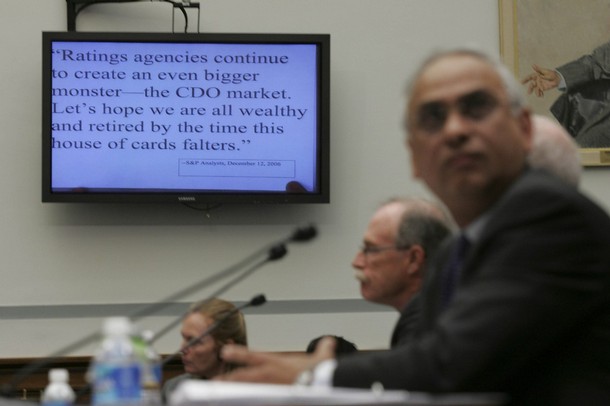

Deven Sharma (R), president of Standard & Poor’s and Raymond McDaniel, chairman and CEO of Moody’s Corporation listen to remarks by committee members as they display a quote on a screen during the House Oversight and Government Reform Committee hearing on “Credit Rating Agencies and the Financial Crisis,” on Capitol Hill in Washington October 22, 2008.

Oct. 22 (Bloomberg) — Employees at Moody’s Investors Service told executives that issuing dubious creditworthy ratings to mortgage-backed securities made it appear they were incompetent or “sold our soul to the devil for revenue,” according to e-mails obtained by U.S. House investigators.

The e-mail was one of several documents made public today at a hearing of the House Oversight and Government Reform Committee in Washington, which is reviewing the role played by Moody’s, Standard & Poor’s and Fitch Ratings in the global credit freeze.

“The story of the credit rating agencies is a story of colossal failure,” Committee Chairman Henry Waxman, a California Democrat, said at the hearing. “The result is that our entire financial system is now at risk.”

Moody’s and S&P in recent months had to downgrade thousands of mortgage-backed securities, many of which were originally given top AAA ratings, as delinquencies on the underlying loans soared well beyond the companies’ estimates and home values fell faster than they expected.

The downgrades contributed to the collapse of Bear Stearns Cos. and Lehman Brothers Holdings Inc., and compelled the U.S. government to set up a system to buy $700 billion of distressed assets from financial companies.

The Securities and Exchange Commission in a July report found the credit-rating companies improperly managed conflicts of interest and violated internal procedures in granting top rankings to mortgage bonds.

An e-mail that a S&P employee wrote to a co-worker in 2006, obtained by committee investigators, said, “Let’s hope we are all wealthy and retired by the time this house of cards falters.”

`Race to the Bottom’

Former executives from S&P and Moody’s told lawmakers today that credit raters relied on outdated models in a “race to the bottom” to maximize profits.

Jerome Fons, a former managing director of credit policy at New York-based Moody’s, told lawmakers that originators of structured securities “typically chose the agency with the lowest standards, engendering a race to the bottom in terms of rating quality.”

The top executives of the credit-rating companies said in testimony that they were unprepared for the sharp drop in home prices and that their systems failed.

“Events have demonstrated that the historical data we used and the assumptions we made significantly underestimated the severity of what has actually occurred,” said Deven Sharma, president of New York-based S&P.

“It is by now clear that a number of the assumptions we used in preparing our ratings on mortgage-backed securities issued between the last quarter of 2005 and the middle of 2007 did not work,” Sharma said in a written statement provided to the committee.

The company has improved its ratings process and transparency, Sharma said, and makes its criteria, analytics, and methodologies available to the public.

Not Performed Well

Stephen W. Joynt, president and chief executive officer of Fitch Inc. in New York, said it “is clear that many of our structured finance rating opinions have not performed well and have been too volatile.”

“We did not foresee the magnitude or velocity of the decline in the U.S. housing market, nor the dramatic shift in borrower behavior brought on by the changing practices in the market,” Joynt said in a written statement to the committee. “Nor did we appreciate the extent of shoddy mortgage origination practices and fraud” between 2005 and 2007.

Weakening Conditions

Raymond W. McDaniel, chairman and CEO of Moody’s Corp., said his company observed weakening conditions as early as July 2003.

“We saw and took action to adjust our assumptions for the portions of the residential mortgage backed securities market that we were asked to rate,” McDaniel said in written testimony. “We did not, however, anticipate the magnitude and speed of the deterioration in mortgage quality or the suddenness of the transition to restrictive lending.”

“We have learned important lessons from these fast-changing market conditions,” McDaniel said. The company has refined its rating methodologies, increased transparency of its analysis, and adopted new policies to avoid conflicts of interest, he said.

Fitch is a unit of Paris-based Fimalac SA. S&P is a unit of McGraw-Hill Cos. Moody’s is a unit of Moody’s Corp.

To contact the reporters on this story: Lorraine Woellert in Washington at [email protected].

Last Updated: October 22, 2008 15:39 EDT

By Lorraine Woellert and Dawn Kopecki

Source: Bloomberg