed support for the Citigroup plan and urged Congress to adopt swiftly a major plan to stimulate spending and to reverse job losses.

“The news this past week, including this morning’s news about Citigroup,” Mr. Obama said, “has made it even more clear that we are facing an economic crisis of historic proportions. If we do not act swiftly and boldly, most experts now believe that we could lose millions of jobs next year.”

Democratic leaders in Congress are gearing up to move quickly on an economic recovery package that aides said could cost more than $500 billion. The goal is to have a legislative package approved by the House and the Senate and ready for Mr. Obama to sign, perhaps on his first day in office, in January.

“We have to make sure,” Mr. Obama said, “that the stimulus is significant enough that it really gives a jolt to the economy.”

The president-elect declined to estimate the size or scope of such legislation, but he said, “We are going to do what’s required.”

In addition to Mr. Geithner as his nominee for Treasury secretary, Mr. Obama also named a former Treasury secretary, Lawrence H. Summers, to head the White House Economic Council and described Mr. Summers’s experience as essential to “navigate the uncharted waters of this economic crisis.”

The selections of Mr. Geithner, who played a large role in the Citigroup rescue plan as president of the Federal Reserve Bank in New York, and Mr. Summers, now a Harvard economist, signaled that Mr. Obama intended to pursue aggressive, yet centrist policies, in finding ways to help jump-start the economy.

Over the next four weeks, Mr. Obama intends to announce most of his cabinet.

While he has already settled on most of the key members, including Gov. Bill Richardson of New Mexico as commerce secretary, the president-elect made certain that his first formal cabinet selections dealt with the economy rather than national security, which more often is given first mention.

Mr. Obama also announced Monday that he had chosen Christina D. Romer to head his Council of Economic Advisers and Melody Barnes as director of his White House Domestic Policy Council. Ms. Romer is an economics professor at the University of California, Berkeley; Ms. Barnes is a longtime aide to Senator Edward M. Kennedy, Democrat of Massachusetts.

Mr. Obama, who has largely been secluded from public view since being elected three weeks ago as the 44th president, is taking steps to be more visible in the next phase of his transition. He is scheduled Tuesday to name his budget director, Peter R. Orszag, who held the job under President Bill Clinton, and is expected to outline new budget reforms that will call on Americans to make sacrifices.

“Right now, our economy is trapped in a vicious cycle,” Mr. Obama said at the news conference.. “The turmoil on Wall Street means a new round of belt-tightening for families and businesses on Main Street, and as folks produce less and consume less, that just deepens the problems in our financial markets.”

As a presidential candidate, Mr. Obama criticized the Bush administration tax cuts for upper-income Americans. On Monday, he declined to say whether he would seek to repeal the tax cuts immediately or rather wait for them to expire in 2011. His advisers have said that his January economic stimulus plan will not include tax increases, for fear of upsetting the economy.

Mr. Obama noted that he still intended to pursue a middle-class tax cut. “The very wealthiest among us,” he said, “will pay a little bit more in order for us to be able to invest in the economy and get it back on track.”

He also said the struggling domestic automobile industry could not be allowed “simply to vanish.” But he also said that companies should not get “a blank check” from taxpayers and that he was surprised the auto companies’ chief executives were not better prepared with specific recovery proposals when they visited Capitol Hill last week.

“My attitude is that we should help the auto industry,” Mr. Obama said. “But what we should expect is that any additional money that we put into the auto industry, any help that we provide, is designed to assure a long-term, sustainable auto industry and not just kicking the can down the road.”

Under the new financing program that Treasury Secretary Henry M. Paulson Jr. plans to announce on Tuesday, the Federal Reserve would create a new special-purpose entity that would buy a wide range of consumer and business debt. The Treasury would contribute the “equity” part of the fund, which would absorb most of the losses that might occur. The Fed would then pump in as much as 95 percent of the money that would be used to purchase assets.

The new fund would, in effect, close the circle in the chaotic evolution of the Treasury rescue effort, officially known as the Troubled Asset Relief Program, or TARP. Under the new version, the government would once again plan to buy assets, including some troubled ones. The Fed would provide most of the money and buy comparatively healthy debt, like bundles of car loans, that private investors have stopped buying in recent weeks.

Laurence H. Meyer, vice chairman of Macroeconomic Advisers, said the new program would give the Federal Reserve a new way to reduce borrowing costs at a time when its standard tool, the overnight federal funds rate, is already close to zero.

“This approach,” Mr. Meyer wrote in a note to clients on Monday, “would allow the Fed to buy private assets that are now very illiquid and trading at distressed levels.”

Mr. Obama offered few specific details of his economic program but suggested that he would include an array of his campaign proposals into his opening legislative package. Rebuilding the economy, he said, “will require action on a great variety of fronts, from education and health care to energy and Social Security.”

Throughout the news conference, which was televised by all the cable and broadcast networks, Mr. Obama spoke in serious tones. There were no bursts of laughter or light-hearted moments, which punctuated his first postelection news conference more than two weeks ago. Instead, he described the financial outlook in some of the bleakest terms he has used.

“The economy’s likely to get worse before it gets better,” Mr. Obama said. “Full recovery will not happen immediately. And to make the investments we need, we’ll have to scour our federal budget, line by line, and make meaningful cuts and sacrifices.”

The announcement of Mr. Obama’s economic team, as well as the broad outlines of his recovery plan, was met by positive reviews from Congressional leaders. But few details have been worked out for how such a sweeping proposal could be ready in time for Mr. Obama’s swearing in.

Edmund L. Andrews, Brian Knowlton and David M. Herszenhorn contributed reporting.

By JEFF ZELENY and JACK HEALY

Published: November 25, 2008

Source: The New York Times