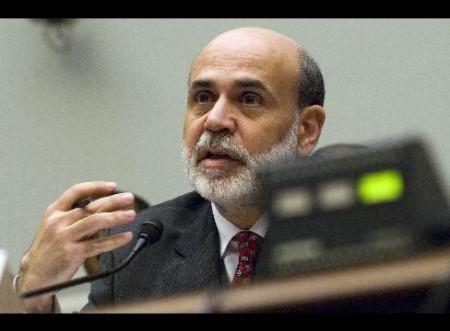

July 21 (Bloomberg) — Ben S. Bernanke and Henry Paulson are under pressure to embrace the big-government policies of America in the 1930s, or Sweden in the 1990s, to contain the conflagration engulfing the U.S. housing and financial markets.

Among the ideas: Using taxpayer money to shore up the capital of loss-ridden Fannie Mae and Freddie Mac, setting up new agencies to buy and refinance mortgages in default, even taking over failing financial institutions.

The government’s current “fire-brigade approach to dealing with the fallout from the extremely weak domestic economy is eroding general confidence in the U.S. financial system,” says Brian Bethune, chief U.S. financial economist at Lexington, Massachusetts-based Global Insight. “Bold, creative, aggressive policy action is needed.”

Trying to envision what steps Washington might have to take, economists hearken back to the last time the country faced a nationwide decline in house prices, during the Great Depression. In response to those travails — which were far worse than today’s — President Franklin D. Roosevelt adopted a radical, multipronged approach with a much bigger government role than anyone is proposing now.

“You need a change in mindset,” says Mohamed El-Erian, co-chief executive officer of Pacific Investment Management Co.

“So far, the hope has been the private sector would provide” the money, says El-Erian, whose Newport Beach, California-based firm manages about $800 billion for investors. “Now the focus is on Washington.”

Taxpayer Money

Treasury Secretary Paulson took a step toward committing taxpayer money when he asked Congress last week to give Treasury the power to invest in Fannie Mae and Freddie Mac if necessary to keep the largest U.S. mortgage-finance companies operating.

Like Federal Reserve Chairman Bernanke’s rescue of Bear Stearns Cos. in March, Paulson’s plan hasn’t convinced investors that other institutions won’t fail. Nor have recession alarms been silenced by the Fed’s interest-rate cuts or President George W. Bush‘s $168-billion stimulus package.

Some experts say the government needs to set up new agencies to foster a recovery in the housing industry, the financial markets and the economy.

Alan Blinder, a former Fed vice chairman who is now a professor at Princeton University in New Jersey, calls for the return of what he’s dubbed “The Incredible HOLC” — the Home Owners Loan Corp. Set up in 1933, the HOLC acquired defaulted residential mortgages from lenders and investors and then refinanced the loans on more favorable terms for the borrowers.

Treasury’s Investment

The Treasury invested $200 million in HOLC stock, the equivalent of about $20 billion today after taking account of the growth of the economy, according to Alex Pollock of the American Enterprise Institute in Washington. The company then was able to borrow an additional $2 billion through bond issues.

The HOLC made more than a million loans and by 1937 owned about 14 percent of outstanding mortgages. That’s equivalent to about 10 million loans worth some $1.4 trillion now, or approximately the total of subprime mortgages, Pollock reckons. The company was liquidated in 1951 after returning an accumulated surplus of $14 million to the Treasury.

The current Congress borrowed some of the principles that governed the HOLC for its proposed expansion of the Federal Housing Administration’s role in mortgage finance, though on a much smaller scale. Under legislation the lawmakers are considering, the FHA would gain the ability to refinance up to $300 billion worth of loans at an estimated cost to the government of $3 billion.

Expanded Program

Blinder says he expects the program to pass this year and predicts it “will be expanded in 2009.”

The former Fed policy maker also suggests the formation of a public-private partnership that would buy up mortgage-backed securities and other collateralized debt obligations at bargain- basement prices. The aim would be to get illiquid fixed-income markets working again.

Some experts have touted another Depression-era agency for revival: the Reconstruction Finance Corp.

Joseph Mason, a former bank regulator who’s now a professor at Louisiana State University in Baton Rouge, says the RFC took a three-step approach to tackling the financial crisis: It closed the weakest banks, recapitalized the others through investment in preferred stock and then tried to return them quickly to health by throwing out management and halting dividend payments.

Swedish Model

Sweden followed some of the same principles in dealing with its banking crisis in the early 1990s. The government was forced to take over several failing financial institutions and ended up owning about 22 percent of the country’s banking-system assets.

The cost to taxpayers was close to 4 percent of Sweden’s gross domestic product, according to Nicola Mai of JPMorgan Chase & Co. in London. In the U.S., that would be equivalent to more than $400 billion today.

Hans Soderstrom, a professor at the Stockholm School of Economics, isn’t convinced the U.S. needs to go that far. “Our whole banking system was collapsing,” he says. “I don’t think the U.S. banking system is. (Want to bet on it?) It’s best, then, to let the private sector take the losses.”

U.S. policy makers have shied away from dramatic actions in hopes that the housing market and the financial-services industry would right themselves and the economy would recover. Those hopes have so far proven misplaced.

Credibility Undermined

“Their repeated attempts to talk up the market during a fundamental crisis have undermined their credibility with legislators, business people and the public,” Mason says.

Confidence among homebuilders has fallen to record lows as prices and sales continue to decline. The Standard & Poor’s 500 Banks Index of 22 stocks is down 39 percent this year, even after a rally at the end of last week. And economists such as Morgan Stanley’s Richard Berner see the economy slipping into a recession in the fourth quarter.

Tom Gallagher, a managing director in Washington for money- management and research firm ISI Group, says significant government action to shore up the housing market and the financial-services industry may have to wait until next year, after a new president takes office.

“Every time something happens, they plug a hole and two new holes open up,” says Nouriel Roubini, a former Treasury official who is chairman of Roubini Global Economics in New York. “What they need is a systematic plan on how to approach this mess.”

To contact the reporter on this story: Rich Miller in Washington at [email protected].

Last Updated: July 20, 2008 19:00 EDT

Source: Bloomberg

Related articles and videos:

– U.S. Financial Breaking Point Soon

– As faith in bank bailouts dims, losses set to deepen

– US: Financial system is a house of cards

– FREDDIE & FANNIE UNCONSTITUTIONAL BAIL OUT USING WHAT?

– The Wall Street Journal Senses Something is Wrong

– US faces global funding crisis, warns Merrill Lynch

– Fed: No more bailouts, except Fannie Mae and Freddie Mac

– Ron Paul on Fox Business News 7/16/08

– Ron Paul vs. Ben Bernanke 7/16/08

– US: $455,000 debt per household

– US: Total Crash of the Entire Financial System Expected, Say Experts

– The Dollar is doomed and the Fed will fail

– More Than 300 US Banks to Fail, Says RBC Capital Markets Analyst

– Are “Dark Pools” Destined to be the Capital Markets’ Next Black Hole?

– Run on banks spells big trouble for US Treasury

– Fannie, Freddie insolvent, Poole tells Bloomberg

– Chinese Government is Top Foreign Holder of Fannie Mae, Freddie Mac Bonds

– Foreclosures Rose 53% in June, Bank Seizures Triple

– Small Banks: Billions in Troubled Construction Loans

– Financial market losses could top 1,600 billion dollars: report

– Dow suffers worst 1st half since ‘70

– Fortis Bank Predicts US Financial Market Meltdown Within Weeks

– Barclays warns of a financial storm as Federal Reserve’s credibility crumbles

– Jim Rogers: Avoid The Dollar At All Costs

– Ron Paul on Iran and Energy June 26, 2008

– Marc Faber: ‘Misleading’ Fed Should Let Banks Fail

– This recession could easily tip into a depression

– Status Report on the Collapse of the U.S. Economy

– 8,500 U.S. banks; many will die soon